Look Inside Young Adult Road Map

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Piecing Together the Insurance Puzzle<br />

Why learn about insurance? If you know the system basics of health insurance, it will be<br />

much easier to understand maps and talk to guides. You can make better choices. You can<br />

avoid getting stuck with an insurance plan that costs too much or doesn’t pay for or cover<br />

the services you need.<br />

Every insurance plan is a kind of puzzle made up of four basic parts:<br />

1.<br />

2.<br />

3.<br />

4.<br />

Premium: This is the amount you pay the insurance company to belong to the plan.<br />

In some plans, this premium is subsidized (paid for by a government agency). That<br />

part may change if your income changes—for example, once you get a full-time job.<br />

Coverage: This piece of the puzzle looks at the types of services the plan will pay for,<br />

and who can provide you with those services (in-network providers). Your plan<br />

may still pay a smaller amount if you use providers who aren’t on that list (called<br />

out-of-network providers).<br />

Out of Pocket: This piece concerns two ways you may still have to use your own<br />

money to pay for some services. You may have a “co-payment” or “co-pay,” which is<br />

an amount you pay every time you see a certain provider. You may also need to pay<br />

a certain amount of money for your health care treatment each year before the insurance<br />

company starts to pay. This is called a deductible. (Sometimes insurance plans<br />

with low premiums can have fairly high co-pays or deductibles.)<br />

Limits: The last piece of the puzzle has to do with things your insurance plan will NOT<br />

cover. “Caps” are limits on the amounts of money the insurance plan will pay for certain<br />

services. Exclusions are types of services for which the plan will not pay. An annual or<br />

lifetime maximum benefit is the greatest amount the insurance company will pay for<br />

a certain type of service over one year (or the entire time you have that policy).<br />

Lifelines<br />

Below are two links to sample<br />

crisis plans:<br />

https://magic.piktochart.com/<br />

output/3641390-how-to-create-asafety-plan<br />

(National Suicide Prevention Lifeline)<br />

http://mentalhealthrecovery.com/<br />

wp-content/uploads/2015/07/<br />

CrisisPlan2012Manual.pdf (http://<br />

mentalhealthrecovery.com/<br />

contact-us/)<br />

These are two apps (iTunes) for<br />

crisis/safety plans:<br />

n Suicide Safety Plan<br />

n Be Safe<br />

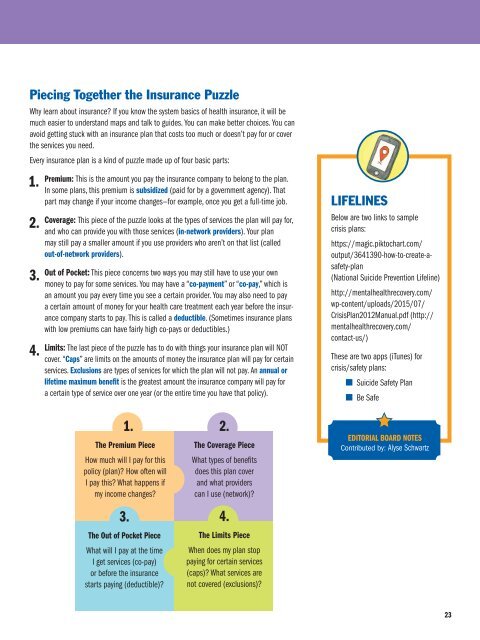

1.<br />

The Premium Piece<br />

How much will I pay for this<br />

policy (plan)? How often will<br />

I pay this? What happens if<br />

my income changes?<br />

3.<br />

The Out of Pocket Piece<br />

What will I pay at the time<br />

I get services (co-pay)<br />

or before the insurance<br />

starts paying (deductible)?<br />

2.<br />

The Coverage Piece<br />

What types of benefits<br />

does this plan cover<br />

and what providers<br />

can I use (network)?<br />

4.<br />

The Limits Piece<br />

When does my plan stop<br />

paying for certain services<br />

(caps)? What services are<br />

not covered (exclusions)?<br />

Editorial Board Notes<br />

Contributed by: Alyse Schwartz<br />

23