2000 Annual Report - Yum!

2000 Annual Report - Yum!

2000 Annual Report - Yum!

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

attributable to favorable Effective Net Pricing. Labor cost<br />

increases, primarily driven by higher wage rates, were almost<br />

fully offset by lower food and paper costs as improved product<br />

cost management resulted in lower overall beverage and<br />

distribution costs. The improvement also included approximately<br />

15 basis points from retroactive beverage rebates<br />

related to 1998 recognized in 1999. In addition, an increase<br />

in favorable insurance-related adjustments over 1998 contributed<br />

approximately 10 basis points to our improvement.<br />

See Note 21 for additional information regarding our insurance-related<br />

adjustments. All of these improvements were<br />

partially offset by volume declines at Taco Bell and the unfavorable<br />

impact of the introduction of lower margin chicken<br />

sandwiches at KFC.<br />

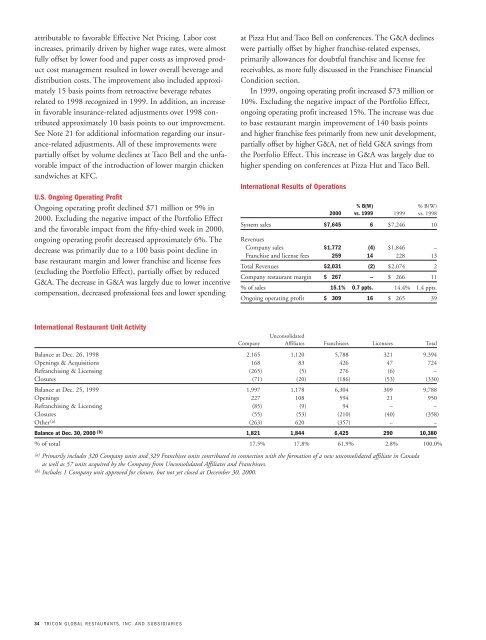

U.S. Ongoing Operating Profit<br />

Ongoing operating profit declined $71 million or 9% in<br />

<strong>2000</strong>. Excluding the negative impact of the Portfolio Effect<br />

and the favorable impact from the fifty-third week in <strong>2000</strong>,<br />

ongoing operating profit decreased approximately 6%. The<br />

decrease was primarily due to a 100 basis point decline in<br />

base restaurant margin and lower franchise and license fees<br />

(excluding the Portfolio Effect), partially offset by reduced<br />

G&A. The decrease in G&A was largely due to lower incentive<br />

compensation, decreased professional fees and lower spending<br />

International Restaurant Unit Activity<br />

34 TRICON GLOBAL RESTAURANTS, INC. AND SUBSIDIARIES<br />

at Pizza Hut and Taco Bell on conferences. The G&A declines<br />

were partially offset by higher franchise-related expenses,<br />

primarily allowances for doubtful franchise and license fee<br />

receivables, as more fully discussed in the Franchisee Financial<br />

Condition section.<br />

In 1999, ongoing operating profit increased $73 million or<br />

10%. Excluding the negative impact of the Portfolio Effect,<br />

ongoing operating profit increased 15%. The increase was due<br />

to base restaurant margin improvement of 140 basis points<br />

and higher franchise fees primarily from new unit development,<br />

partially offset by higher G&A, net of field G&A savings from<br />

the Portfolio Effect. This increase in G&A was largely due to<br />

higher spending on conferences at Pizza Hut and Taco Bell.<br />

International Results of Operations<br />

% B(W) % B(W)<br />

<strong>2000</strong> vs. 1999 1999 vs. 1998<br />

System sales $7,645 6 $7,246 10<br />

Revenues<br />

Company sales $1,772 (4) $1,846 –<br />

Franchise and license fees 259 14 228 13<br />

Total Revenues $2,031 (2) $2,074 2<br />

Company restaurant margin $÷«267 – $÷«266 11<br />

% of sales 15.1% 0.7«ppts. 14.4% 1.4«ppts.<br />

Ongoing operating profit $÷«309 16 $÷«265 39<br />

Unconsolidated<br />

Company Affiliates Franchisees Licensees Total<br />

Balance at Dec. 26, 1998 2,165 1,120 5,788 321 9,394<br />

Openings & Acquisitions 168 83 426 47 724<br />

Refranchising & Licensing (265) (5) 276 (6) –<br />

Closures (71) (20) (186) (53) (330)<br />

Balance at Dec. 25, 1999 1,997 1,178 6,304 309 9,788<br />

Openings 227 108 594 21 950<br />

Refranchising & Licensing (85) (9) 94 – –<br />

Closures (55) (53) (210) (40) (358)<br />

Other (a) (263) 620 (357) – –<br />

Balance at Dec. 30, <strong>2000</strong> (b) 1,821 1,844 6,425 290 10,380<br />

% of total 17.5% 17.8% 61.9% 2.8% 100.0%<br />

(a) Primarily includes 320 Company units and 329 Franchisee units contributed in connection with the formation of a new unconsolidated affiliate in Canada<br />

as well as 57 units acquired by the Company from Unconsolidated Affiliates and Franchisees.<br />

(b) Includes 1 Company unit approved for closure, but not yet closed at December 30, <strong>2000</strong>.