You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Selwyn</strong> <strong>Times</strong> Wednesday <strong>September</strong> <strong>20</strong> <strong>20</strong>23<br />

24<br />

NEWS<br />

Latest Canterbury news at starnews.co.nz<br />

Late payments rise as banks pile<br />

on the mortgage pressure<br />

Rising interest rates are<br />

putting the squeeze on<br />

finances, with a growing<br />

number of homeowners<br />

failing to pay their<br />

mortgages on time.<br />

Diana Clement reports<br />

CREDIT AGENCY Centrix<br />

says 18,800 mortgage accounts<br />

missed a payment in July this<br />

year – a 31 per cent increase on<br />

July last year.<br />

The figures, which are lower<br />

than March when 19,300<br />

accounts were reported as past<br />

due, come amid a new round of<br />

hikes in mortgage interest rates.<br />

ANZ, ASB, BNZ and Westpac<br />

have all bumped up their home<br />

loan rates over the past weeks,<br />

with standard rates for one-year<br />

and two-year terms above 7 per<br />

cent and stretching towards 8 per<br />

cent.<br />

The jumps mean homeowners<br />

who are now rolling onto higher<br />

rates are having to find on<br />

average more than $1<strong>20</strong>0 extra a<br />

month.<br />

For some homeowners, the<br />

cost of servicing their mortgage<br />

could be a lot higher. Centrix<br />

says 240,000 mortgage-holders<br />

in New Zealand owe more than<br />

$500,000 to their lender, with<br />

42,500 owing less than $50,000.<br />

Data released by the Reserve<br />

Bank in July shows that the<br />

number of homeowners adding<br />

to their mortgage, to fund<br />

big ticket purchases or home<br />

renovations, has nearly halved<br />

since <strong>20</strong>21.<br />

The value of mortgage top-ups<br />

in the 12 months to July was $7.7<br />

billion, down from $13.6 billion<br />

in the 12 months to July <strong>20</strong>21.<br />

It’s a trend that mortgage<br />

advisers are seeing in their dayto-day<br />

work.<br />

Mortgage adviser Neville<br />

Modlin from The Lending Team<br />

said rising interest rates had led<br />

to a decline in top-ups, with<br />

many homeowners worried<br />

about how to meet existing<br />

payments. Other<br />

factors included<br />

an increase<br />

in bank test<br />

rates and the<br />

October national<br />

election. Also<br />

Neville<br />

Modlin<br />

likely to have<br />

had an impact<br />

was Cyclone<br />

Gabrielle and<br />

the Auckland floods, which will<br />

have resulted in some renovation<br />

work requiring top-ups being<br />

covered by insurance claims.<br />

Loanmarket adviser Rodney<br />

King suspects that there may be<br />

an even greater drop off in topups<br />

for renovations such as new<br />

kitchens or extra rooms than the<br />

Reserve Bank<br />

numbers suggest.<br />

“The top ups<br />

we are seeing<br />

[tend] to be for<br />

energy efficient<br />

purposes, such as<br />

hybrid/EV cars,<br />

solar panels or Rodney<br />

double glazing King<br />

to homes, taking<br />

advantage of banks’ various<br />

offers to encourage these loans,”<br />

he said.<br />

However, Jeff Royle, adviser<br />

at iLender.co.nz, thinks some<br />

borrowing has moved from topups<br />

to general<br />

refinance, with<br />

borrowers going<br />

to new lenders<br />

to get cash back<br />

offers or better<br />

terms.<br />

He said that<br />

while there<br />

was not a lot<br />

of difference in interest rates<br />

Jeff Royle<br />

between lenders, there was quite<br />

a difference in how the banks<br />

calculate income.<br />

Campbell Hastie, of Hastie<br />

Mortgages Ltd, said client topups<br />

had dropped off.<br />

“In terms of numbers, it’s<br />

about 40 loans [last year] and<br />

15 loans now, so quite the drop.<br />

Most of these loans are under<br />

$100,000 - more like $<strong>20</strong>,000 to<br />

$50,000,” he said.<br />

“With interest rates going up<br />

and the cost of living going up,<br />

I think people are more focused<br />

on getting by than trying to do<br />

more. Joe Public has also got<br />

the message that the CCCFA<br />

[Credit Contracts and Consumer<br />

Finance Act] meant their KFC<br />

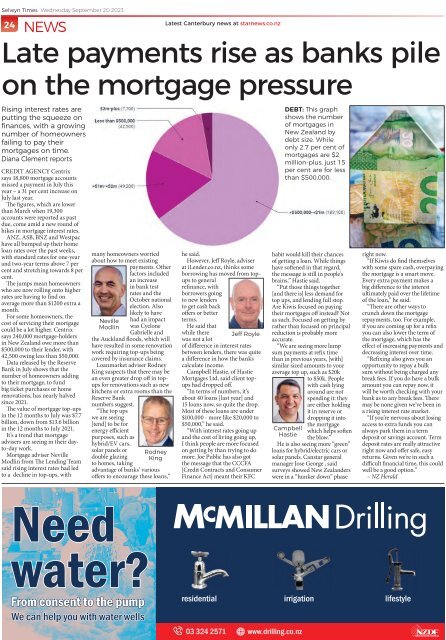

DEBT: This graph<br />

shows the number<br />

of mortgages in<br />

New Zealand by<br />

debt size. While<br />

only 2.7 per cent of<br />

mortgages are $2<br />

million-plus, just 15<br />

per cent are for less<br />

than $500,000.<br />

habit would kill their chances<br />

of getting a loan. While things<br />

have softened in that regard,<br />

the message is still in people’s<br />

brains,” Hastie said.<br />

“Put those things together<br />

[and there is] less demand for<br />

top ups, and lending full stop.<br />

Are Kiwis focused on paying<br />

their mortgages off instead? Not<br />

as such. Focused on getting by<br />

rather than focused on principal<br />

reduction is probably more<br />

accurate.<br />

“We are seeing more lump<br />

sum payments at refix time<br />

than in previous years, [with]<br />

similar sized amounts to your<br />

average top up, such as $<strong>20</strong>k<br />

to $50k. People<br />

with cash lying<br />

around are not<br />

spending it: they<br />

are either holding<br />

it in reserve or<br />

dropping it into<br />

Campbell<br />

Hastie<br />

the mortgage<br />

which helps soften<br />

the blow.”<br />

He is also seeing more “green”<br />

loans for hybrid/electric cars or<br />

solar panels. Canstar general<br />

manager Jose George , said<br />

surveys showed New Zealanders<br />

were in a “hunker down” phase<br />

right now.<br />

“If Kiwis do find themselves<br />

with some spare cash, overpaying<br />

the mortgage is a smart move.<br />

Every extra payment makes a<br />

big difference to the interest<br />

ultimately paid over the lifetime<br />

of the loan,” he said.<br />

“There are other ways to<br />

crunch down the mortgage<br />

repayments, too. For example,<br />

if you are coming up for a refix<br />

you can also lower the term of<br />

the mortgage, which has the<br />

effect of increasing payments and<br />

decreasing interest over time.<br />

“Refixing also gives you an<br />

opportunity to repay a bulk<br />

sum without being charged any<br />

break fees. If you do have a bulk<br />

amount you can repay now, it<br />

will be worth checking with your<br />

bank as to any break fees. There<br />

may be none given we’ve been in<br />

a rising interest rate market.<br />

“If you’re nervous about losing<br />

access to extra funds you can<br />

always park them in a term<br />

deposit or savings account. Term<br />

deposit rates are really attractive<br />

right now and offer safe, easy<br />

returns. Given we’re in such a<br />

difficult financial time, this could<br />

well be a good option.”<br />

– NZ Herald<br />

Need<br />

water?<br />

From consent to the pump<br />

We can help you with water wells<br />

residential irrigation lifestyle<br />

03 324 2571 www.drilling.co.nz