Multibranding - Yum!

Multibranding - Yum!

Multibranding - Yum!

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

as a decrease primarily driven by store closures was largely<br />

offset by new unit development.<br />

Company sales increased $491 million or 11% in<br />

2002. Excluding the favorable impact of the YGR acquisition,<br />

company sales increased 3%. The increase was driven<br />

by new unit development and same store sales growth.<br />

The increase was partially offset by store closures and<br />

refranchising.<br />

Franchise and license fees increased $29 million or<br />

5% in 2002. Excluding the favorable impact of the YGR<br />

acquisition, franchise and license fees increased 3%. The<br />

increase was driven by same store sales growth and new<br />

unit development, partially offset by store closures.<br />

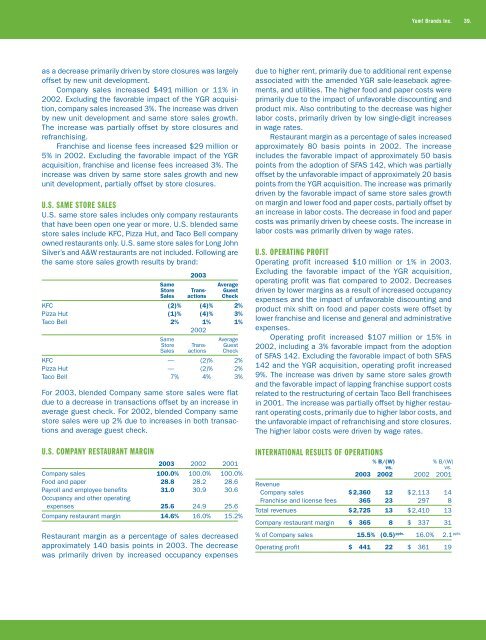

U.S. SAME STORE SALES<br />

U.S. same store sales includes only company restaurants<br />

that have been open one year or more. U.S. blended same<br />

store sales include KFC, Pizza Hut, and Taco Bell company<br />

owned restaurants only. U.S. same store sales for Long John<br />

Silver’s and A&W restaurants are not included. Following are<br />

the same store sales growth results by brand:<br />

2003<br />

Same Average<br />

Store Trans- Guest<br />

Sales actions Check<br />

KFC (2)% (4)% 2%<br />

Pizza Hut (1)% (4)% 3%<br />

Taco Bell 2% 1%<br />

2002<br />

1%<br />

Same Average<br />

Store Trans- Guest<br />

Sales actions Check<br />

KFC — (2)% 2%<br />

Pizza Hut — (2)% 2%<br />

Taco Bell 7% 4% 3%<br />

For 2003, blended Company same store sales were flat<br />

due to a decrease in transactions offset by an increase in<br />

average guest check. For 2002, blended Company same<br />

store sales were up 2% due to increases in both transactions<br />

and average guest check.<br />

U.S. COMPANY RESTAURANT MARGIN<br />

2003 2002 2001<br />

Company sales 100.0% 100.0% 100.0%<br />

Food and paper 28.8 28.2 28.6<br />

Payroll and employee benefits<br />

Occupancy and other operating<br />

31.0 30.9 30.6<br />

expenses 25.6 24.9 25.6<br />

Company restaurant margin 14.6% 16.0% 15.2%<br />

Restaurant margin as a percentage of sales decreased<br />

approximately 140 basis points in 2003. The decrease<br />

was primarily driven by increased occupancy expenses<br />

<strong>Yum</strong>! Brands Inc. 39.<br />

due to higher rent, primarily due to additional rent expense<br />

associated with the amended YGR sale-leaseback agreements,<br />

and utilities. The higher food and paper costs were<br />

primarily due to the impact of unfavorable discounting and<br />

product mix. Also contributing to the decrease was higher<br />

labor costs, primarily driven by low single-digit increases<br />

in wage rates.<br />

Restaurant margin as a percentage of sales increased<br />

approximately 80 basis points in 2002. The increase<br />

includes the favorable impact of approximately 50 basis<br />

points from the adoption of SFAS 142, which was partially<br />

offset by the unfavorable impact of approximately 20 basis<br />

points from the YGR acquisition. The increase was primarily<br />

driven by the favorable impact of same store sales growth<br />

on margin and lower food and paper costs, partially offset by<br />

an increase in labor costs. The decrease in food and paper<br />

costs was primarily driven by cheese costs. The increase in<br />

labor costs was primarily driven by wage rates.<br />

U.S. OPERATING PROFIT<br />

Operating profit increased $10 million or 1% in 2003.<br />

Excluding the favorable impact of the YGR acquisition,<br />

operating profit was flat compared to 2002. Decreases<br />

driven by lower margins as a result of increased occupancy<br />

expenses and the impact of unfavorable discounting and<br />

product mix shift on food and paper costs were offset by<br />

lower franchise and license and general and administrative<br />

expenses.<br />

Operating profit increased $107 million or 15% in<br />

2002, including a 3% favorable impact from the adoption<br />

of SFAS 142. Excluding the favorable impact of both SFAS<br />

142 and the YGR acquisition, operating profit increased<br />

9%. The increase was driven by same store sales growth<br />

and the favorable impact of lapping franchise support costs<br />

related to the restructuring of certain Taco Bell franchisees<br />

in 2001. The increase was partially offset by higher restaurant<br />

operating costs, primarily due to higher labor costs, and<br />

the unfavorable impact of refranchising and store closures.<br />

The higher labor costs were driven by wage rates.<br />

INTERNATIONAL RESULTS OF OPERATIONS<br />

% B/(W) % B/(W)<br />

vs. vs.<br />

2003 2002 2002 2001<br />

Revenue<br />

Company sales $ 2,360 12 $ 2,113 14<br />

Franchise and license fees 365 23 297 8<br />

Total revenues $ 2,725 13 $ 2,410 13<br />

Company restaurant margin $ 365 8 $ 337 31<br />

% of Company sales 15.5% (0.5) ppts. 16.0% 2.1 )ppts.<br />

Operating profit $ 441 22 $ 361 19