2000 Annual Report - Yum!

2000 Annual Report - Yum!

2000 Annual Report - Yum!

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

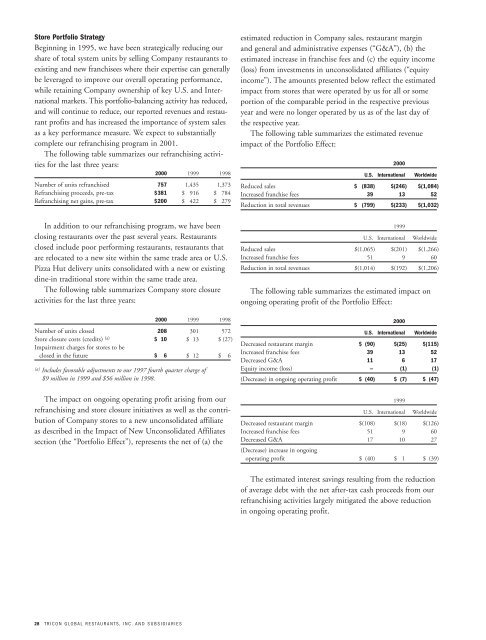

Store Portfolio Strategy<br />

Beginning in 1995, we have been strategically reducing our<br />

share of total system units by selling Company restaurants to<br />

existing and new franchisees where their expertise can generally<br />

be leveraged to improve our overall operating performance,<br />

while retaining Company ownership of key U.S. and International<br />

markets. This portfolio-balancing activity has reduced,<br />

and will continue to reduce, our reported revenues and restaurant<br />

profits and has increased the importance of system sales<br />

as a key performance measure. We expect to substantially<br />

complete our refranchising program in 2001.<br />

The following table summarizes our refranchising activities<br />

for the last three years:<br />

<strong>2000</strong> 1999 1998<br />

Number of units refranchised 757 1,435 1,373<br />

Refranchising proceeds, pre-tax $381 $«««916 $«««784<br />

Refranchising net gains, pre-tax $200 $«««422 $«««279<br />

In addition to our refranchising program, we have been<br />

closing restaurants over the past several years. Restaurants<br />

closed include poor performing restaurants, restaurants that<br />

are relocated to a new site within the same trade area or U.S.<br />

Pizza Hut delivery units consolidated with a new or existing<br />

dine-in traditional store within the same trade area.<br />

The following table summarizes Company store closure<br />

activities for the last three years:<br />

28 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES<br />

<strong>2000</strong> 1999 1998<br />

Number of units closed 208 301 572<br />

Store closure costs (credits) (a) $««10 $««13 $«(27)<br />

Impairment charges for stores to be<br />

closed in the future $««÷6 $««12 $«÷«6<br />

(a) Includes favorable adjustments to our 1997 fourth quarter charge of<br />

$9 million in 1999 and $56 million in 1998.<br />

The impact on ongoing operating profit arising from our<br />

refranchising and store closure initiatives as well as the contribution<br />

of Company stores to a new unconsolidated affiliate<br />

as described in the Impact of New Unconsolidated Affiliates<br />

section (the “Portfolio Effect”), represents the net of (a) the<br />

estimated reduction in Company sales, restaurant margin<br />

and general and administrative expenses (“G&A”), (b) the<br />

estimated increase in franchise fees and (c) the equity income<br />

(loss) from investments in unconsolidated affiliates (“equity<br />

income”). The amounts presented below reflect the estimated<br />

impact from stores that were operated by us for all or some<br />

portion of the comparable period in the respective previous<br />

year and were no longer operated by us as of the last day of<br />

the respective year.<br />

The following table summarizes the estimated revenue<br />

impact of the Portfolio Effect:<br />

<strong>2000</strong><br />

U.S. International Worldwide<br />

Reduced sales $«««(838) $(246) $(1,084)<br />

Increased franchise fees 39 13 52<br />

Reduction in total revenues $«««(799) $(233) $(1,032)<br />

1999<br />

U.S. International Worldwide<br />

Reduced sales $(1,065) $(201) $(1,266)<br />

Increased franchise fees 51 9 60<br />

Reduction in total revenues $(1,014) $(192) $(1,206)<br />

The following table summarizes the estimated impact on<br />

ongoing operating profit of the Portfolio Effect:<br />

<strong>2000</strong><br />

U.S. International Worldwide<br />

Decreased restaurant margin $««(90) $(25) $(115)<br />

Increased franchise fees 39 13 52<br />

Decreased G&A 11 6 17<br />

Equity income (loss) – (1) (1)<br />

(Decrease) in ongoing operating profit $««(40) $÷(7) $÷(47)<br />

1999<br />

U.S. International Worldwide<br />

Decreased restaurant margin $(108) $(18) $(126)<br />

Increased franchise fees 51 9 60<br />

Decreased G&A 17 10 27<br />

(Decrease) increase in ongoing<br />

operating profit $÷(40) $÷«1 $÷(39)<br />

The estimated interest savings resulting from the reduction<br />

of average debt with the net after-tax cash proceeds from our<br />

refranchising activities largely mitigated the above reduction<br />

in ongoing operating profit.