GB00_erste lage_E - Erste Group

GB00_erste lage_E - Erste Group

GB00_erste lage_E - Erste Group

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

greater, since some of the staff cuts in 1999 were not made until the second half of the year<br />

and thus were not fully reflected in the accounts until financial 2000.<br />

Weighted according to the degree of employment (excluding employees on parental leave),<br />

the headcount of the <strong>Erste</strong> Bank <strong>Group</strong> exhibited the following trend:<br />

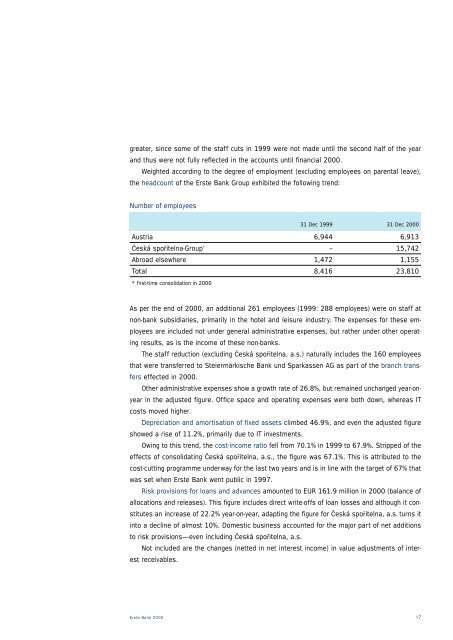

Number of employees<br />

31 Dec 1999 31 Dec 2000<br />

Austria 6,944 6,913<br />

Česká spořitelna-<strong>Group</strong> * – 15,742<br />

Abroad elsewhere 1,472 1,155<br />

Total 8,416 23,810<br />

* first-time consolidation in 2000<br />

As per the end of 2000, an additional 261 employees (1999: 288 employees) were on staff at<br />

non-bank subsidiaries, primarily in the hotel and leisure industry. The expenses for these employees<br />

are included not under general administrative expenses, but rather under other operating<br />

results, as is the income of these non-banks.<br />

The staff reduction (excluding Česká spořitelna, a.s.) naturally includes the 160 employees<br />

that were transferred to Steiermärkische Bank und Sparkassen AG as part of the branch transfers<br />

effected in 2000.<br />

Other administrative expenses show a growth rate of 26.8%, but remained unchanged year-on-<br />

year in the adjusted figure. Office space and operating expenses were both down, whereas IT<br />

costs moved higher.<br />

Depreciation and amortisation of fixed assets climbed 46.9%, and even the adjusted figure<br />

showed a rise of 11.2%, primarily due to IT investments.<br />

Owing to this trend, the cost-income ratio fell from 70.1% in 1999 to 67.9%. Stripped of the<br />

effects of consolidating Česká spořitelna, a.s., the figure was 67.1%. This is attributed to the<br />

cost-cutting programme underway for the last two years and is in line with the target of 67% that<br />

was set when <strong>Erste</strong> Bank went public in 1997.<br />

Risk provisions for loans and advances amounted to EUR 161.9 million in 2000 (balance of<br />

allocations and releases). This figure includes direct write-offs of loan losses and although it con-<br />

stitutes an increase of 22.2% year-on-year, adapting the figure for Česká spořitelna, a.s. turns it<br />

into a decline of almost 10%. Domestic business accounted for the major part of net additions<br />

to risk provisions—even including Česká spořitelna, a.s.<br />

Not included are the changes (netted in net interest income) in value adjustments of interest<br />

receivables.<br />

<strong>Erste</strong> Bank 2000 17

![Fact Sheet Erste Campus [pdf; 181.2 KB] - Erste Group](https://img.yumpu.com/3839392/1/184x260/fact-sheet-erste-campus-pdf-1812-kb-erste-group.jpg?quality=85)