DRIVE A2B April 2018

*** SCROLL DOWN TO SELECT ALTERNATIVE MAGAZINE EDITIONS *** Australia's only Magazine for the Commercial Passenger Transport Industry. News and views for Drivers, Owners and Operators of Taxi, Hire Car, Limousine, Ride Share, Booked Hire Vehicles, Rank and Hail Cars.

*** SCROLL DOWN TO SELECT ALTERNATIVE MAGAZINE EDITIONS ***

Australia's only Magazine for the Commercial Passenger Transport Industry.

News and views for Drivers, Owners and Operators of Taxi, Hire Car, Limousine, Ride Share, Booked Hire Vehicles, Rank and Hail Cars.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

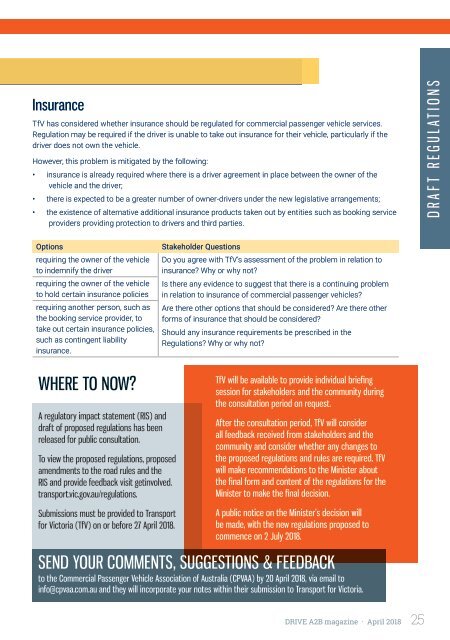

Insurance<br />

TfV has considered whether insurance should be regulated for commercial passenger vehicle services.<br />

Regulation may be required if the driver is unable to take out insurance for their vehicle, particularly if the<br />

driver does not own the vehicle.<br />

However, this problem is mitigated by the following:<br />

• insurance is already required where there is a driver agreement in place between the owner of the<br />

vehicle and the driver;<br />

• there is expected to be a greater number of owner-drivers under the new legislative arrangements;<br />

• the existence of alternative additional insurance products taken out by entities such as booking service<br />

providers providing protection to drivers and third parties.<br />

DRAFT REGULATIONS<br />

Options<br />

requiring the owner of the vehicle<br />

to indemnify the driver<br />

requiring the owner of the vehicle<br />

to hold certain insurance policies<br />

requiring another person, such as<br />

the booking service provider, to<br />

take out certain insurance policies,<br />

such as contingent liability<br />

insurance.<br />

Stakeholder Questions<br />

Do you agree with TfV’s assessment of the problem in relation to<br />

insurance? Why or why not?<br />

Is there any evidence to suggest that there is a continuing problem<br />

in relation to insurance of commercial passenger vehicles?<br />

Are there other options that should be considered? Are there other<br />

forms of insurance that should be considered?<br />

Should any insurance requirements be prescribed in the<br />

Regulations? Why or why not?<br />

WHERE TO NOW?<br />

A regulatory impact statement (RIS) and<br />

draft of proposed regulations has been<br />

released for public consultation.<br />

To view the proposed regulations, proposed<br />

amendments to the road rules and the<br />

RIS and provide feedback visit getinvolved.<br />

transport.vic.gov.au/regulations.<br />

TfV will be available to provide individual briefing<br />

session for stakeholders and the community during<br />

the consultation period on request.<br />

After the consultation period, TfV will consider<br />

all feedback received from stakeholders and the<br />

community and consider whether any changes to<br />

the proposed regulations and rules are required. TfV<br />

will make recommendations to the Minister about<br />

the final form and content of the regulations for the<br />

Minister to make the final decision.<br />

Submissions must be provided to Transport<br />

for Victoria (TfV) on or before 27 <strong>April</strong> <strong>2018</strong>.<br />

A public notice on the Minister’s decision will<br />

be made, with the new regulations proposed to<br />

commence on 2 July <strong>2018</strong>.<br />

SEND YOUR COMMENTS, SUGGESTIONS & FEEDBACK<br />

to the Commercial Passenger Vehicle Association of Australia (CPVAA) by 20 <strong>April</strong> <strong>2018</strong>, via email to<br />

info@cpvaa.com.au and they will incorporate your notes within their submission to Transport for Victoria.<br />

<strong>DRIVE</strong> <strong>A2B</strong> magazine · <strong>April</strong> <strong>2018</strong> 25