GB00_erste lage_E - Erste Group

GB00_erste lage_E - Erste Group

GB00_erste lage_E - Erste Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

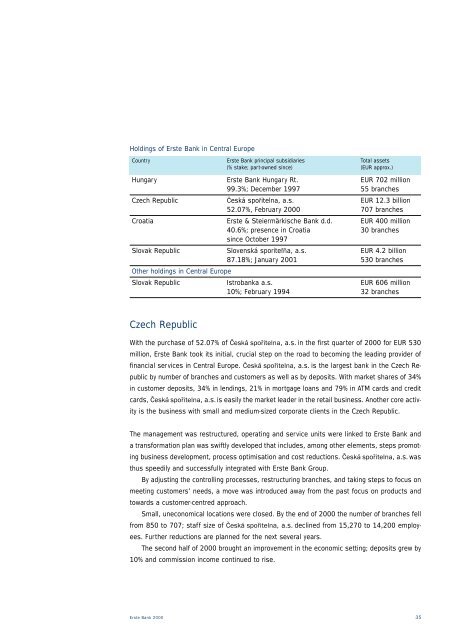

Holdings of <strong>Erste</strong> Bank in Central Europe<br />

Country <strong>Erste</strong> Bank principal subsidiaries Total assets<br />

(% stake; part-owned since) (EUR approx.)<br />

Hungary <strong>Erste</strong> Bank Hungary Rt. EUR 702 million<br />

99.3%; December 1997 55 branches<br />

Czech Republic Česká spořitelna, a.s. EUR 12.3 billion<br />

52.07%, February 2000 707 branches<br />

Croatia <strong>Erste</strong> & Steiermärkische Bank d.d. EUR 400 million<br />

40.6%; presence in Croatia<br />

since October 1997<br />

30 branches<br />

Slovak Republic Slovenská sporiteľňa, a.s. EUR 4.2 billion<br />

87.18%; January 2001 530 branches<br />

Other holdings in Central Europe<br />

Slovak Republic Istrobanka a.s. EUR 606 million<br />

10%; February 1994 32 branches<br />

Czech Republic<br />

With the purchase of 52.07% of Česká spořitelna, a.s. in the first quarter of 2000 for EUR 530<br />

million, <strong>Erste</strong> Bank took its initial, crucial step on the road to becoming the leading provider of<br />

financial services in Central Europe. Česká spořitelna, a.s. is the largest bank in the Czech Republic<br />

by number of branches and customers as well as by deposits. With market shares of 34%<br />

in customer deposits, 34% in lendings, 21% in mortgage loans and 79% in ATM cards and credit<br />

cards, Česká spořitelna, a.s. is easily the market leader in the retail business. Another core activity<br />

is the business with small and medium-sized corporate clients in the Czech Republic.<br />

The management was restructured, operating and service units were linked to <strong>Erste</strong> Bank and<br />

a transformation plan was swiftly developed that includes, among other elements, steps promoting<br />

business development, process optimisation and cost reductions. Česká spořitelna, a.s. was<br />

thus speedily and successfully integrated with <strong>Erste</strong> Bank <strong>Group</strong>.<br />

By adjusting the controlling processes, restructuring branches, and taking steps to focus on<br />

meeting customers’ needs, a move was introduced away from the past focus on products and<br />

towards a customer-centred approach.<br />

Small, uneconomical locations were closed. By the end of 2000 the number of branches fell<br />

from 850 to 707; staff size of Česká spořitelna, a.s. declined from 15,270 to 14,200 employees.<br />

Further reductions are planned for the next several years.<br />

The second half of 2000 brought an improvement in the economic setting; deposits grew by<br />

10% and commission income continued to rise.<br />

<strong>Erste</strong> Bank 2000 35

![Fact Sheet Erste Campus [pdf; 181.2 KB] - Erste Group](https://img.yumpu.com/3839392/1/184x260/fact-sheet-erste-campus-pdf-1812-kb-erste-group.jpg?quality=85)