THE ACCOUNTANT_AUTUMN_2018_VER-7-L

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TECHNICAL<br />

Is this perhaps the right time to invest in Apple stock?<br />

just around the corner, enticing<br />

you to jump ship into the new<br />

glitzy stock!<br />

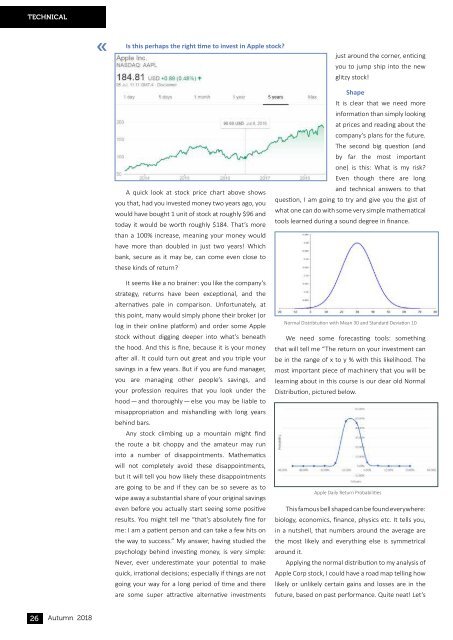

A quick look at stock price chart above shows<br />

you that, had you invested money two years ago, you<br />

would have bought 1 unit of stock at roughly $96 and<br />

today it would be worth roughly $184. That’s more<br />

than a 100% increase, meaning your money would<br />

have more than doubled in just two years! Which<br />

bank, secure as it may be, can come even close to<br />

these kinds of return?<br />

It seems like a no brainer: you like the company’s<br />

strategy, returns have been exceptional, and the<br />

alternatives pale in comparison. Unfortunately, at<br />

this point, many would simply phone their broker (or<br />

log in their online platform) and order some Apple<br />

stock without digging deeper into what’s beneath<br />

the hood. And this is fine, because it is your money<br />

after all. It could turn out great and you triple your<br />

savings in a few years. But if you are fund manager,<br />

you are managing other people’s savings, and<br />

your profession requires that you look under the<br />

hood — and thoroughly — else you may be liable to<br />

misappropriation and mishandling with long years<br />

behind bars.<br />

Any stock climbing up a mountain might find<br />

the route a bit choppy and the amateur may run<br />

into a number of disappointments. Mathematics<br />

will not completely avoid these disappointments,<br />

but it will tell you how likely these disappointments<br />

are going to be and if they can be so severe as to<br />

wipe away a substantial share of your original savings<br />

even before you actually start seeing some positive<br />

results. You might tell me “that’s absolutely fine for<br />

me: I am a patient person and can take a few hits on<br />

the way to success.” My answer, having studied the<br />

psychology behind investing money, is very simple:<br />

Never, ever underestimate your potential to make<br />

quick, irrational decisions; especially if things are not<br />

going your way for a long period of time and there<br />

are some super attractive alternative investments<br />

Shape<br />

It is clear that we need more<br />

information than simply looking<br />

at prices and reading about the<br />

company’s plans for the future.<br />

The second big question (and<br />

by far the most important<br />

one) is this: What is my risk?<br />

Even though there are long<br />

and technical answers to that<br />

question, I am going to try and give you the gist of<br />

what one can do with some very simple mathematical<br />

tools learned during a sound degree in finance.<br />

Normal Distribtution with Mean 30 and Standard Deviation 10<br />

We need some forecasting tools: something<br />

that will tell me “The return on your investment can<br />

be in the range of x to y % with this likelihood. The<br />

most important piece of machinery that you will be<br />

learning about in this course is our dear old Normal<br />

Distribution, pictured below.<br />

Apple Daily Return Probabilities<br />

This famous bell shaped can be found everywhere:<br />

biology, economics, finance, physics etc. It tells you,<br />

in a nutshell, that numbers around the average are<br />

the most likely and everything else is symmetrical<br />

around it.<br />

Applying the normal distribution to my analysis of<br />

Apple Corp stock, I could have a road map telling how<br />

likely or unlikely certain gains and losses are in the<br />

future, based on past performance. Quite neat! Let’s<br />

26 Autumn <strong>2018</strong>