quarterly-insurtech-briefing-q4-2017

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

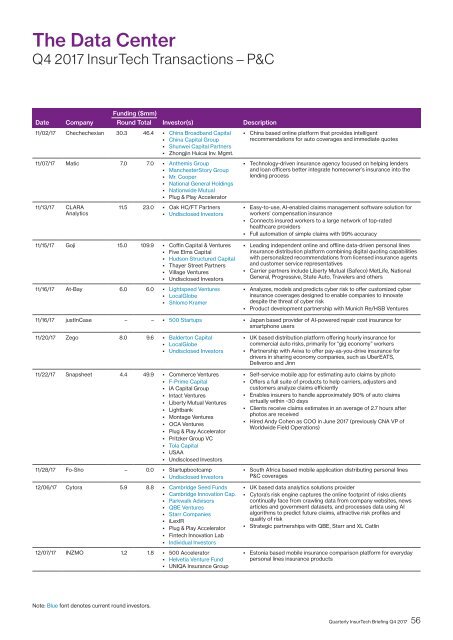

The Data Center<br />

Q4 <strong>2017</strong> InsurTech Transactions – P&C<br />

Date<br />

Company<br />

Funding ($mm)<br />

Round Total Investor(s) Description<br />

11/02/17 Chechechexian 30.3 46.4 • China Broadband Capital<br />

• China Capital Group<br />

• Shunwei Capital Partners<br />

• Zhongjin Huicai Inv. Mgmt.<br />

11/07/17 Matic 7.0 7.0 • Anthemis Group<br />

• ManchesterStory Group<br />

• Mr. Cooper<br />

• National General Holdings<br />

• Nationwide Mutual<br />

• Plug & Play Accelerator<br />

11/13/17 CLARA<br />

Analytics<br />

11.5 23.0 • Oak HC/FT Partners<br />

• Undisclosed Investors<br />

• China based online platform that provides intelligent<br />

recommendations for auto coverages and immediate quotes<br />

• Technology-driven insurance agency focused on helping lenders<br />

and loan officers better integrate homeowner’s insurance into the<br />

lending process<br />

• Easy-to-use, AI-enabled claims management software solution for<br />

workers’ compensation insurance<br />

• Connects insured workers to a large network of top-rated<br />

healthcare providers<br />

• Full automation of simple claims with 99% accuracy<br />

11/15/17 Goji 15.0 109.9 • Coffin Capital & Ventures<br />

• Five Elms Capital<br />

• Hudson Structured Capital<br />

• Thayer Street Partners<br />

• Village Ventures<br />

• Undisclosed Investors<br />

11/16/17 At-Bay 6.0 6.0 • Lightspeed Ventures<br />

• LocalGlobe<br />

• Shlomo Kramer<br />

• Leading independent online and offline data-driven personal lines<br />

insurance distribution platform combining digital quoting capabilities<br />

with personalized recommendations from licensed insurance agents<br />

and customer service representatives<br />

• Carrier partners include Liberty Mutual (Safeco) MetLife, National<br />

General, Progressive, State Auto, Travelers and others<br />

• Analyzes, models and predicts cyber risk to offer customized cyber<br />

insurance coverages designed to enable companies to innovate<br />

despite the threat of cyber risk<br />

• Product development partnership with Munich Re/HSB Ventures<br />

11/16/17 justInCase – – • 500 Startups • Japan based provider of AI-powered repair cost insurance for<br />

smartphone users<br />

11/20/17 Zego 8.0 9.6 • Balderton Capital<br />

• LocalGlobe<br />

• Undisclosed Investors<br />

11/22/17 Snapsheet 4.4 49.9 • Commerce Ventures<br />

• F-Prime Capital<br />

• IA Capital Group<br />

• Intact Ventures<br />

• Liberty Mutual Ventures<br />

• Lightbank<br />

• Montage Ventures<br />

• OCA Ventures<br />

• Plug & Play Accelerator<br />

• Pritzker Group VC<br />

• Tola Capital<br />

• USAA<br />

• Undisclosed Investors<br />

11/28/17 Fo-Sho – 0.0 • Startupbootcamp<br />

• Undisclosed Investors<br />

12/06/17 Cytora 5.9 8.8 • Cambridge Seed Funds<br />

• Cambridge Innovation Cap.<br />

• Parkwalk Advisors<br />

• QBE Ventures<br />

• Starr Companies<br />

• iLexIR<br />

• Plug & Play Accelerator<br />

• Fintech Innovation Lab<br />

• Individual Investors<br />

12/07/17 INZMO 1.2 1.8 • 500 Accelerator<br />

• Helvetia Venture Fund<br />

• UNIQA Insurance Group<br />

• UK based distribution platform offering hourly insurance for<br />

commercial auto risks, primarily for “gig economy” workers<br />

• Partnership with Aviva to offer pay-as-you-drive insurance for<br />

drivers in sharing economy companies, such as UberEATS,<br />

Deliveroo and Jinn<br />

• Self-service mobile app for estimating auto claims by photo<br />

• Offers a full suite of products to help carriers, adjusters and<br />

customers analyze claims efficiently<br />

• Enables insurers to handle approximately 90% of auto claims<br />

virtually within ~30 days<br />

• Clients receive claims estimates in an average of 2.7 hours after<br />

photos are received<br />

• Hired Andy Cohen as COO in June <strong>2017</strong> (previously CNA VP of<br />

Worldwide Field Operations)<br />

• South Africa based mobile application distributing personal lines<br />

P&C coverages<br />

• UK based data analytics solutions provider<br />

• Cytora’s risk engine captures the online footprint of risks clients<br />

continually face from crawling data from company websites, news<br />

articles and government datasets, and processes data using AI<br />

algorithms to predict future claims, attractive risk profiles and<br />

quality of risk<br />

• Strategic partnerships with QBE, Starr and XL Catlin<br />

• Estonia based mobile insurance comparison platform for everyday<br />

personal lines insurance products<br />

Note: Blue font denotes current round investors.<br />

Quarterly InsurTech Briefing Q4 <strong>2017</strong> 56