2005 Annual Report Julius Baer Holding Ltd. - GAM Holding AG

2005 Annual Report Julius Baer Holding Ltd. - GAM Holding AG

2005 Annual Report Julius Baer Holding Ltd. - GAM Holding AG

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

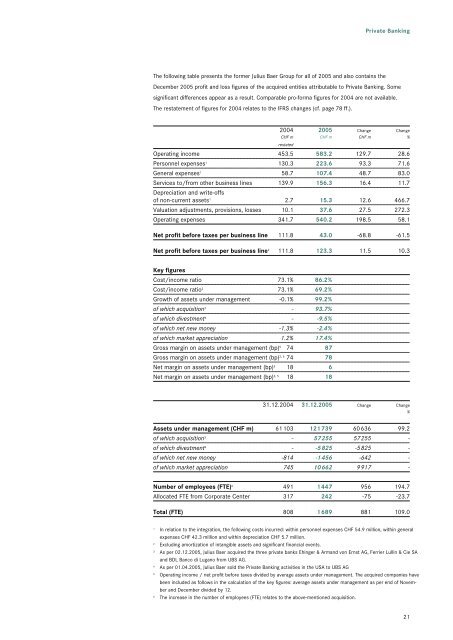

Private Banking<br />

The following table presents the former <strong>Julius</strong> <strong>Baer</strong> Group for all of <strong>2005</strong> and also contains the<br />

December <strong>2005</strong> profit and loss figures of the acquired entities attributable to Private Banking. Some<br />

significant differences appear as a result. Comparable pro-forma figures for 2004 are not available.<br />

The restatement of figures for 2004 relates to the IFRS changes (cf. page 78 ff.).<br />

2004 <strong>2005</strong> Change Change<br />

CHF m<br />

restated<br />

CHF m CHF m %<br />

Operating income 453.5 583.2 129.7 28.6<br />

Personnel expenses 1 130.3 223.6 93.3 71.6<br />

General expenses 1 58.7 107.4 48.7 83.0<br />

Services to/from other business lines 139.9 156.3 16.4 11.7<br />

Depreciation and write-offs<br />

of non-current assets 1 2.7 15.3 12.6 466.7<br />

Valuation adjustments, provisions, losses 10.1 37.6 27.5 272.3<br />

Operating expenses 341.7 540.2 198.5 58.1<br />

Net profit before taxes per business line 111.8 43.0 -68.8 -61.5<br />

Net profit before taxes per business line 2 111.8 123.3 11.5 10.3<br />

Key figures<br />

Cost/income ratio 73.1% 86.2%<br />

Cost/income ratio 2 73.1% 69.2%<br />

Growth of assets under management -0.1% 99.2%<br />

of which acquisition 3 - 93.7%<br />

of which divestment 4 - -9.5%<br />

of which net new money -1.3% -2.4%<br />

of which market appreciation 1.2% 17.4%<br />

Gross margin on assets under management (bp) 5 74 87<br />

Gross margin on assets under management (bp) 2, 5 74 78<br />

Net margin on assets under management (bp) 5 18 6<br />

Net margin on assets under management (bp) 2, 5 18 18<br />

31.12.2004 31.12.<strong>2005</strong> Change Change<br />

%<br />

Assets under management (CHF m) 61103 121739 60636 99.2<br />

of which acquisition 3 - 57255 57255 -<br />

of which divestment 4 - -5825 -5825 -<br />

of which net new money -814 -1456 -642 -<br />

of which market appreciation 745 10662 9917 -<br />

Number of employees (FTE) 6 491 1447 956 194.7<br />

Allocated FTE from Corporate Center 317 242 -75 -23.7<br />

Total (FTE) 808 1689 881 109.0<br />

1 In relation to the integration, the following costs incurred: within personnel expenses CHF 54.9 million, within general<br />

expenses CHF 42.3 million and within depreciation CHF 5.7 million.<br />

2 Excluding amortization of intangible assets and significant financial events.<br />

3 As per 02.12.<strong>2005</strong>, <strong>Julius</strong> <strong>Baer</strong> acquired the three private banks Ehinger & Armand von Ernst <strong>AG</strong>, Ferrier Lullin & Cie SA<br />

and BDL Banco di Lugano from UBS <strong>AG</strong>.<br />

4 As per 01.04.<strong>2005</strong>, <strong>Julius</strong> <strong>Baer</strong> sold the Private Banking activities in the USA to UBS <strong>AG</strong><br />

5 Operating income / net profit before taxes divided by average assets under management. The acquired companies have<br />

been included as follows in the calculation of the key figures: average assets under management as per end of November<br />

and December divided by 12.<br />

6 The increase in the number of employees (FTE) relates to the above-mentioned acquisition.<br />

21