Multibranding - Yum!

Multibranding - Yum!

Multibranding - Yum!

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The increase in other (income) expense in 2003 was<br />

primarily driven by the improved operating performance of<br />

our unconsolidated affiliates, particularly in China.<br />

WORLDWIDE FACILITY ACTIONS<br />

We recorded a net loss from facility actions of $36 million,<br />

$32 million and $1 million in 2003, 2002 and 2001,<br />

respectively. See the Store Portfolio Strategy section for<br />

more detail of our refranchising and closure activities and<br />

Note 7 for a summary of the components of facility actions<br />

by reportable operating segment.<br />

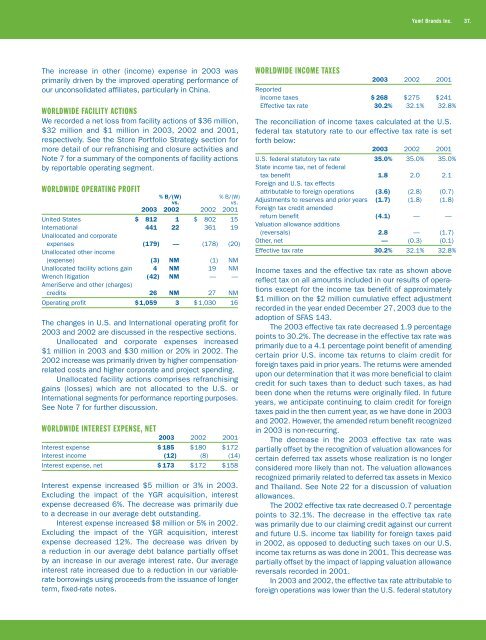

WORLDWIDE OPERATING PROFIT<br />

% B/(W) % B/(W)<br />

vs. vs.<br />

2003 2002 2002 2001<br />

United States $ 812 1 $ 802 15<br />

International<br />

Unallocated and corporate<br />

441 22 361 19<br />

expenses<br />

Unallocated other income<br />

(179) — (178) (20)<br />

(expense) (3) NM (1) NM<br />

Unallocated facility actions gain 4 NM 19 NM<br />

Wrench litigation<br />

AmeriServe and other (charges)<br />

(42) NM — —<br />

credits 26 NM 27 NM<br />

Operating profit $ 1,059 3 $ 1,030 16<br />

The changes in U.S. and International operating profit for<br />

2003 and 2002 are discussed in the respective sections.<br />

Unallocated and corporate expenses increased<br />

$1 million in 2003 and $30 million or 20% in 2002. The<br />

2002 increase was primarily driven by higher compensationrelated<br />

costs and higher corporate and project spending.<br />

Unallocated facility actions comprises refranchising<br />

gains (losses) which are not allocated to the U.S. or<br />

International segments for performance reporting purposes.<br />

See Note 7 for further discussion.<br />

WORLDWIDE INTEREST EXPENSE, NET<br />

2003 2002 2001<br />

Interest expense $ 185 $ 180 $ 172<br />

Interest income (12) (8) (14)<br />

Interest expense, net $ 173 $ 172 $ 158<br />

Interest expense increased $5 million or 3% in 2003.<br />

Excluding the impact of the YGR acquisition, interest<br />

expense decreased 6%. The decrease was primarily due<br />

to a decrease in our average debt outstanding.<br />

Interest expense increased $8 million or 5% in 2002.<br />

Excluding the impact of the YGR acquisition, interest<br />

expense decreased 12%. The decrease was driven by<br />

a reduction in our average debt balance partially offset<br />

by an increase in our average interest rate. Our average<br />

interest rate increased due to a reduction in our variablerate<br />

borrowings using proceeds from the issuance of longer<br />

term, fixed-rate notes.<br />

WORLDWIDE INCOME TAXES<br />

<strong>Yum</strong>! Brands Inc. 37.<br />

2003 2002 2001<br />

Reported<br />

Income taxes $ 268 $ 275 $ 241<br />

Effective tax rate 30.2% 32.1% 32.8%<br />

The reconciliation of income taxes calculated at the U.S.<br />

federal tax statutory rate to our effective tax rate is set<br />

forth below:<br />

2003 2002 2001<br />

U.S. federal statutory tax rate<br />

State income tax, net of federal<br />

35.0% 35.0% 35.0%<br />

tax benefit<br />

Foreign and U.S. tax effects<br />

1.8 2.0 2.1<br />

attributable to foreign operations (3.6) (2.8) (0.7)<br />

Adjustments to reserves and prior years<br />

Foreign tax credit amended<br />

(1.7) (1.8) (1.8)<br />

return benefit<br />

Valuation allowance additions<br />

(4.1) — —<br />

(reversals) 2.8 — (1.7)<br />

Other, net — (0.3) (0.1)<br />

Effective tax rate 30.2% 32.1% 32.8%<br />

Income taxes and the effective tax rate as shown above<br />

reflect tax on all amounts included in our results of operations<br />

except for the income tax benefit of approximately<br />

$1 million on the $2 million cumulative effect adjustment<br />

recorded in the year ended December 27, 2003 due to the<br />

adoption of SFAS 143.<br />

The 2003 effective tax rate decreased 1.9 percentage<br />

points to 30.2%. The decrease in the effective tax rate was<br />

primarily due to a 4.1 percentage point benefit of amending<br />

certain prior U.S. income tax returns to claim credit for<br />

foreign taxes paid in prior years. The returns were amended<br />

upon our determination that it was more beneficial to claim<br />

credit for such taxes than to deduct such taxes, as had<br />

been done when the returns were originally filed. In future<br />

years, we anticipate continuing to claim credit for foreign<br />

taxes paid in the then current year, as we have done in 2003<br />

and 2002. However, the amended return benefit recognized<br />

in 2003 is non-recurring.<br />

The decrease in the 2003 effective tax rate was<br />

partially offset by the recognition of valuation allowances for<br />

certain deferred tax assets whose realization is no longer<br />

considered more likely than not. The valuation allowances<br />

recognized primarily related to deferred tax assets in Mexico<br />

and Thailand. See Note 22 for a discussion of valuation<br />

allowances.<br />

The 2002 effective tax rate decreased 0.7 percentage<br />

points to 32.1%. The decrease in the effective tax rate<br />

was primarily due to our claiming credit against our current<br />

and future U.S. income tax liability for foreign taxes paid<br />

in 2002, as opposed to deducting such taxes on our U.S.<br />

income tax returns as was done in 2001. This decrease was<br />

partially offset by the impact of lapping valuation allowance<br />

reversals recorded in 2001.<br />

In 2003 and 2002, the effective tax rate attributable to<br />

foreign operations was lower than the U.S. federal statutory