November/December 2021

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Contract The Business Talk Pilot Barometer<br />

SLOWING DOWN?<br />

As uncertainty slows demand, ‘the bubble isn’t bursting, but it may be deflating’ says<br />

Neil Cooper-Smith, senior analyst, Business Pilot...<br />

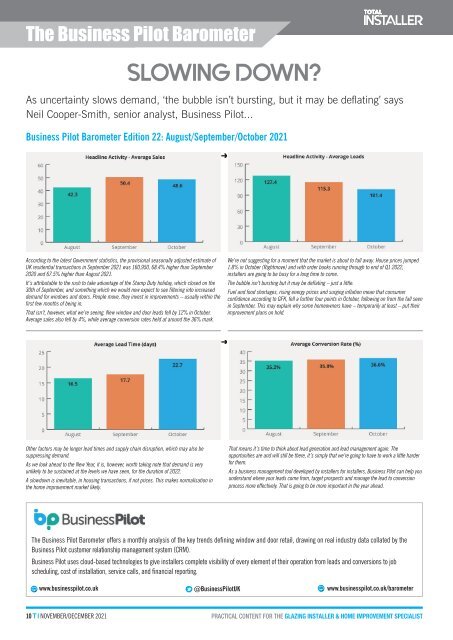

Business Pilot Barometer Edition 22: August/September/October <strong>2021</strong><br />

According to the latest Government statistics, the provisional seasonally adjusted estimate of<br />

UK residential transactions in September <strong>2021</strong> was 160,950, 68.4% higher than September<br />

2020 and 67.5% higher than August <strong>2021</strong>.<br />

It’s attributable to the rush to take advantage of the Stamp Duty holiday, which closed on the<br />

30th of September, and something which we would now expect to see filtering into increased<br />

demand for windows and doors. People move, they invest in improvements – usually within the<br />

first few months of being in.<br />

That isn’t, however, what we’re seeing. New window and door leads fell by 12% in October.<br />

Average sales also fell by 4%, while average conversion rates held at around the 36% mark.<br />

We’re not suggesting for a moment that the market is about to fall away. House prices jumped<br />

1.8% in October (Rightmove) and with order books running through to end of Q1 2022,<br />

installers are going to be busy for a long time to come.<br />

The bubble isn’t bursting but it may be deflating – just a little.<br />

Fuel and food shortages, rising energy prices and surging inflation mean that consumer<br />

confidence according to GFK, fell a further four points in October, following on from the fall seen<br />

in September. This may explain why some homeowners have – temporarily at least – put their<br />

improvement plans on hold.<br />

Other factors may be longer lead times and supply chain disruption, which may also be<br />

suppressing demand.<br />

As we look ahead to the New Year, it is, however, worth taking note that demand is very<br />

unlikely to be sustained at the levels we have seen, for the duration of 2022.<br />

A slowdown is inevitable, in housing transactions, if not prices. This makes normalisation in<br />

the home improvement market likely.<br />

That means it’s time to think about lead generation and lead management again. The<br />

opportunities are and will still be there, it’s simply that we’re going to have to work a little harder<br />

for them.<br />

As a business management tool developed by installers for installers, Business Pilot can help you<br />

understand where your leads come from, target prospects and manage the lead to conversion<br />

process more effectively. That is going to be more important in the year ahead.<br />

The Business Pilot Barometer offers a monthly analysis of the key trends defining window and door retail, drawing on real industry data collated by the<br />

Business Pilot customer relationship management system (CRM).<br />

Business Pilot uses cloud-based technologies to give installers complete visibility of every element of their operation from leads and conversions to job<br />

scheduling, cost of installation, service calls, and financial reporting.<br />

www.businesspilot.co.uk<br />

@BusinessPilotUK<br />

www.businesspilot.co.uk/barometer<br />

10 T I NOVEMBER/DECEMBER <strong>2021</strong><br />

PRACTICAL CONTENT FOR THE GLAZING INSTALLER & HOME IMPROVEMENT SPECIALIST