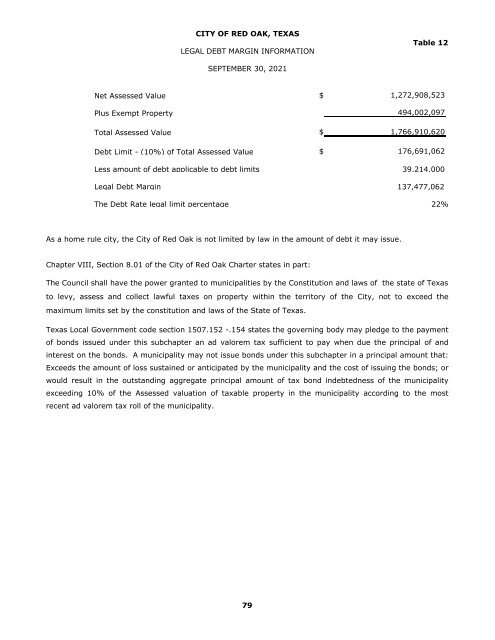

CITY OF RED OAK, TEXAS LEGAL DEBT MARGIN INFORMATION Table 12 SEPTEMBER 30, <strong>2021</strong> Net Assessed Value $ 1,272,908,523 Plus Exempt Property 494,002,097 Total Assessed Value $ 1,766,910,620 Debt Limit - (10%) of Total Assessed Value $ 176,691,062 Less amount of debt applicable to debt limits 39,214,000 Legal Debt Margin 137,477,062 The Debt Rate legal limit percentage 22% As a home rule city, the City of Red Oak is not limited by law in the amount of debt it may issue. Chapter VIII, Section 8.01 of the City of Red Oak Charter states in part: The Council shall have the power granted to municipalities by the Constitution and laws of the state of Texas to levy, assess and collect lawful taxes on property within the territory of the City, not to exceed the maximum limits set by the constitution and laws of the State of Texas. Texas Local Government code section 1507.152 -.154 states the governing body may pledge to the payment of bonds issued under this subchapter an ad valorem tax sufficient to pay when due the principal of and interest on the bonds. A municipality may not issue bonds under this subchapter in a principal amount that: Exceeds the amount of loss sustained or anticipated by the municipality and the cost of issuing the bonds; or would result in the outstanding aggregate principal amount of tax bond indebtedness of the municipality exceeding 10% of the Assessed valuation of taxable property in the municipality according to the most recent ad valorem tax roll of the municipality. 79

CITY OF RED OAK, TEXAS PLEDGE-REVENUE COVERAGE Table 13 LAST TEN FISCAL YEARS Fiscal (1) (2) (3) Year Less Net Average Ended Gross Operating Available Debt 9/30 Revenue Expense Revenue Service Coverage 2012 4,367,643 3,104,920 1,262,723 1,775,620 0.95 2013 4,747,708 3,491,798 1,255,910 1,389,497 1.05 2014 5,179,084 4,042,943 1,136,141 1,521,694 1.31 2015 5,577,700 3,945,042 1,632,658 1,542,945 1.54 2016 6,369,552 4,579,093 1,790,459 1,698,340 1.42 2017 7,129,965 4,631,965 2,498,000 1,484,467 1.97 2018 7,676,753 4,851,428 2,825,325 1,538,190 1.79 2019 8,009,066 5,633,340 2,375,726 1,581,608 1.27 2020 8,727,199 6,569,673 2,157,526 1,316,000 1.14 <strong>2021</strong> 9,477,411 6,701,841 2,775,570 1,390,000 1.51 Source: <strong>Annual</strong> <strong>Comprehensive</strong> <strong>Financial</strong> <strong>Report</strong> (1) Gross Revenue includes all Water and Sewer revenues. (2) Operating expense includes all Water and Sewer expense excluding depreciation. (3) Average annual debt service is the average principal and interest payments due over the remaining term of all water and sewer bonds. 80

- Page 1:

City of Red Oak, Texas Annual Compr

- Page 4 and 5:

Required Supplementary Information

- Page 6 and 7:

THIS PAGE LEFT BLANK INTENTIONALLY

- Page 8 and 9:

THIS PAGE LEFT BLANK INTENTIONALLY

- Page 10 and 11:

THE CITY The City of Red Oak (the

- Page 12 and 13:

at the intersection of State Highwa

- Page 14 and 15:

OTHER INFORMATION Independent Audit

- Page 16:

CITIZENS City Attorney Robert Hager

- Page 19 and 20:

THIS PAGE LEFT BLANK INTENTIONALLY

- Page 21 and 22:

THIS PAGE LEFT BLANK INTENTIONALLY

- Page 23 and 24:

Other Matters Required Supplementar

- Page 25 and 26:

Both of the government-wide financi

- Page 27 and 28:

Changes in Net Position Governmenta

- Page 29 and 30:

Governmental Activities Business-ty

- Page 31 and 32:

This requirement was met, and excee

- Page 33 and 34:

THIS PAGE LEFT BLANK INTENTIONALLY

- Page 35 and 36:

CITY OF RED OAK, TEXAS STATEMENT OF

- Page 37 and 38:

CITY OF RED OAK, TEXAS BALANCE SHEE

- Page 39 and 40:

THIS PAGE LEFT BLANK INTENTIONALLY

- Page 41 and 42:

CITY OF RED OAK, TEXAS STATEMENT OF

- Page 43 and 44:

CITY OF RED OAK, TEXAS RECONCILIATI

- Page 45 and 46:

THIS PAGE LEFT BLANK INTENTIONALLY

- Page 47 and 48:

CITY OF RED OAK, TEXAS STATEMENT OF

- Page 49 and 50:

THIS PAGE LEFT BLANK INTENTIONALLY

- Page 51 and 52:

Governmental fund financial stateme

- Page 53 and 54:

The costs of normal maintenance and

- Page 55 and 56:

In the fund financial statements, g

- Page 57 and 58:

IV. RECEIVABLES The City’s receiv

- Page 59 and 60:

Bond Reserve Fund For the Industria

- Page 61 and 62:

Annual debt service requirements fo

- Page 63 and 64: A summary of plan provisions for th

- Page 65 and 66: The City’s net pension liability

- Page 67 and 68: Discount Rate The SDBF program is t

- Page 69 and 70: XII. TAX ABATEMENTS The city enters

- Page 71 and 72: THIS PAGE LEFT BLANK INTENTIONALLY

- Page 73 and 74: CITY OF RED OAK, TEXAS SCHEDULE OF

- Page 75 and 76: CITY OF RED OAK, TEXAS SCHEDULE OF

- Page 77 and 78: CITY OF RED OAK, TEXAS SCHEDULE OF

- Page 79 and 80: CITY OF RED OAK, TEXAS SCHEDULE OF

- Page 81 and 82: CITY OF RED OAK, TEXAS COMBINING BA

- Page 83 and 84: CITY OF RED OAK, TEXAS COMBINING ST

- Page 85 and 86: CITY OF RED OAK, TEXAS SCHEDULE OF

- Page 87 and 88: THIS PAGE LEFT BLANK INTENTIONALLY

- Page 89 and 90: THIS PAGE LEFT BLANK INTENTIONALLY

- Page 91 and 92: CITY OF RED OAK, TEXAS NET POSITION

- Page 93 and 94: CITY OF RED OAK, TEXAS CHANGES IN N

- Page 95 and 96: CITY OF RED OAK, TEXAS CHANGES IN N

- Page 97 and 98: CITY OF RED OAK, TEXAS FUND BALANCE

- Page 99 and 100: CITY OF RED OAK, TEXAS CHANGES IN F

- Page 101 and 102: CITY OF RED OAK, TEXAS ASSESSED VAL

- Page 103 and 104: CITY OF RED OAK, TEXAS DIRECT AND O

- Page 105 and 106: THIS PAGE LEFT BLANK INTENTIONALLY

- Page 107 and 108: CITY OF RED OAK, TEXAS RATIOS OF GE

- Page 109 and 110: THIS PAGE LEFT BLANK INTENTIONALLY

- Page 111 and 112: CITY OF RED OAK, TEXAS RATIOS OF GE

- Page 113: CITY OF RED OAK, TEXAS DIRECT AND O

- Page 117 and 118: THIS PAGE LEFT BLANK INTENTIONALLY

- Page 119 and 120: CITY OF RED OAK, TEXAS FULL-TIME EQ

- Page 121 and 122: CITY OF RED OAK, TEXAS OPERATING IN

- Page 123 and 124: CITY OF RED OAK, TEXAS CAPITAL ASSE

- Page 125 and 126: THIS PAGE LEFT BLANK INTENTIONALLY

- Page 127 and 128: Compliance and Other Matters As par

- Page 129: THIS PAGE LEFT BLANK INTENTIONALLY