Nor'West News: February 22, 2024

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

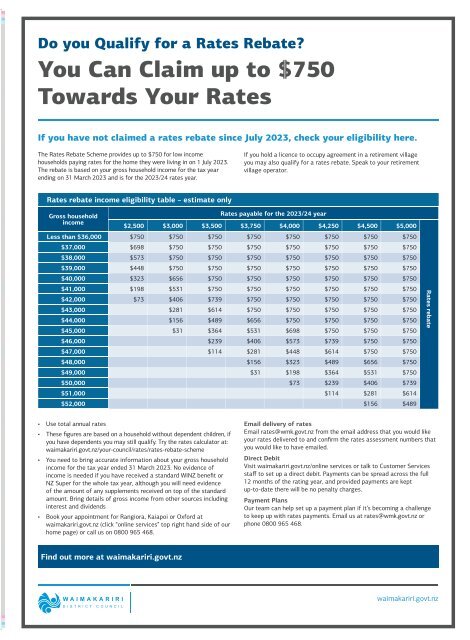

Do you Qualify for aRates Rebate?<br />

You Can Claim up to $750<br />

Towards Your Rates<br />

If you have not claimed arates rebate since July 2023, check your eligibility here.<br />

The Rates Rebate Scheme provides up to$750 for low income<br />

households paying rates for the home they were living in on 1July 2023.<br />

The rebate is based on your gross household income for the tax year<br />

ending on 31 March 2023 and is for the 2023/24 rates year.<br />

If you hold alicence to occupy agreement in aretirement village<br />

you may also qualify for arates rebate. Speak toyour retirement<br />

village operator.<br />

Rates rebate income eligibility table –estimate only<br />

Gross household<br />

income<br />

Rates payable for the 2023/24 year<br />

$2,500 $3,000 $3,500 $3,750 $4,000 $4,250 $4,500 $5,000<br />

Less than $36,000 $750 $750 $750 $750 $750 $750 $750 $750<br />

$37,000 $698 $750 $750 $750 $750 $750 $750 $750<br />

$38,000 $573 $750 $750 $750 $750 $750 $750 $750<br />

$39,000 $448 $750 $750 $750 $750 $750 $750 $750<br />

$40,000 $323 $656 $750 $750 $750 $750 $750 $750<br />

$41,000 $198 $531 $750 $750 $750 $750 $750 $750<br />

$42,000 $73 $406 $739 $750 $750 $750 $750 $750<br />

$43,000 $281 $614 $750 $750 $750 $750 $750<br />

$44,000 $156 $489 $656 $750 $750 $750 $750<br />

$45,000 $31 $364 $531 $698 $750 $750 $750<br />

$46,000 $239 $406 $573 $739 $750 $750<br />

$47,000 $114 $281 $448 $614 $750 $750<br />

$48,000 $156 $323 $489 $656 $750<br />

$49,000 $31 $198 $364 $531 $750<br />

$50,000 $73 $239 $406 $739<br />

$51,000 $114 $281 $614<br />

$52,000 $156 $489<br />

Rates rebate<br />

• Use total annual rates<br />

• These figures are based on ahousehold without dependent children, if<br />

you have dependents you may still qualify. Try the rates calculator at:<br />

waimakariri.govt.nz/your-council/rates/rates-rebate-scheme<br />

• You need to bring accurate information about your gross household<br />

income for the tax year ended 31March 2023. No evidence of<br />

income is needed if you have received astandard WINZ benefit or<br />

NZ Super for the whole tax year, although you will need evidence<br />

of the amount of any supplements received on top of the standard<br />

amount. Bring details of gross income from other sources including<br />

interest and dividends<br />

• Book your appointment for Rangiora, Kaiapoi or Oxford at<br />

waimakariri.govt.nz (click “online services” top right hand side of our<br />

home page) or call us on 0800 965 468.<br />

Email delivery of rates<br />

Email rates@wmk.govt.nz from the email address that you would like<br />

your rates delivered to and confirm the rates assessment numbers that<br />

you would like to have emailed.<br />

Direct Debit<br />

Visit waimakariri.govt.nz/online services or talk toCustomer Services<br />

staff to set up adirect debit. Payments can be spread across the full<br />

12 months of the rating year, and provided payments are kept<br />

up-to-date there will be no penalty charges.<br />

Payment Plans<br />

Our team can help set up apayment plan if it’s becoming achallenge<br />

to keep up with rates payments. Email us at rates@wmk.govt.nz or<br />

phone 0800 965 468.<br />

Find out more atwaimakariri.govt.nz