You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

22 SAY YOU SAW IT IN SUBURBAN July 20, 2021 – August 23, 2021<br />

By Jeff Ostrowski<br />

BANKRATE.COM<br />

Home prices are soaring,<br />

pushed higher by a combination<br />

of record-low mortgage<br />

rates, strong demand<br />

from buyers and a lingering<br />

lack of new construction.<br />

In 2021, a new factor put<br />

pressure on home prices:<br />

Month after month, lumber<br />

prices jumped to new<br />

highs. Lumber costs soared<br />

more than 30 percent from<br />

January through May.<br />

However, lumber prices<br />

finally are cooling a bit<br />

as lumber mills ramp up<br />

production to meet the<br />

frenzied demand. In June,<br />

futures prices for lumber<br />

dropped below $1,000,<br />

off 45 percent from their<br />

springtime peak.<br />

Even so, the National Association<br />

of Home Builders<br />

says steep lumber prices<br />

still tack thousands<br />

of dollars onto the cost of<br />

a new home, an unwelcome<br />

increase for buyers<br />

already struggling to find<br />

homes they can afford. The<br />

trade group has lobbied<br />

President Joe Biden and<br />

Congress to end tariffs on<br />

Canadian wood sent to the<br />

United States.<br />

The Labor Department’s<br />

producer price index shows<br />

lumber more than doubled<br />

from May 2020 to May<br />

2021. The National Association<br />

of Home Builders<br />

says the price tripled in<br />

just 12 months.<br />

Activity on the futures<br />

markets has been even<br />

more eye-popping. The<br />

price of lumber for March<br />

delivery resembles a<br />

price chart for bitcoin or<br />

Gamestop shares.<br />

A series of cascading effects<br />

Usually, homebuyers can<br />

ignore the intricacies of<br />

lumber futures markets<br />

and trade policy with Canada.<br />

But the intensity of<br />

the price spike for wood is<br />

affecting consumers.<br />

The National Association<br />

of Home Builders points to<br />

a variety of setbacks created<br />

by the lack of lumber.<br />

A builder in Georgia says<br />

he has been forced to postpone<br />

construction starts,<br />

delays that will limit housing<br />

supply going into the<br />

spring selling season.<br />

A builder in Alabama<br />

reports that the bill for<br />

lumber used to frame a<br />

typical new home jumped<br />

from $35,000 a year ago<br />

to $71,000 now. Mirroring<br />

that observation, the<br />

National Association of<br />

Home Builders says soaring<br />

lumber prices caused<br />

MAINE<br />

High lumber prices ease: Here’s what it<br />

means for homeowners and homebuyers<br />

the price of an average<br />

new single-family home to<br />

increase by $35,872 this<br />

spring compared to spring<br />

2020.<br />

In another wrinkle, a<br />

Kansas builder says appraisers<br />

aren’t considering<br />

lumber prices in their<br />

analysis, and therefore are<br />

undervaluing homes.<br />

PulteGroup, one of the<br />

nation’s largest builders,<br />

says it expects to raise<br />

prices this year as it passes<br />

on the climbing cost of<br />

wood. “Driven primarily<br />

by increases in lumber and<br />

labor, our house costs will<br />

be higher in 2021,” Pulte-<br />

Group Chief Financial<br />

Officer Robert O’Shaughnessy<br />

said in a recent<br />

earnings call.<br />

Homebuilders aren’t the<br />

only buyers of lumber, of<br />

course. Homeowners renovating<br />

their houses also<br />

have diverted some of the<br />

supply by building fences,<br />

decks and additions.<br />

Lumber is just one factor<br />

in home prices<br />

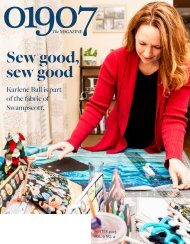

Lumber prices<br />

finally are<br />

cooling a bit<br />

as lumber<br />

mills ramp up<br />

production<br />

to meet the<br />

frenzied<br />

demand.<br />

PHOTO | TRIBUNE NEWS<br />

SERVICE<br />

The dramatic rise in<br />

lumber prices has grabbed<br />

headlines in recent weeks.<br />

But wood costs are just one<br />

factor in the complicated<br />

equation behind home<br />

prices.<br />

The biggest factor is<br />

supply and demand. The<br />

U.S. population, and particularly<br />

the generational<br />

bulge of millennials entering<br />

their 30s and starting<br />

households, is growing<br />

faster than the number<br />

of homes available. That<br />

means that even as wood<br />

prices come back to earth,<br />

home prices are unlikely to<br />

follow.<br />

“Lumber is not the main<br />

reason why homes are<br />

unaffordable,” says Alex<br />

Barron of the Housing Research<br />

Center in El Paso,<br />

Texas. “It is the lack of<br />

resale supply — too many<br />

homes are still in the<br />

hands of landlords and<br />

investors. We had no land<br />

development after the<br />

crash for over a decade.”