quarterly-insurtech-briefing-q4-2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

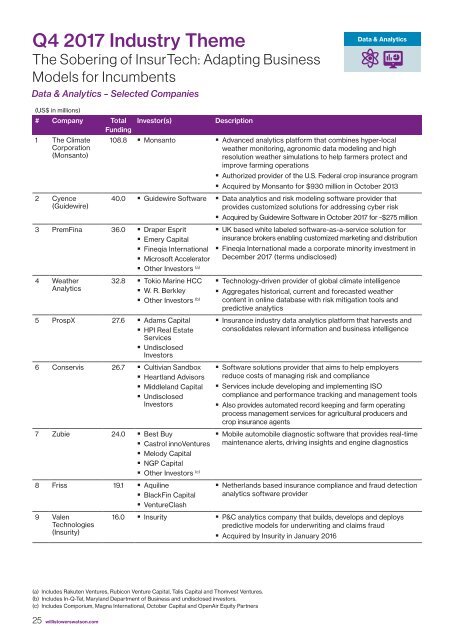

Q4 <strong>2017</strong> Industry Theme<br />

The Sobering of InsurTech: Adapting Business<br />

Models for Incumbents<br />

Data & Analytics – Selected Companies<br />

Data & Analytics<br />

(US$ in millions)<br />

# Company Total<br />

Funding<br />

Investor(s)<br />

1 The Climate 108.8 • Monsanto<br />

Corporation<br />

(Monsanto)<br />

2 Cyence<br />

(Guidewire)<br />

40.0 • Guidewire Software<br />

3 PremFina 36.0 • Draper Esprit<br />

• Emery Capital<br />

• Fineqia International<br />

• Microsoft Accelerator<br />

• Other Investors (a)<br />

4 Weather 32.8 • Tokio Marine HCC<br />

Analytics<br />

• W. R. Berkley<br />

• Other Investors (b)<br />

5 ProspX 27.6 • Adams Capital<br />

• HPI Real Estate<br />

Services<br />

• Undisclosed<br />

Investors<br />

6 Conservis 26.7 • Cultivian Sandbox<br />

• Heartland Advisors<br />

• Middleland Capital<br />

• Undisclosed<br />

Investors<br />

7 Zubie 24.0 • Best Buy<br />

• Castrol innoVentures<br />

• Melody Capital<br />

• NGP Capital<br />

• Other Investors (c)<br />

8 Friss 19.1 • Aquiline<br />

• BlackFin Capital<br />

• VentureClash<br />

9 Valen<br />

Technologies<br />

(Insurity)<br />

16.0 • Insurity<br />

Description<br />

• Advanced analytics platform that combines hyper-local<br />

weather monitoring, agronomic data modeling and high<br />

resolution weather simulations to help farmers protect and<br />

improve farming operations<br />

• Authorized provider of the U.S. Federal crop insurance program<br />

• Acquired by Monsanto for $930 million in October 2013<br />

• Data analytics and risk modeling software provider that<br />

provides customized solutions for addressing cyber risk<br />

• Acquired by Guidewire Software in October <strong>2017</strong> for ~$275 million<br />

• UK based white labeled software-as-a-service solution for<br />

insurance brokers enabling customized marketing and distribution<br />

• Fineqia International made a corporate minority investment in<br />

December <strong>2017</strong> (terms undisclosed)<br />

• Technology-driven provider of global climate intelligence<br />

• Aggregates historical, current and forecasted weather<br />

content in online database with risk mitigation tools and<br />

predictive analytics<br />

• Insurance industry data analytics platform that harvests and<br />

consolidates relevant information and business intelligence<br />

• Software solutions provider that aims to help employers<br />

reduce costs of managing risk and compliance<br />

• Services include developing and implementing ISO<br />

compliance and performance tracking and management tools<br />

• Also provides automated record keeping and farm operating<br />

process management services for agricultural producers and<br />

crop insurance agents<br />

• Mobile automobile diagnostic software that provides real-time<br />

maintenance alerts, driving insights and engine diagnostics<br />

• Netherlands based insurance compliance and fraud detection<br />

analytics software provider<br />

• P&C analytics company that builds, develops and deploys<br />

predictive models for underwriting and claims fraud<br />

• Acquired by Insurity in January 2016<br />

(a) Includes Rakuten Ventures, Rubicon Venture Capital, Talis Capital and Thomvest Ventures.<br />

(b) Includes In-Q-Tel, Maryland Department of Business and undisclosed investors.<br />

(c) Includes Comporium, Magna International, October Capital and OpenAir Equity Partners<br />

25 willistowerswatson.com