FBR Issue 2 - 2019

Top Low Cost Franchises of 2019 | Multi-Unit Franchises | Rockstar Franchisees

Top Low Cost Franchises of 2019 | Multi-Unit Franchises | Rockstar Franchisees

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>FBR</strong> SPECIAL REPORT<br />

Scalability—Low-cost franchise owners typically<br />

don’t incur the large loan debt that is<br />

common with higher cost investments, allowing<br />

owners to scale much more rapidly. “The<br />

low start-up cost gives our franchisees scalability<br />

and flexibility, which is very attractive for<br />

someone researching business opportunities,”<br />

said Lou Shager, president of Mosquito Joe.<br />

Recession Resistant—Many low cost franchise<br />

opportunities don’t require expensive<br />

overhead or a large staff, which means they<br />

have a better chance of surviving an economic<br />

downturn.<br />

More Location Choices—The majority of<br />

low-cost franchises are service-based businesses<br />

that can be run out of a home office or<br />

mobile unit. Others, such as Cruise Planners<br />

and Dream Vacations can be run from anywhere<br />

in the world, so long as there is an<br />

internet connection!<br />

Financing Options for Low-Cost Franchises<br />

Flexible Hours—With no brick and mortar<br />

location to attend to, most low-cost franchise<br />

opportunities offer owners the ability to make<br />

their own schedule. “A home-based business<br />

allows our franchisees to have a great amount<br />

of autonomy,” said Shager. “The flexibility of<br />

running a business from home allows families<br />

to excel at their business without sacrificing<br />

time for their other responsibilities. They’re<br />

able to get the kids to and from school while<br />

successfully handling scheduling, routing and<br />

customer calls.”<br />

WHAT TO EXPECT WHEN YOU BUY<br />

A LOW-COST FRANCHISE<br />

Like any new business, there are one-time and<br />

recurring costs you’ll need to cover as you<br />

start and grow your business. With a franchise<br />

purchase, there are four primary cost considerations<br />

you’ll need to understand before you<br />

get started:<br />

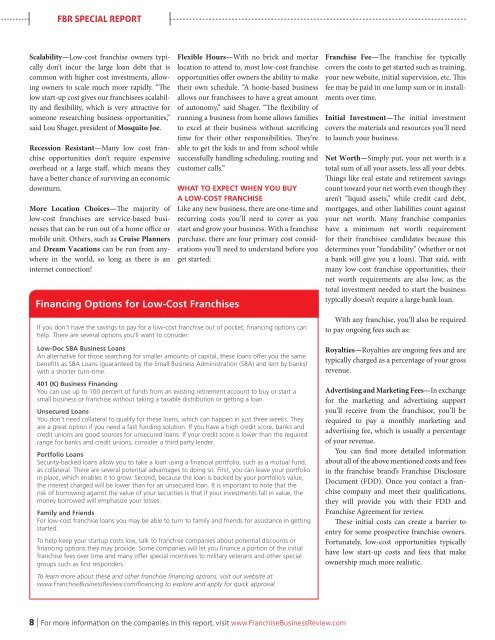

If you don’t have the savings to pay for a low-cost franchise out of pocket, financing options can<br />

help. There are several options you’ll want to consider:<br />

Low-Doc SBA Business Loans<br />

An alternative for those searching for smaller amounts of capital, these loans offer you the same<br />

benefits as SBA Loans (guaranteed by the Small Business Administration (SBA) and lent by banks)<br />

with a shorter turn-time.<br />

401 (K) Business Financing<br />

You can use up to 100 percent of funds from an existing retirement account to buy or start a<br />

small business or franchise without taking a taxable distribution or getting a loan.<br />

Unsecured Loans<br />

You don’t need collateral to qualify for these loans, which can happen in just three weeks. They<br />

are a great option if you need a fast funding solution. If you have a high credit score, banks and<br />

credit unions are good sources for unsecured loans. If your credit score is lower than the required<br />

range for banks and credit unions, consider a third party lender.<br />

Portfolio Loans<br />

Security-backed loans allow you to take a loan using a financial portfolio, such as a mutual fund,<br />

as collateral. There are several potential advantages to doing so. First, you can leave your portfolio<br />

in place, which enables it to grow. Second, because the loan is backed by your portfolio’s value,<br />

the interest charged will be lower than for an unsecured loan. It is important to note that the<br />

risk of borrowing against the value of your securities is that if your investments fall in value, the<br />

money borrowed will emphasize your losses.<br />

Family and Friends<br />

For low-cost franchise loans you may be able to turn to family and friends for assistance in getting<br />

started.<br />

To help keep your startup costs low, talk to franchise companies about potential discounts or<br />

financing options they may provide. Some companies will let you finance a portion of the initial<br />

franchise fees over time and many offer special incentives to military veterans and other special<br />

groups such as first responders.<br />

To learn more about these and other franchise financing options, visit our website at<br />

www.FranchiseBusinessReview.com/financing to explore and apply for quick approval.<br />

Franchise Fee—The franchise fee typically<br />

covers the costs to get started such as training,<br />

your new website, initial supervision, etc. This<br />

fee may be paid in one lump sum or in installments<br />

over time.<br />

Initial Investment—The initial investment<br />

covers the materials and resources you’ll need<br />

to launch your business.<br />

Net Worth—Simply put, your net worth is a<br />

total sum of all your assets, less all your debts.<br />

Things like real estate and retirement savings<br />

count toward your net worth even though they<br />

aren’t “liquid assets,” while credit card debt,<br />

mortgages, and other liabilities count against<br />

your net worth. Many franchise companies<br />

have a minimum net worth requirement<br />

for their franchisee candidates because this<br />

determines your “fundability” (whether or not<br />

a bank will give you a loan). That said, with<br />

many low-cost franchise opportunities, their<br />

net worth requirements are also low, as the<br />

total investment needed to start the business<br />

typically doesn’t require a large bank loan.<br />

With any franchise, you’ll also be required<br />

to pay ongoing fees such as:<br />

Royalties—Royalties are ongoing fees and are<br />

typically charged as a percentage of your gross<br />

revenue.<br />

Advertising and Marketing Fees—In exchange<br />

for the marketing and advertising support<br />

you’ll receive from the franchisor, you’ll be<br />

required to pay a monthly marketing and<br />

advertising fee, which is usually a percentage<br />

of your revenue.<br />

You can find more detailed information<br />

about all of the above mentioned costs and fees<br />

in the franchise brand’s Franchise Disclosure<br />

Document (FDD). Once you contact a franchise<br />

company and meet their qualifications,<br />

they will provide you with their FDD and<br />

Franchise Agreement for review.<br />

These initial costs can create a barrier to<br />

entry for some prospective franchise owners.<br />

Fortunately, low-cost opportunities typically<br />

have low start-up costs and fees that make<br />

ownership much more realistic.<br />

8 | For more information on the companies in this report, visit www.FranchiseBusinessReview.com