quarterly-insurtech-briefing-q4-2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

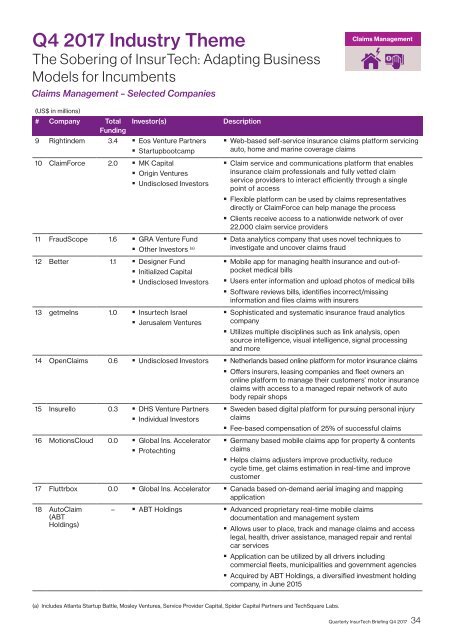

Q4 <strong>2017</strong> Industry Theme<br />

The Sobering of InsurTech: Adapting Business<br />

Models for Incumbents<br />

Claims Management – Selected Companies<br />

Claims Management<br />

(US$ in millions)<br />

# Company Total<br />

Funding<br />

Investor(s)<br />

9 Rightindem 3.4 • Eos Venture Partners<br />

• Startupbootcamp<br />

10 ClaimForce 2.0 • MK Capital<br />

• Origin Ventures<br />

• Undisclosed Investors<br />

11 FraudScope 1.6 • GRA Venture Fund<br />

• Other Investors (a)<br />

12 Better 1.1 • Designer Fund<br />

• Initialized Capital<br />

• Undisclosed Investors<br />

13 getmeIns 1.0 • Insurtech Israel<br />

• Jerusalem Ventures<br />

14 OpenClaims 0.6 • Undisclosed Investors<br />

15 Insurello 0.3 • DHS Venture Partners<br />

• Individual Investors<br />

16 MotionsCloud 0.0 • Global Ins. Accelerator<br />

• Protechting<br />

17 Fluttrbox 0.0 • Global Ins. Accelerator<br />

18 AutoClaim<br />

(ABT<br />

Holdings)<br />

– • ABT Holdings<br />

Description<br />

• Web-based self-service insurance claims platform servicing<br />

auto, home and marine coverage claims<br />

• Claim service and communications platform that enables<br />

insurance claim professionals and fully vetted claim<br />

service providers to interact efficiently through a single<br />

point of access<br />

• Flexible platform can be used by claims representatives<br />

directly or ClaimForce can help manage the process<br />

• Clients receive access to a nationwide network of over<br />

22,000 claim service providers<br />

• Data analytics company that uses novel techniques to<br />

investigate and uncover claims fraud<br />

• Mobile app for managing health insurance and out-ofpocket<br />

medical bills<br />

• Users enter information and upload photos of medical bills<br />

• Software reviews bills, identifies incorrect/missing<br />

information and files claims with insurers<br />

• Sophisticated and systematic insurance fraud analytics<br />

company<br />

• Utilizes multiple disciplines such as link analysis, open<br />

source intelligence, visual intelligence, signal processing<br />

and more<br />

• Netherlands based online platform for motor insurance claims<br />

• Offers insurers, leasing companies and fleet owners an<br />

online platform to manage their customers’ motor insurance<br />

claims with access to a managed repair network of auto<br />

body repair shops<br />

• Sweden based digital platform for pursuing personal injury<br />

claims<br />

• Fee-based compensation of 25% of successful claims<br />

• Germany based mobile claims app for property & contents<br />

claims<br />

• Helps claims adjusters improve productivity, reduce<br />

cycle time, get claims estimation in real-time and improve<br />

customer<br />

• Canada based on-demand aerial imaging and mapping<br />

application<br />

• Advanced proprietary real-time mobile claims<br />

documentation and management system<br />

• Allows user to place, track and manage claims and access<br />

legal, health, driver assistance, managed repair and rental<br />

car services<br />

• Application can be utilized by all drivers including<br />

commercial fleets, municipalities and government agencies<br />

• Acquired by ABT Holdings, a diversified investment holding<br />

company, in June 2015<br />

(a) Includes Atlanta Startup Battle, Mosley Ventures, Service Provider Capital, Spider Capital Partners and TechSquare Labs.<br />

Quarterly InsurTech Briefing Q4 <strong>2017</strong> 34