quarterly-insurtech-briefing-q4-2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

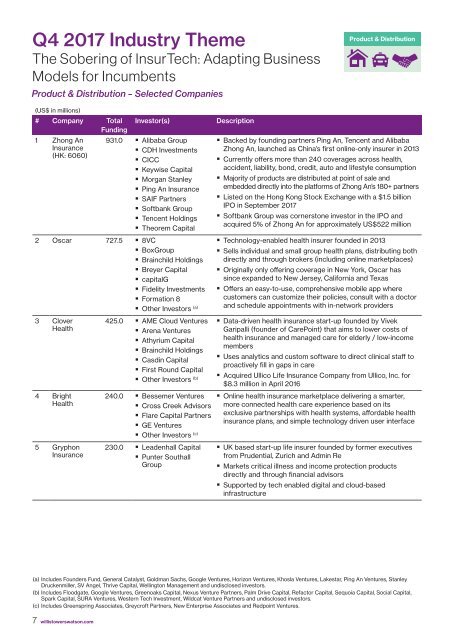

Q4 <strong>2017</strong> Industry Theme<br />

The Sobering of InsurTech: Adapting Business<br />

Models for Incumbents<br />

Product & Distribution – Selected Companies<br />

Product & Distribution<br />

(US$ in millions)<br />

# Company Total<br />

Funding<br />

Investor(s)<br />

1 Zhong An 931.0 • Alibaba Group<br />

Insurance<br />

• CDH Investments<br />

(HK: 6060)<br />

• CICC<br />

• Keywise Capital<br />

• Morgan Stanley<br />

• Ping An Insurance<br />

• SAIF Partners<br />

• Softbank Group<br />

• Tencent Holdings<br />

• Theorem Capital<br />

2 Oscar 727.5 • 8VC<br />

• BoxGroup<br />

• Brainchild Holdings<br />

• Breyer Capital<br />

• capitalG<br />

• Fidelity Investments<br />

• Formation 8<br />

• Other Investors (a)<br />

3 Clover 425.0 • AME Cloud Ventures<br />

Health<br />

• Arena Ventures<br />

• Athyrium Capital<br />

• Brainchild Holdings<br />

• Casdin Capital<br />

• First Round Capital<br />

• Other Investors (b)<br />

4 Bright<br />

Health<br />

5 Gryphon<br />

Insurance<br />

240.0 • Bessemer Ventures<br />

• Cross Creek Advisors<br />

• Flare Capital Partners<br />

• GE Ventures<br />

• Other Investors (c)<br />

230.0 • Leadenhall Capital<br />

• Punter Southall<br />

Group<br />

Description<br />

• Backed by founding partners Ping An, Tencent and Alibaba<br />

Zhong An, launched as China’s first online-only insurer in 2013<br />

• Currently offers more than 240 coverages across health,<br />

accident, liability, bond, credit, auto and lifestyle consumption<br />

• Majority of products are distributed at point of sale and<br />

embedded directly into the platforms of Zhong An’s 180+ partners<br />

• Listed on the Hong Kong Stock Exchange with a $1.5 billion<br />

IPO in September <strong>2017</strong><br />

• Softbank Group was cornerstone investor in the IPO and<br />

acquired 5% of Zhong An for approximately US$522 million<br />

• Technology-enabled health insurer founded in 2013<br />

• Sells individual and small group health plans, distributing both<br />

directly and through brokers (including online marketplaces)<br />

• Originally only offering coverage in New York, Oscar has<br />

since expanded to New Jersey, California and Texas<br />

• Offers an easy-to-use, comprehensive mobile app where<br />

customers can customize their policies, consult with a doctor<br />

and schedule appointments with in-network providers<br />

• Data-driven health insurance start-up founded by Vivek<br />

Garipalli (founder of CarePoint) that aims to lower costs of<br />

health insurance and managed care for elderly / low-income<br />

members<br />

• Uses analytics and custom software to direct clinical staff to<br />

proactively fill in gaps in care<br />

• Acquired Ullico Life Insurance Company from Ullico, Inc. for<br />

$8.3 million in April 2016<br />

• Online health insurance marketplace delivering a smarter,<br />

more connected health care experience based on its<br />

exclusive partnerships with health systems, affordable health<br />

insurance plans, and simple technology driven user interface<br />

• UK based start-up life insurer founded by former executives<br />

from Prudential, Zurich and Admin Re<br />

• Markets critical illness and income protection products<br />

directly and through financial advisors<br />

• Supported by tech enabled digital and cloud-based<br />

infrastructure<br />

(a) Includes Founders Fund, General Catalyst, Goldman Sachs, Google Ventures, Horizon Ventures, Khosla Ventures, Lakestar, Ping An Ventures, Stanley<br />

Druckenmiller, SV Angel, Thrive Capital, Wellington Management and undisclosed investors.<br />

(b) Includes Floodgate, Google Ventures, Greenoaks Capital, Nexus Venture Partners, Palm Drive Capital, Refactor Capital, Sequoia Capital, Social Capital,<br />

Spark Capital, SURA Ventures, Western Tech Investment, Wildcat Venture Partners and undisclosed investors.<br />

(c) Includes Greenspring Associates, Greycroft Partners, New Enterprise Associates and Redpoint Ventures.<br />

7 willistowerswatson.com