Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

POLITICS 13<br />

This month’s issue:<br />

Greek Bailout<br />

Why Greece were<br />

Right to Vote ‘No’<br />

KOPELIS<br />

BY GEORGE<br />

The Greek referendum on Sunday sent a clear message to<br />

European and international observers that Greece would no<br />

longer tolerate the austerity measures implemented over the<br />

last five years.<br />

61% of Greeks voted ‘No’ to accepting the conditions of the<br />

latest bailout offer, which included further cuts to pensions,<br />

reduced spending on subsidies and defence, and other<br />

reforms.<br />

The ‘No’ vote justified the Greek government’s determined<br />

stance against austerity. SYRIZA and its leader Alexis Tsipras<br />

were elected in January <strong>2015</strong> based on their opposition to the<br />

proposed bailout measures.<br />

A ‘Yes’ vote would have made Tsipras’ position untenable<br />

as it would have indicated majority opposition to his<br />

government’s policies, leading to new elections and more<br />

political instability.<br />

Since the election, the ‘troika’ of the European<br />

Commission, the European Central Bank and the<br />

International Monetary Fund have restricted Greek banks’<br />

access to credit as a response to the election of an antiausterity<br />

campaign.<br />

This essentially forced Tsipras to close all banks from<br />

the 29th of June until at least Wednesday the 8th of July<br />

to prevent a run on the banks. Greeks are limited to €60<br />

withdrawals from cash machines as ATMs run dry across the<br />

country.<br />

The ‘No’ vote is not a rational economic decision, (it<br />

frustrated the troika greatly) but instead it’s a social<br />

decision motivated by the plight of the ordinary people. 25%<br />

of Greeks were unemployed in March and half of all young<br />

people don’t have work.<br />

The Greek people are right to consider that if five years of<br />

the rational economics of austerity have not delivered any<br />

visible relief for the population, then a different solution<br />

should be tried.<br />

The most important consequence of the ‘No’ vote is that it<br />

makes a Greek exit from the Eurozone a real possibility.<br />

When the banks run out of money, which is extremely<br />

likely if no deal can be reached in Brussels this week, the<br />

"There would definitely be a<br />

few months of high costs of<br />

living but free of the Euro,<br />

Greeks will have much more<br />

of a say in the affairs of their<br />

own country. That can only<br />

be a good thing. "<br />

Greek government will need to provide emergency funding.<br />

The problem is the government has no money!<br />

To solve this, the government could print its own currency.<br />

This would run against Euro treaties, basically pushing<br />

Greece out of the Eurozone. It would immediately lose most<br />

of its worth, leading to high inflation for a short time.<br />

This cheaper, more competitive new currency could<br />

quickly lead to higher exports - especially in tourism (which<br />

currently makes up about 20% of the economy).<br />

A resolution to the crisis would also bring an end to much<br />

of the instability on the global sharemarket in the last few<br />

weeks.<br />

There is little risk of Greece becoming the first of many<br />

countries to leave the Euro. Other struggling economies such<br />

as Italy and Spain are much larger countries with centralised<br />

economies and larger industrial bases.<br />

There would definitely be a few months of high costs of<br />

living but free of the Euro, Greeks will have much more of<br />

a say in the affairs of their own country. That can only be a<br />

good thing.<br />

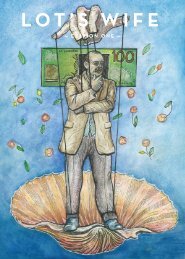

Image Courtesy of : www.flickr.com/photos/124247024@N07/