quarterly-insurtech-briefing-q4-2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

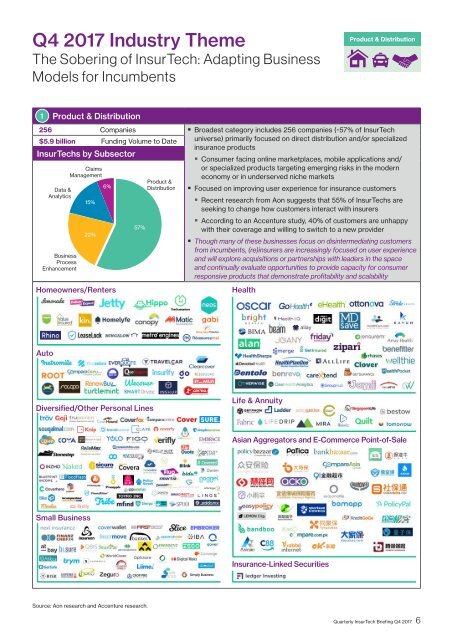

Q4 <strong>2017</strong> Industry Theme<br />

The Sobering of InsurTech: Adapting Business<br />

Models for Incumbents<br />

Product & Distribution<br />

1 Product & Distribution<br />

256 Companies • Broadest category includes 256 companies (~57% of InsurTech<br />

$5.9 billion Funding Volume to Date universe) primarily focused on direct distribution and/or specialized<br />

insurance products<br />

InsurTechs by Subsector<br />

• Consumer facing online marketplaces, mobile applications and/<br />

Claims<br />

Management<br />

or specialized products targeting emerging risks in the modern<br />

economy or in underserved niche markets<br />

Data &<br />

Analytics<br />

Business<br />

Process<br />

Enhancement<br />

15%<br />

22%<br />

6%<br />

Homeowners/Renters<br />

57%<br />

Product &<br />

Distribution<br />

• Focused on improving user experience for insurance customers<br />

• Recent research from Aon suggests that 55% of InsurTechs are<br />

seeking to change how customers interact with insurers<br />

• According to an Accenture study, 40% of customers are unhappy<br />

with their coverage and willing to switch to a new provider<br />

• Though many of these businesses focus on disintermediating customers<br />

from incumbents, (re)insurers are increasingly focused on user experience<br />

and will explore acquisitions or partnerships with leaders in the space<br />

and continually evaluate opportunities to provide capacity for consumer<br />

responsive products that demonstrate profitability and scalability<br />

Health<br />

Auto<br />

Diversified/Other Personal Lines<br />

Life & Annuity<br />

Asian Aggregators and E-Commerce Point-of-Sale<br />

Small Business<br />

Insurance-Linked Securities<br />

Source: Aon research and Accenture research.<br />

Quarterly InsurTech Briefing Q4 <strong>2017</strong> 6