The Economic Value of WTAMU Main Report

This report assesses the impact of West Texas A&M University (WTAMU) on the regional economy and the benefits generated by the university for students, taxpayers, and society. The results of this study show that WTAMU creates a positive net impact on the regional economy and generates a positive return on investment for students, taxpayers, and society.

This report assesses the impact of West Texas A&M University (WTAMU) on the regional economy and the benefits generated by the university for students, taxpayers, and society. The results of this study show that WTAMU creates a positive net impact on the regional economy and generates a positive return on investment for students, taxpayers, and society.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

money spent on operations <strong>of</strong> the university or money spent by students on<br />

tuition and fees, an average <strong>of</strong> $8.00 in benefits will accrue to society in Texas. 43<br />

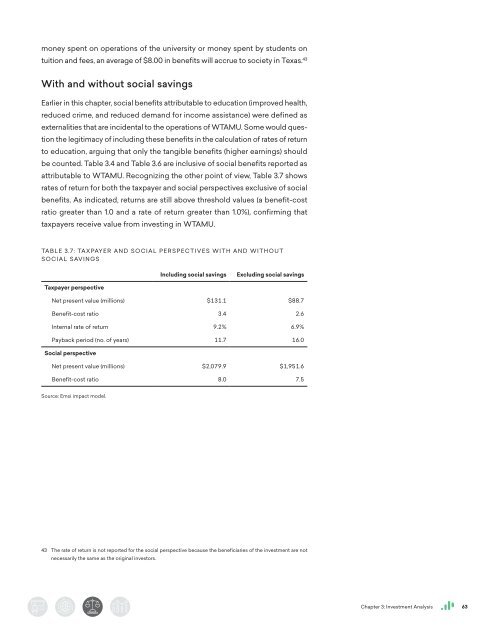

With and without social savings<br />

Earlier in this chapter, social benefits attributable to education (improved health,<br />

reduced crime, and reduced demand for income assistance) were defined as<br />

externalities that are incidental to the operations <strong>of</strong> <strong>WTAMU</strong>. Some would question<br />

the legitimacy <strong>of</strong> including these benefits in the calculation <strong>of</strong> rates <strong>of</strong> return<br />

to education, arguing that only the tangible benefits (higher earnings) should<br />

be counted. Table 3.4 and Table 3.6 are inclusive <strong>of</strong> social benefits reported as<br />

attributable to <strong>WTAMU</strong>. Recognizing the other point <strong>of</strong> view, Table 3.7 shows<br />

rates <strong>of</strong> return for both the taxpayer and social perspectives exclusive <strong>of</strong> social<br />

benefits. As indicated, returns are still above threshold values (a benefit-cost<br />

ratio greater than 1.0 and a rate <strong>of</strong> return greater than 1.0%), confirming that<br />

taxpayers receive value from investing in <strong>WTAMU</strong>.<br />

TABLE 3.7: TAXPAYER AND SOCIAL PERSPECTIVES WITH AND WITHOUT<br />

SOCIAL SAVINGS<br />

Including social savings<br />

Excluding social savings<br />

Taxpayer perspective<br />

Net present value (millions) $131.1 $88.7<br />

Benefit-cost ratio 3.4 2.6<br />

Internal rate <strong>of</strong> return 9.2% 6.9%<br />

Payback period (no. <strong>of</strong> years) 11.7 16.0<br />

Social perspective<br />

Net present value (millions) $2,079.9 $1,951.6<br />

Benefit-cost ratio 8.0 7.5<br />

Source: Emsi impact model.<br />

43 <strong>The</strong> rate <strong>of</strong> return is not reported for the social perspective because the beneficiaries <strong>of</strong> the investment are not<br />

necessarily the same as the original investors.<br />

Chapter 3: Investment Analysis 63