FLEISCHWIRTSCHAFT international_04_2018

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

.....................................................................................................................................................................<br />

10<br />

Fleischwirtschaft <strong>international</strong> 4_<strong>2018</strong><br />

Pork<br />

China's boom appears to have peaked<br />

opened up better prospects for<br />

European pig farmers. This situation<br />

has inspired farms struggling<br />

with financial problems to carry<br />

on. At the same time it increased<br />

the willingness of more efficient<br />

farms to invest. The optimistic<br />

mood in the context of the low<br />

feed prices brought distinct<br />

growth momentum to the North<br />

American processing industry. In<br />

<strong>2018</strong> the reduction of the global<br />

pig population will continue at a<br />

slightly slower rate. China is likely<br />

to reduce its stocks again by<br />

15 mill. animals or 3.4%. As herd<br />

sizes are increasing in many<br />

countries, above all in the USA,<br />

the global downsize will only<br />

amount to 1.3%. Altogether the<br />

global pig population will then be<br />

quantified at just under 893 mill.<br />

animals. All in all we are moving<br />

towards a smaller but more efficient<br />

global herd (Fig. 1).<br />

In Russia the state promotion,<br />

in combination with the protectionist<br />

strategy, is bearing fruit. It<br />

remains to be seen whether the<br />

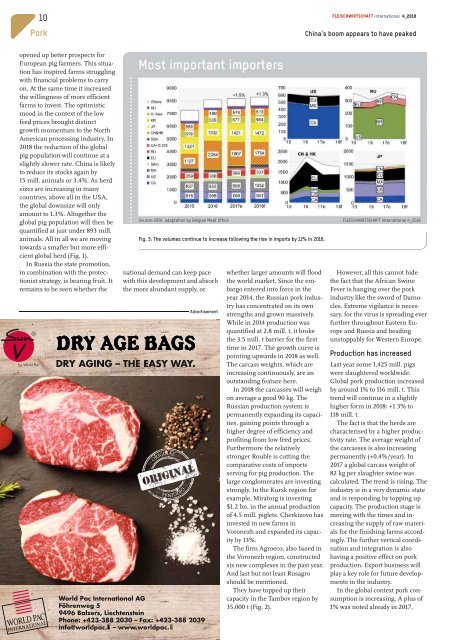

Source: GIRA, adaptation by Belgian Meat Office <strong>FLEISCHWIRTSCHAFT</strong> <strong>international</strong> 4_<strong>2018</strong><br />

Fig. 3: The volumes continue to increase following the rise in imports by 11% in 2016.<br />

national demand can keep pace<br />

with this development and absorb<br />

the more abundant supply, or<br />

Advertisement<br />

whether larger amounts will flood<br />

the world market. Since the embargo<br />

entered into force in the<br />

year 2014, the Russian pork industry<br />

has concentrated on its own<br />

strengths and grown massively.<br />

While in 2014 production was<br />

quantified at 2.8 mill. t, it broke<br />

the 3.5 mill. t barrier for the first<br />

time in 2017. The growth curve is<br />

pointing upwards in <strong>2018</strong> as well.<br />

The carcass weights, which are<br />

increasing continuously, are an<br />

outstanding feature here.<br />

In <strong>2018</strong> the carcasses will weigh<br />

on average a good 90 kg. The<br />

Russian production system is<br />

permanently expanding its capacities,<br />

gaining points through a<br />

higher degree of efficiency and<br />

profiting from low feed prices.<br />

Furthermore the relatively<br />

stronger Rouble is cutting the<br />

comparative costs of imports<br />

serving for pig production. The<br />

large conglomerates are investing<br />

strongly. In the Kursk region for<br />

example, Miratorg is investing<br />

$1.2 bn. in the annual production<br />

of 4.5 mill. piglets. Cherkizovo has<br />

invested in new farms in<br />

Voronezh and expanded its capacity<br />

by 13%.<br />

The firm Agroeco, also based in<br />

the Voronezh region, constructed<br />

six new complexes in the past year.<br />

And last but not least Rusagro<br />

should be mentioned.<br />

They have topped up their<br />

capacity in the Tambov region by<br />

35,000 t (Fig. 2).<br />

However, all this cannot hide<br />

the fact that the African Swine<br />

Fever is hanging over the pork<br />

industry like the sword of Damocles.<br />

Extreme vigilance is necessary,<br />

for the virus is spreading ever<br />

further throughout Eastern Europe<br />

and Russia and heading<br />

unstoppably for Western Europe.<br />

Production has increased<br />

Last year some 1,425 mill. pigs<br />

were slaughtered worldwide.<br />

Global pork production increased<br />

by around 1% to 116mill. t. This<br />

trend will continue in a slightly<br />

higher form in <strong>2018</strong>: +1.3% to<br />

118mill. t.<br />

The fact is that the herds are<br />

characterised by a higher productivity<br />

rate. The average weight of<br />

the carcasses is also increasing<br />

permanently (+0.4%/year). In<br />

2017 a global carcass weight of<br />

82 kg per slaughter swine was<br />

calculated. The trend is rising. The<br />

industry is in a very dynamic state<br />

and is responding by topping up<br />

capacity. The production stage is<br />

moving with the times and increasing<br />

the supply of raw materials<br />

for the finishing farms accordingly.<br />

The further vertical coordination<br />

and integration is also<br />

having a positive effect on pork<br />

production. Export business will<br />

play a key role for future developments<br />

in the industry.<br />

In the global context pork consumption<br />

is increasing. A plus of<br />

1% was noted already in 2017,