quarterly-insurtech-briefing-q4-2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Quarterly InsurTech Briefing<br />

Introduction<br />

Who Benefits from Modularization?<br />

Our Thought Leadership feature further focuses on the<br />

InsurTech sobering phenomenon and the associated<br />

growth of incumbent interest in technologies addressing<br />

their back-office needs. With technology moving forward<br />

at an unprecedented pace, incumbents are increasingly<br />

electing to outsource functions to highly specialized new<br />

entrants, renting evolving modules of technology that<br />

can be tailored to suit their individual needs. Though this<br />

approach may be more cost effective, it further fuels the<br />

question of whether incumbents will allow value in the<br />

industry to shift towards new entrants. In time, market<br />

participants will come to understand which module in<br />

the chain generates the most value. It is plausible that<br />

automation in distribution will shift value towards efficiency<br />

of internal processes that support cutting-edge modeling<br />

and underwriting engines.<br />

Who Were The Winners In <strong>2017</strong>?<br />

Our (re)insurer innovation survey shows that innovation<br />

does not necessarily correlate with geography, size or<br />

even underlying product. Four companies voted to be most<br />

innovative: Munich Re, Lemonade, AXA and Swiss Re vary<br />

in size from the hundreds of millions to over $30 billion,<br />

focus on personal or commercial lines products, insurance<br />

or reinsurance and have global or local platforms.<br />

Hundreds of InsurTech startups are looking for their place<br />

in the insurance value chain. To summarize the year, we<br />

cataloged 100 companies to watch into four categories,<br />

including the top 25 companies in product & distribution,<br />

business process enhancement, data & analytics and<br />

claims management. We believe that these categories<br />

represent the current frontiers of innovation in insurance.<br />

Over half of InsurTechs target distribution and product<br />

design, with data & analytics and claims management<br />

representing relatively smaller segments. We expect the<br />

business process enhancement category to grow based<br />

on the current level of incumbent focus on this area.<br />

Incumbents Fuel Investment Momentum in Q4<br />

$697 million of InsurTech funding in Q4 rounded off <strong>2017</strong><br />

at a total of $2.3 billion, a 36% increase from $1.7 billion<br />

recorded in 2016 and the second highest total for any<br />

year to date. (Re)insurers, directly and through corporate<br />

venture arms, are increasing their activity in the sector<br />

and expanding their focus to invest in a broad range of<br />

technologies with potential applications to their core<br />

(re)insurance businesses. 35 private technology<br />

investments by (re)insurers in Q4 and 120 private technology<br />

investments by (re)insurers in <strong>2017</strong> are the highest totals<br />

recorded in any quarter and year to date, respectively.<br />

I want to thank you for all the comments and guidance<br />

we received during the year. We are very grateful for the<br />

positive response to our Quarterly InsurTech Briefing to<br />

date. We want to continue to improve it, and as ever, we<br />

welcome your feedback and suggestions.<br />

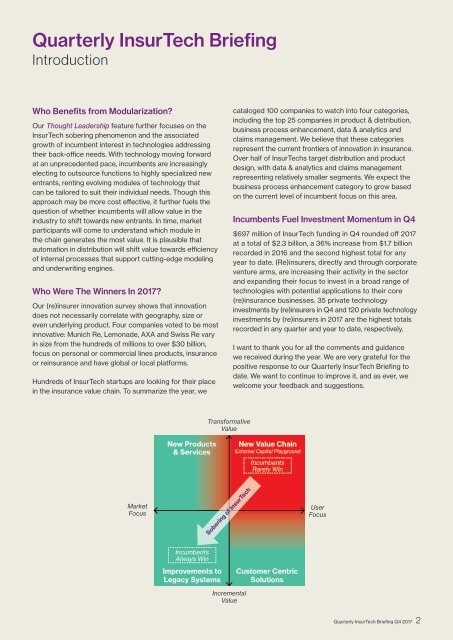

Transformative<br />

Value<br />

New Products<br />

& Services<br />

New Value Chain<br />

External Capital Playground<br />

Incumbents<br />

Rarely Win<br />

Market<br />

Focus<br />

Sobering of InsurTech<br />

User<br />

Focus<br />

Incumbents<br />

Always Win<br />

Improvements to<br />

Legacy Systems<br />

Customer Centric<br />

Solutions<br />

Incremental<br />

Value<br />

Quarterly InsurTech Briefing Q4 <strong>2017</strong> 2