The Recycler Issue 317

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FEATURE<br />

UK Printer & Copier Market<br />

According to Statista.com the UK is the fourth largest market in<br />

the world so we have been looking at the data and getting<br />

feedback from partners in the independent reseller and reuse<br />

(remanufacturing) channel.<br />

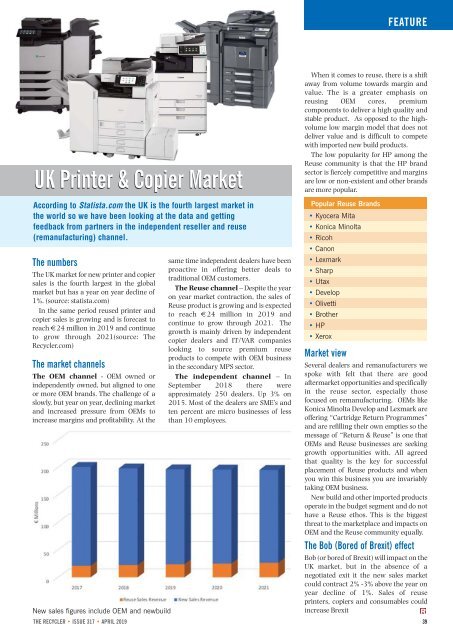

<strong>The</strong> numbers<br />

<strong>The</strong> UK market for new printer and copier<br />

sales is the fourth largest in the global<br />

market but has a year on year decline of<br />

1%. (source: statista.com)<br />

In the same period reused printer and<br />

copier sales is growing and is forecast to<br />

reach €24 million in 2019 and continue<br />

to grow through 2021(source: <strong>The</strong><br />

<strong>Recycler</strong>.com)<br />

<strong>The</strong> market channels<br />

<strong>The</strong> OEM channel - OEM owned or<br />

independently owned, but aligned to one<br />

or more OEM brands. <strong>The</strong> challenge of a<br />

slowly, but year on year, declining market<br />

and increased pressure from OEMs to<br />

increase margins and profitability. At the<br />

New sales figures include OEM and newbuild<br />

THE RECYCLER • ISSUE <strong>317</strong> • APRIL 2019<br />

same time independent dealers have been<br />

proactive in offering better deals to<br />

traditional OEM customers.<br />

<strong>The</strong> Reuse channel – Despite the year<br />

on year market contraction, the sales of<br />

Reuse product is growing and is expected<br />

to reach €24 million in 2019 and<br />

continue to grow through 2021. <strong>The</strong><br />

growth is mainly driven by independent<br />

copier dealers and IT/VAR companies<br />

looking to source premium reuse<br />

products to compete with OEM business<br />

in the secondary MPS sector.<br />

<strong>The</strong> independent channel – In<br />

September 2018 there were<br />

approximately 250 dealers. Up 3% on<br />

2015. Most of the dealers are SME’s and<br />

ten percent are micro businesses of less<br />

than 10 employees.<br />

When it comes to reuse, there is a shift<br />

away from volume towards margin and<br />

value. <strong>The</strong> is a greater emphasis on<br />

reusing OEM cores, premium<br />

components to deliver a high quality and<br />

stable product. As opposed to the highvolume<br />

low margin model that does not<br />

deliver value and is difficult to compete<br />

with imported new build products.<br />

<strong>The</strong> low popularity for HP among the<br />

Reuse community is that the HP brand<br />

sector is fiercely competitive and margins<br />

are low or non-existent and other brands<br />

are more popular.<br />

Popular Reuse Brands<br />

• Kyocera Mita<br />

• Konica Minolta<br />

• Ricoh<br />

• Canon<br />

• Lexmark<br />

• Sharp<br />

• Utax<br />

• Develop<br />

• Olivetti<br />

• Brother<br />

• HP<br />

• Xerox<br />

Market view<br />

Several dealers and remanufacturers we<br />

spoke with felt that there are good<br />

aftermarket opportunities and specifically<br />

in the reuse sector, especially those<br />

focused on remanufacturing. OEMs like<br />

Konica Minolta Develop and Lexmark are<br />

offering “Cartridge Return Programmes”<br />

and are refilling their own empties so the<br />

message of “Return & Reuse” is one that<br />

OEMs and Reuse businesses are seeking<br />

growth opportunities with. All agreed<br />

that quality is the key for successful<br />

placement of Reuse products and when<br />

you win this business you are invariably<br />

taking OEM business.<br />

New build and other imported products<br />

operate in the budget segment and do not<br />

have a Reuse ethos. This is the biggest<br />

threat to the marketplace and impacts on<br />

OEM and the Reuse community equally.<br />

<strong>The</strong> Bob (Bored of Brexit) effect<br />

Bob (or bored of Brexit) will impact on the<br />

UK market, but in the absence of a<br />

negotiated exit it the new sales market<br />

could contract 2% -3% above the year on<br />

year decline of 1%. Sales of reuse<br />

printers, copiers and consumables could<br />

increase Brexit<br />

R<br />

39