Infrastructure Investments in Renewable Energy - RREEF Real Estate

Infrastructure Investments in Renewable Energy - RREEF Real Estate

Infrastructure Investments in Renewable Energy - RREEF Real Estate

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

W<strong>in</strong>d<br />

Solar<br />

Biofuels<br />

Mature <strong>in</strong>frastructure funds, by contrast, do not <strong>in</strong>vest <strong>in</strong> the “pipel<strong>in</strong>e” assets, as the<br />

development, permitt<strong>in</strong>g, f<strong>in</strong>anc<strong>in</strong>g, and construction risks do not meet the profile of such<br />

funds. Mature funds only target those assets which are operat<strong>in</strong>g or where the f<strong>in</strong>anc<strong>in</strong>g is <strong>in</strong><br />

place. Such mature funds also pass off the construction risk through an Eng<strong>in</strong>eer<strong>in</strong>g,<br />

Procurement and Construction (EPC) contract. 40<br />

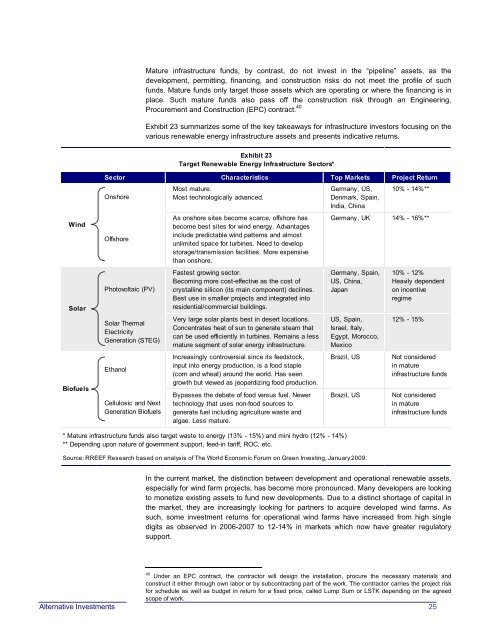

Exhibit 23 summarizes some of the key takeaways for <strong>in</strong>frastructure <strong>in</strong>vestors focus<strong>in</strong>g on the<br />

various renewable energy <strong>in</strong>frastructure assets and presents <strong>in</strong>dicative returns.<br />

Exhibit 23<br />

Target <strong>Renewable</strong> <strong>Energy</strong> <strong>Infrastructure</strong> Sectors*<br />

Sector Characteristics Top Markets Project Return<br />

Most mature. Germany, US, 10% - 14%**<br />

Onshore<br />

Most technologically advanced. Denmark, Spa<strong>in</strong>,<br />

India, Ch<strong>in</strong>a<br />

As onshore sites become scarce, offshore has<br />

become best sites for w<strong>in</strong>d energy. Advantages<br />

Germany, UK 14% - 16%**<br />

Offshore<br />

<strong>in</strong>clude predictable w<strong>in</strong>d patterns and almost<br />

unlimited space for turb<strong>in</strong>es. Need to develop<br />

storage/transmission facilities. More expensive<br />

than onshore.<br />

Fastest grow<strong>in</strong>g sector. Germany, Spa<strong>in</strong>, 10% - 12%<br />

Becom<strong>in</strong>g more cost-effective as the cost of US, Ch<strong>in</strong>a, Heavily dependent<br />

Photovoltaic (PV) crystall<strong>in</strong>e silicon (its ma<strong>in</strong> component) decl<strong>in</strong>es. Japan on <strong>in</strong>centive<br />

Best use <strong>in</strong> smaller projects and <strong>in</strong>tegrated <strong>in</strong>to<br />

residential/commercial build<strong>in</strong>gs.<br />

regime<br />

Solar Thermal<br />

Electricity<br />

Generation (STEG)<br />

Ethanol<br />

Cellulosic and Next<br />

Generation Biofuels<br />

Very large solar plants best <strong>in</strong> desert locations. US, Spa<strong>in</strong>, 12% - 15%<br />

Concentrates heat of sun to generate steam that Israel, Italy,<br />

can be used efficiently <strong>in</strong> turb<strong>in</strong>es. Rema<strong>in</strong>s a less Egypt, Morocco,<br />

mature segment of solar energy <strong>in</strong>frastructure. Mexico<br />

Increas<strong>in</strong>gly controversial s<strong>in</strong>ce its feedstock, Brazil, US Not considered<br />

<strong>in</strong>put <strong>in</strong>to energy production, is a food staple <strong>in</strong> mature<br />

(corn and wheat) around the world. Has seen<br />

growth but viewed as jeopardiz<strong>in</strong>g food production.<br />

<strong>in</strong>frastructure funds<br />

Bypasses the debate of food versus fuel. Newer Brazil, US Not considered<br />

technology that uses non-food sources to <strong>in</strong> mature<br />

generate fuel <strong>in</strong>clud<strong>in</strong>g agriculture waste and<br />

algae. Less mature.<br />

<strong>in</strong>frastructure funds<br />

* Mature <strong>in</strong>frastructure funds also target waste to energy (13% - 15%) and m<strong>in</strong>i hydro (12% - 14%)<br />

** Depend<strong>in</strong>g upon nature of government support, feed-<strong>in</strong> tariff, ROC, etc.<br />

Source: <strong>RREEF</strong> Research based on analysis of The World Economic Forum on Green Invest<strong>in</strong>g, January 2009.<br />

In the current market, the dist<strong>in</strong>ction between development and operational renewable assets,<br />

especially for w<strong>in</strong>d farm projects, has become more pronounced. Many developers are look<strong>in</strong>g<br />

to monetize exist<strong>in</strong>g assets to fund new developments. Due to a dist<strong>in</strong>ct shortage of capital <strong>in</strong><br />

the market, they are <strong>in</strong>creas<strong>in</strong>gly look<strong>in</strong>g for partners to acquire developed w<strong>in</strong>d farms. As<br />

such, some <strong>in</strong>vestment returns for operational w<strong>in</strong>d farms have <strong>in</strong>creased from high s<strong>in</strong>gle<br />

digits as observed <strong>in</strong> 2006-2007 to 12-14% <strong>in</strong> markets which now have greater regulatory<br />

support.<br />

40<br />

Under an EPC contract, the contractor will design the <strong>in</strong>stallation, procure the necessary materials and<br />

construct it either through own labor or by subcontract<strong>in</strong>g part of the work. The contractor carries the project risk<br />

for schedule as well as budget <strong>in</strong> return for a fixed price, called Lump Sum or LSTK depend<strong>in</strong>g on the agreed<br />

scope of work.<br />

Alternative <strong>Investments</strong> 25