Multibranding - Yum!

Multibranding - Yum!

Multibranding - Yum!

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

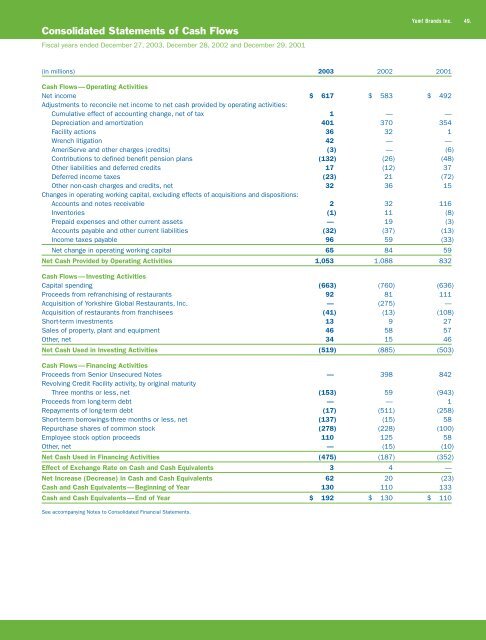

Consolidated Statements of Cash Flows<br />

Fiscal years ended December 27, 2003, December 28, 2002 and December 29, 2001<br />

<strong>Yum</strong>! Brands Inc. 49.<br />

(in millions) 2003 2002 2001<br />

Cash Flows — Operating Activities<br />

Net income<br />

Adjustments to reconcile net income to net cash provided by operating activities:<br />

$ 617 $ 583 $ 492<br />

Cumulative effect of accounting change, net of tax 1 — —<br />

Depreciation and amortization 401 370 354<br />

Facility actions 36 32 1<br />

Wrench litigation 42 — —<br />

AmeriServe and other charges (credits) (3) — (6)<br />

Contributions to defined benefit pension plans (132) (26) (48)<br />

Other liabilities and deferred credits 17 (12) 37<br />

Deferred income taxes (23) 21 (72)<br />

Other non-cash charges and credits, net<br />

Changes in operating working capital, excluding effects of acquisitions and dispositions:<br />

32 36 15<br />

Accounts and notes receivable 2 32 116<br />

Inventories (1) 11 (8)<br />

Prepaid expenses and other current assets — 19 (3)<br />

Accounts payable and other current liabilities (32) (37) (13)<br />

Income taxes payable 96 59 (33)<br />

Net change in operating working capital 65 84 59<br />

Net Cash Provided by Operating Activities 1,053 1,088 832<br />

Cash Flows — Investing Activities<br />

Capital spending (663) (760) (636)<br />

Proceeds from refranchising of restaurants 92 81 111<br />

Acquisition of Yorkshire Global Restaurants, Inc. — (275) —<br />

Acquisition of restaurants from franchisees (41) (13) (108)<br />

Short-term investments 13 9 27<br />

Sales of property, plant and equipment 46 58 57<br />

Other, net 34 15 46<br />

Net Cash Used in Investing Activities (519) (885) (503)<br />

Cash Flows — Financing Activities<br />

Proceeds from Senior Unsecured Notes<br />

Revolving Credit Facility activity, by original maturity<br />

— 398 842<br />

Three months or less, net (153) 59 (943)<br />

Proceeds from long-term debt — — 1<br />

Repayments of long-term debt (17) (511) (258)<br />

Short-term borrowings-three months or less, net (137) (15) 58<br />

Repurchase shares of common stock (278) (228) (100)<br />

Employee stock option proceeds 110 125 58<br />

Other, net — (15) (10)<br />

Net Cash Used in Financing Activities (475) (187) (352)<br />

Effect of Exchange Rate on Cash and Cash Equivalents 3 4 —<br />

Net Increase (Decrease) in Cash and Cash Equivalents 62 20 (23)<br />

Cash and Cash Equivalents — Beginning of Year 130 110 133<br />

Cash and Cash Equivalents — End of Year $ 192 $ 130 $ 110<br />

See accompanying Notes to Consolidated Financial Statements.