2005 Annual Report Julius Baer Holding Ltd. - GAM Holding AG

2005 Annual Report Julius Baer Holding Ltd. - GAM Holding AG

2005 Annual Report Julius Baer Holding Ltd. - GAM Holding AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

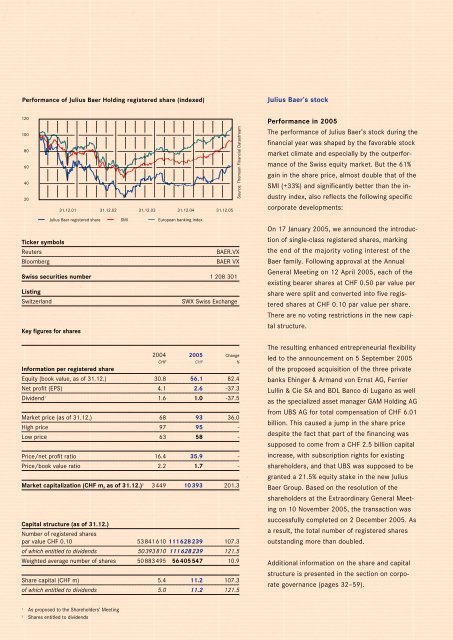

Performance of <strong>Julius</strong> <strong>Baer</strong> <strong>Holding</strong> registered share (indexed)<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

31.12.01 31.12.02 31.12.03 31.12.04 31.12.05<br />

<strong>Julius</strong> <strong>Baer</strong> registered share SMI<br />

European banking index<br />

Ticker symbols<br />

Reuters BAER.VX<br />

Bloomberg BAER VX<br />

Swiss securities number 1 208 301<br />

Listing<br />

Switzerland SWX Swiss Exchange<br />

Key figures for shares<br />

2004 <strong>2005</strong> Change<br />

CHF CHF %<br />

Information per registered share<br />

Equity (book value, as of 31.12.) 30.8 56.1 82.4<br />

Net profit (EPS) 4.1 2.6 -37.3<br />

Dividend1 1.6 1.0 -37.5<br />

Market price (as of 31.12.) 68 93 36.0<br />

High price 97 95 -<br />

Low price 63 58 -<br />

Price/net profit ratio 16.4 35.9 -<br />

Price/book value ratio 2.2 1.7 -<br />

Market capitalization (CHF m, as of 31.12.) 2 3449 10393 201.3<br />

Capital structure (as of 31.12.)<br />

Number of registered shares<br />

par value CHF 0.10 53841610 111628239 107.3<br />

of which entitled to dividends 50393810 111628239 121.5<br />

Weighted average number of shares 50883495 56405547 10.9<br />

Share capital (CHF m) 5.4 11.2 107.3<br />

of which entitled to dividends 5.0 11.2 121.5<br />

1 As proposed to the Shareholders’ Meeting<br />

2 Shares entitled to dividends<br />

Source: Thomson Financial Datastream<br />

<strong>Julius</strong> <strong>Baer</strong>’s stock<br />

Performance in <strong>2005</strong><br />

The performance of <strong>Julius</strong> <strong>Baer</strong>’s stock during the<br />

financial year was shaped by the favorable stock<br />

market climate and especially by the outperformance<br />

of the Swiss equity market. But the 61%<br />

gain in the share price, almost double that of the<br />

SMI (+33%) and significantly better than the industry<br />

index, also reflects the following specific<br />

corporate developments:<br />

On 17 January <strong>2005</strong>, we announced the introduction<br />

of single-class registered shares, marking<br />

the end of the majority voting interest of the<br />

<strong>Baer</strong> family. Following approval at the <strong>Annual</strong><br />

General Meeting on 12 April <strong>2005</strong>, each of the<br />

existing bearer shares at CHF 0.50 par value per<br />

share were split and converted into five registered<br />

shares at CHF 0.10 par value per share.<br />

There are no voting restrictions in the new capital<br />

structure.<br />

The resulting enhanced entrepreneurial flexibility<br />

led to the announcement on 5 September <strong>2005</strong><br />

of the proposed acquisition of the three private<br />

banks Ehinger & Armand von Ernst <strong>AG</strong>, Ferrier<br />

Lullin & Cie SA and BDL Banco di Lugano as well<br />

as the specialized asset manager <strong>GAM</strong> <strong>Holding</strong> <strong>AG</strong><br />

from UBS <strong>AG</strong> for total compensation of CHF 6.01<br />

billion. This caused a jump in the share price<br />

despite the fact that part of the financing was<br />

supposed to come from a CHF 2.5 billion capital<br />

increase, with subscription rights for existing<br />

shareholders, and that UBS was supposed to be<br />

granted a 21.5% equity stake in the new <strong>Julius</strong><br />

<strong>Baer</strong> Group. Based on the resolution of the<br />

shareholders at the Extraordinary General Meeting<br />

on 10 November <strong>2005</strong>, the transaction was<br />

successfully completed on 2 December <strong>2005</strong>. As<br />

a result, the total number of registered shares<br />

outstanding more than doubled.<br />

Additional information on the share and capital<br />

structure is presented in the section on corporate<br />

governance (pages 32–59).