The Economic Value of WTAMU Main Report

This report assesses the impact of West Texas A&M University (WTAMU) on the regional economy and the benefits generated by the university for students, taxpayers, and society. The results of this study show that WTAMU creates a positive net impact on the regional economy and generates a positive return on investment for students, taxpayers, and society.

This report assesses the impact of West Texas A&M University (WTAMU) on the regional economy and the benefits generated by the university for students, taxpayers, and society. The results of this study show that WTAMU creates a positive net impact on the regional economy and generates a positive return on investment for students, taxpayers, and society.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

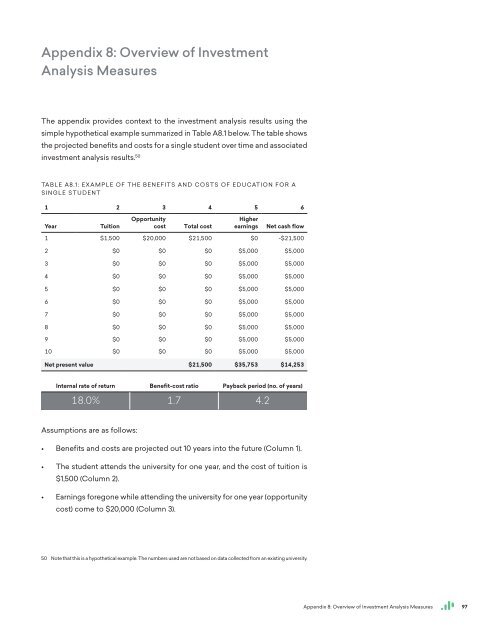

Appendix 8: Overview <strong>of</strong> Investment<br />

Analysis Measures<br />

<strong>The</strong> appendix provides context to the investment analysis results using the<br />

simple hypothetical example summarized in Table A8.1 below. <strong>The</strong> table shows<br />

the projected benefits and costs for a single student over time and associated<br />

investment analysis results. 50<br />

TABLE A8.1: EXAMPLE OF THE BENEFITS AND COSTS OF EDUCATION FOR A<br />

SINGLE STUDENT<br />

1 2 3 4 5 6<br />

Year<br />

Tuition<br />

Opportunity<br />

cost<br />

Total cost<br />

Higher<br />

earnings<br />

Net cash flow<br />

1 $1,500 $20,000 $21,500 $0 -$21,500<br />

2 $0 $0 $0 $5,000 $5,000<br />

3 $0 $0 $0 $5,000 $5,000<br />

4 $0 $0 $0 $5,000 $5,000<br />

5 $0 $0 $0 $5,000 $5,000<br />

6 $0 $0 $0 $5,000 $5,000<br />

7 $0 $0 $0 $5,000 $5,000<br />

8 $0 $0 $0 $5,000 $5,000<br />

9 $0 $0 $0 $5,000 $5,000<br />

10 $0 $0 $0 $5,000 $5,000<br />

Net present value $21,500 $35,753 $14,253<br />

Internal rate <strong>of</strong> return Benefit-cost ratio Payback period (no. <strong>of</strong> years)<br />

18.0% 1.7 4.2<br />

Assumptions are as follows:<br />

• Benefits and costs are projected out 10 years into the future (Column 1).<br />

• <strong>The</strong> student attends the university for one year, and the cost <strong>of</strong> tuition is<br />

$1,500 (Column 2).<br />

• Earnings foregone while attending the university for one year (opportunity<br />

cost) come to $20,000 (Column 3).<br />

50 Note that this is a hypothetical example. <strong>The</strong> numbers used are not based on data collected from an existing university.<br />

Appendix 8: Overview <strong>of</strong> Investment Analysis Measures<br />

97