Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

FEATURE | Watch Industry Review<br />

BY THE DIGITS<br />

Watch the Numbers<br />

by MARTIN FOSTER<br />

W<br />

e have followed the ups and downs<br />

of Australia’s COVID-19 politics as<br />

we watched the rest of the world<br />

twist and turn under the insidious influences<br />

of the Delta strain during the pandemic.<br />

It seems that hospitality and entertainment have been<br />

the big losers as they rely on customers coming in and<br />

sitting down for lunch or dinner or attending live events<br />

and trade exhibitions.<br />

As we know, it is this very form of business that logically<br />

suffers from lockdowns, which prevent in-person<br />

attendance and reduce retail ‘foot-traffic’.<br />

In contrast, the extraordinary performance of the watch<br />

industry shows another side to the lockdown coin.<br />

Sales figures indicate that consumers at the top of the<br />

market were largely unaffected by the rules and<br />

restrictions – they simply had to find a different way<br />

to dispense their buying power.<br />

There are many examples to illustrate this point.<br />

Industry media has reported Rolex and Tudor sales in<br />

the UK and Ireland generated sales of £468 million<br />

($AU867.7 million), up from £415 million ($AU769.4<br />

million), an increase of 13 per cent even during the<br />

lockdown chaos.<br />

As an example of unbridled insanity and excess funds<br />

was the auction of a newly-released Patek Philippe<br />

model – a factory-sealed olive-green Nautilus – which<br />

was sold in April by Antiquorum in Monaco.<br />

The nominated retail price of $AU48,000 was utterly<br />

dwarfed by the auction sale, which was a staggering<br />

$AU650,000 including buyer’s premium.<br />

Bidders online and in the saleroom refused to back<br />

down until the price nudged half a million US dollars.<br />

That was just one example! Research, conducted by<br />

retail analytics firm GfK, also reveals other distortions<br />

in the watch market.<br />

Total watch sales value in the UK in August for models<br />

£468m<br />

Rolex and Tudor<br />

sales in the UK<br />

and Ireland, <strong>2021</strong><br />

– an increase of<br />

13 per cent<br />

21<br />

watch brands<br />

presenting at<br />

the independent<br />

WatchPro Salon<br />

in London in<br />

<strong>November</strong> <strong>2021</strong><br />

23,600<br />

attendees at<br />

September's Hong<br />

Kong Watch & Clock<br />

Fair, including<br />

members of the<br />

public<br />

$650,000<br />

auction price<br />

realised for Patek<br />

Philippe Nautilus,<br />

April <strong>2021</strong> – more<br />

than seven times its<br />

retail price<br />

61%<br />

increase in average<br />

prices of watches<br />

purchased in the UK<br />

between September<br />

2020 and August <strong>2021</strong><br />

priced at £500–1,000 ($AU925 –1,851) fell by 7 per cent<br />

– but increased by 31 per cent for models priced at<br />

£5,000–10,000 ($AU9,257–18,515), and saw a stunning<br />

rise of 19 per cent for timepieces priced at more than<br />

£10,000 ($AU18,515).<br />

Overall, average prices rose by more than 61 per cent for<br />

the 12-month period from September 2020 to August <strong>2021</strong><br />

as customers actively sought more expensive watches.<br />

GfK’s research reported that for July <strong>2021</strong> alone, the total<br />

value of watch sales in Great Britain was 34 per cent<br />

higher than in the same month in 2019.<br />

We may safely observe that<br />

there is unrestrained wealth at<br />

the top of the market burning<br />

holes in the pockets of buyers<br />

who suffer no budgetary cares –<br />

and the watch industry is happily<br />

celebrating the bonus”<br />

Swatch Group – which includes brands such as<br />

Omega, Tissot, Breguet, and Longines, among others<br />

– went against the trend with a 39 per cent revenue<br />

decline in 2020.<br />

However, this was of its own doing and partly a result<br />

of the unsettled restructuring of its UK operations.<br />

The Swatch result is an exception, and we may safely<br />

observe that there is unrestrained wealth at the top of the<br />

market burning holes in the pockets of buyers who suffer<br />

no budgetary cares – and the watch industry is happily<br />

celebrating the bonus.<br />

Return of the fairs<br />

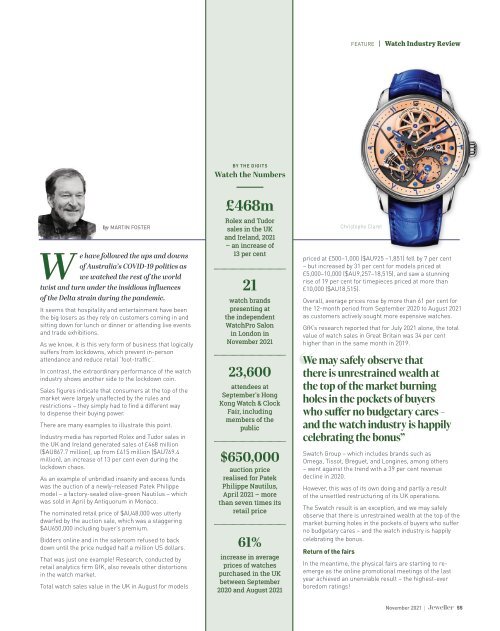

Christophe Claret<br />

In the meantime, the physical fairs are starting to reemerge<br />

as the online promotional meetings of the last<br />

year achieved an unenviable result – the highest-ever<br />

boredom ratings!<br />

<strong>November</strong> <strong>2021</strong> | 55