Infrastructure Investments in Renewable Energy - RREEF Real Estate

Infrastructure Investments in Renewable Energy - RREEF Real Estate

Infrastructure Investments in Renewable Energy - RREEF Real Estate

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

particularly <strong>in</strong> Europe, will lead to more focus on renewable <strong>in</strong>vestment. Over 70% of the<br />

world’s oil reserves are held <strong>in</strong> regions with significant geopolitical risk, driv<strong>in</strong>g many countries<br />

to reduce their exposure to energy supply <strong>in</strong>terruptions through the development of domestic<br />

renewable sources. 6 Accord<strong>in</strong>gly, we expect to see a secular growth trend <strong>in</strong> renewable<br />

energy <strong>in</strong>vestment opportunities.<br />

<strong>Energy</strong> Market Conditions<br />

Bus<strong>in</strong>ess as Usual Projections<br />

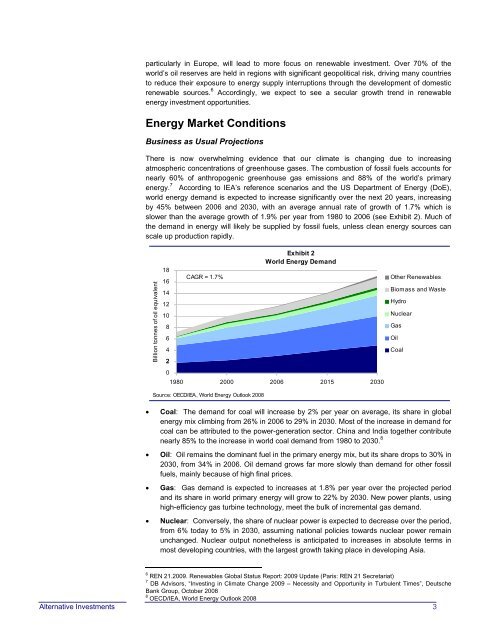

There is now overwhelm<strong>in</strong>g evidence that our climate is chang<strong>in</strong>g due to <strong>in</strong>creas<strong>in</strong>g<br />

atmospheric concentrations of greenhouse gases. The combustion of fossil fuels accounts for<br />

nearly 60% of anthropogenic greenhouse gas emissions and 88% of the world’s primary<br />

energy. 7 Accord<strong>in</strong>g to IEA’s reference scenarios and the US Department of <strong>Energy</strong> (DoE),<br />

world energy demand is expected to <strong>in</strong>crease significantly over the next 20 years, <strong>in</strong>creas<strong>in</strong>g<br />

by 45% between 2006 and 2030, with an average annual rate of growth of 1.7% which is<br />

slower than the average growth of 1.9% per year from 1980 to 2006 (see Exhibit 2). Much of<br />

the demand <strong>in</strong> energy will likely be supplied by fossil fuels, unless clean energy sources can<br />

scale up production rapidly.<br />

Billion tonnes of oil equivalent<br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

- 0<br />

CAGR = 1.7%<br />

Exhibit 2<br />

World <strong>Energy</strong> Demand<br />

1980 2000 2006 2015 2030<br />

Source: OECD/IEA, World <strong>Energy</strong> Outlook 2008<br />

Other <strong>Renewable</strong>s<br />

Biomass and Waste<br />

� Coal: The demand for coal will <strong>in</strong>crease by 2% per year on average, its share <strong>in</strong> global<br />

energy mix climb<strong>in</strong>g from 26% <strong>in</strong> 2006 to 29% <strong>in</strong> 2030. Most of the <strong>in</strong>crease <strong>in</strong> demand for<br />

coal can be attributed to the power-generation sector. Ch<strong>in</strong>a and India together contribute<br />

nearly 85% to the <strong>in</strong>crease <strong>in</strong> world coal demand from 1980 to 2030. 8<br />

� Oil: Oil rema<strong>in</strong>s the dom<strong>in</strong>ant fuel <strong>in</strong> the primary energy mix, but its share drops to 30% <strong>in</strong><br />

2030, from 34% <strong>in</strong> 2006. Oil demand grows far more slowly than demand for other fossil<br />

fuels, ma<strong>in</strong>ly because of high f<strong>in</strong>al prices.<br />

� Gas: Gas demand is expected to <strong>in</strong>creases at 1.8% per year over the projected period<br />

and its share <strong>in</strong> world primary energy will grow to 22% by 2030. New power plants, us<strong>in</strong>g<br />

high-efficiency gas turb<strong>in</strong>e technology, meet the bulk of <strong>in</strong>cremental gas demand.<br />

� Nuclear: Conversely, the share of nuclear power is expected to decrease over the period,<br />

from 6% today to 5% <strong>in</strong> 2030, assum<strong>in</strong>g national policies towards nuclear power rema<strong>in</strong><br />

unchanged. Nuclear output nonetheless is anticipated to <strong>in</strong>creases <strong>in</strong> absolute terms <strong>in</strong><br />

most develop<strong>in</strong>g countries, with the largest growth tak<strong>in</strong>g place <strong>in</strong> develop<strong>in</strong>g Asia.<br />

6<br />

REN 21.2009. <strong>Renewable</strong>s Global Status Report: 2009 Update (Paris: REN 21 Secretariat)<br />

7<br />

DB Advisors, “Invest<strong>in</strong>g <strong>in</strong> Climate Change 2009 – Necessity and Opportunity <strong>in</strong> Turbulent Times”, Deutsche<br />

Bank Group, October 2008<br />

8<br />

OECD/IEA, World <strong>Energy</strong> Outlook 2008<br />

Alternative <strong>Investments</strong> 3<br />

Hydro<br />

Nuclear<br />

Gas<br />

Oil<br />

Coal