- Page 1 and 2: C i t y o f M o r e n o Va l l e y

- Page 3 and 4: INTRODUCTION CITY OF MORENO VALLEY

- Page 5 and 6: CITY OF MORENO VALLEY FY 2011/12 -

- Page 7 and 8: Introduction

- Page 9 and 10: As the City experiences stability i

- Page 11 and 12: City’s tax base in many ways: thr

- Page 13 and 14: Revenue Highlights and Assumptions

- Page 15 and 16: known increases in commercial and r

- Page 17 and 18: Use of Money & Property, the majori

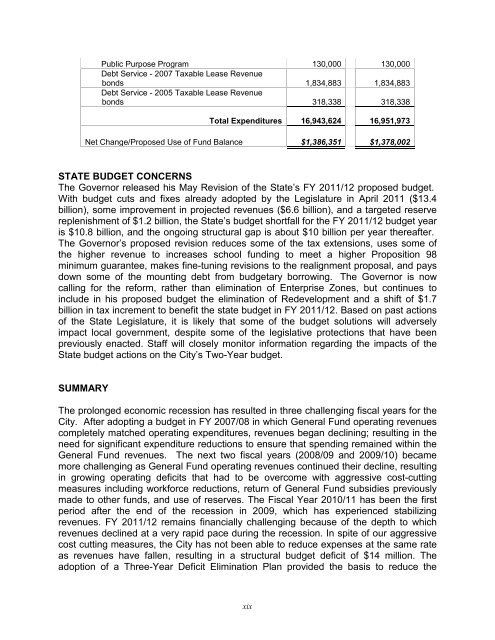

- Page 19 and 20: Balancing the General Fund Budget t

- Page 21 and 22: OTHER KEY FUNDS The following summa

- Page 23 and 24: The Parks and Community Services De

- Page 25: Electric Utility This fund is used

- Page 29 and 30: CITY OF MORENO VALLEY MUNICIPAL OFF

- Page 31 and 32: 2009-10 Position Description Type N

- Page 33 and 34: 2009-10 Position Description Type N

- Page 36 and 37: City of Moreno Valley Budget Proces

- Page 38 and 39: City of Moreno Valley Financial Str

- Page 40: BUSINESS UNIT The Business Unit is

- Page 43 and 44: Department Description CITY COUNCIL

- Page 45 and 46: 17 CITY COUNCIL Department / Busine

- Page 47 and 48: Department Description CITY CLERK T

- Page 49 and 50: 21 CITY CLERK Department / Business

- Page 51 and 52: Department Description Administrat

- Page 53 and 54: 25 CITY MANAGER Department / Busine

- Page 55 and 56: Department Description CITY ATTORNE

- Page 57 and 58: 29 Department / Business Unit CITY

- Page 59 and 60: Department Description COMMUNITY &

- Page 61 and 62: 33 Department / Business Unit COMMU

- Page 63 and 64: Fund Business Unit Actual Projected

- Page 65 and 66: Department Description FINANCIAL &

- Page 67 and 68: 39 Sr. Accountant Defunded Accounta

- Page 69 and 70: 41 Department / Business Unit City

- Page 71 and 72: Fund Business Unit Actual Projected

- Page 73: City of Moreno Valley FY2011/12 - 2

- Page 76 and 77:

coaching youth sports, special even

- Page 78 and 79:

50 Department / Business Unit FIRE

- Page 81 and 82:

Department Description Human Resour

- Page 83 and 84:

55 Department / Business Unit HUMAN

- Page 85 and 86:

Department Description PARKS AND CO

- Page 87 and 88:

and renewals, answer account inquir

- Page 89 and 90:

61 Department / Business Unit PARKS

- Page 91 and 92:

63 Department / Business Unit City

- Page 93 and 94:

Department Description POLICE DEPAR

- Page 95 and 96:

67 Department / Business Unit POLIC

- Page 97 and 98:

Department Description PUBLIC WORKS

- Page 99 and 100:

Department Mission Statement The mi

- Page 101 and 102:

73 PUBLIC WORKS Department / Busine

- Page 103 and 104:

75 Department / Business Unit City

- Page 105 and 106:

77 Department / Business Unit City

- Page 107 and 108:

City of Moreno Valley 2011/12 - 201

- Page 109:

Revenue & Expense by Fund

- Page 112 and 113:

Operating Expenditures 2011/12 Capi

- Page 114 and 115:

CAPITAL PROJECTS ADMIN 2,100 - - -

- Page 117 and 118:

Revenues: GENERAL FUND Taxes: Prope

- Page 119 and 120:

Revenues: GRAND TOTAL Taxes: Proper

- Page 121 and 122:

92 Debt Service Funds 5,658,840 Int

- Page 123 and 124:

94 Police Department 41,261,770 Non

- Page 125 and 126:

Fund Fund Title 194 JAG GRANT - COD

- Page 127 and 128:

Fund Fund Title 501 2005 LEASE REV

- Page 129 and 130:

Fund Fund Title 194 JAG GRANT - COD

- Page 131 and 132:

Fund Fund Title 501 2005 LEASE REV

- Page 133 and 134:

103 Fund Balance Reserved: 2009/10

- Page 135 and 136:

Revenue Detail

- Page 137 and 138:

Fund f u n d Object Object Descript

- Page 139 and 140:

Fund f u n d Object Object Descript

- Page 141 and 142:

Fund f u n d Object Object Descript

- Page 143 and 144:

Fund f u n d Object Object Descript

- Page 145 and 146:

Fund f u n d Object Object Descript

- Page 147 and 148:

Fund 204 f u n d Object Object Desc

- Page 149 and 150:

Fund 229 f u n d Object Object Desc

- Page 151 and 152:

Fund f u n d Object Object Descript

- Page 153 and 154:

Fund f u n d Object Object Descript

- Page 155 and 156:

Fund f u n d Object Object Descript

- Page 157 and 158:

126

- Page 159 and 160:

127 Co BU Obj Operating Capital Tot

- Page 161 and 162:

129 Fund Business GENERAL FUND Unit

- Page 163 and 164:

131 Fund Business Unit Obj Sub Asse

- Page 165 and 166:

Capital Improvement Projects (CIP)

- Page 167 and 168:

134 City of Moreno Valley Capital I

- Page 169 and 170:

136 City of Moreno Valley Capital I

- Page 171 and 172:

138 City of Moreno Valley Capital I

- Page 173 and 174:

140 City of Moreno Valley Capital I

- Page 175 and 176:

142 City of Moreno Valley Capital I

- Page 177 and 178:

144 City of Moreno Valley Capital I

- Page 179 and 180:

146 City of Moreno Valley Capital I

- Page 181 and 182:

Revenues: GENERAL FUND Taxes: Prope

- Page 183 and 184:

Fund and Business Unit 00010 GENERA

- Page 185 and 186:

PROGRAM NAME: City Council FUND: 01

- Page 187 and 188:

PROGRAM NAME: City Clerk - Administ

- Page 189 and 190:

PROGRAM NAME: City Attorney FUND: 0

- Page 191 and 192:

PROGRAM NAME: Human Resources FUND:

- Page 193 and 194:

PROGRAM NAME: Financial & Administr

- Page 195 and 196:

PROGRAM NAME: Financial & Administr

- Page 197 and 198:

PROGRAM NAME: CDD Graffiti Abatemen

- Page 199 and 200:

PROGRAM NAME: CDD Code Compliance F

- Page 201 and 202:

PROGRAM NAME: PW Administration FUN

- Page 203 and 204:

PROGRAM NAME: PW Solid Waste FUND:

- Page 205 and 206:

PROGRAM NAME: PW Traffic Signal Mai

- Page 207 and 208:

PROGRAM NAME: PW Street Maintenance

- Page 209 and 210:

PROGRAM NAME: PW Graffiti Removal F

- Page 211 and 212:

PROGRAM NAME: Police Administration

- Page 213 and 214:

PROGRAM NAME: Police Traffic Enforc

- Page 215 and 216:

PROGRAM NAME: Police Crime Preventi

- Page 217 and 218:

PROGRAM NAME: Police Special Enforc

- Page 219 and 220:

PROGRAM NAME: Animal Services FUND:

- Page 221 and 222:

PROGRAM NAME: Rancho Belago Sign Pr

- Page 223 and 224:

PROGRAM NAME: Crossing Guards FUND:

- Page 225 and 226:

PROGRAM NAME: Development Services

- Page 227 and 228:

PROGRAM NAME: CDD Planning Commissi

- Page 229 and 230:

PROGRAM NAME: CDD Building & Safety

- Page 231 and 232:

PROGRAM NAME: PW Land Development F

- Page 233 and 234:

PROGRAM NAME: PW - HLFV Project FUN

- Page 235 and 236:

PROGRAM NAME: PW Sunesys, LLC FUND:

- Page 237 and 238:

PROGRAM NAME: PW - Transportation D

- Page 239 and 240:

PROGRAM NAME: Document Imaging - Bu

- Page 241 and 242:

PROGRAM NAME: Fire Operations FUND:

- Page 243 and 244:

Community Services District

- Page 245 and 246:

Revenues: ZONE "D" STD LDSC FUND Ta

- Page 247 and 248:

Revenues: LIBRARY SERVICES FUND Tax

- Page 249 and 250:

ZONE "S" 185 - - - - - - - 53,295 6

- Page 251 and 252:

Business Unit 78285 E15 - Celebrati

- Page 253 and 254:

PROGRAM NAME: Senior Programs FUND:

- Page 255 and 256:

PROGRAM NAME: Park Ranger Program F

- Page 257 and 258:

PROGRAM NAME: Park Maintenance FUND

- Page 259 and 260:

PROGRAM NAME: Golf Course Program F

- Page 261 and 262:

PROGRAM NAME: Banquet Recreation Ce

- Page 263 and 264:

PROGRAM NAME: Community Services FU

- Page 265 and 266:

PROGRAM NAME: Non-Departmental Zone

- Page 267 and 268:

PROGRAM NAME: Arterial Street Light

- Page 269 and 270:

PROGRAM NAME: Extensive Landscape M

- Page 271 and 272:

PROGRAM NAME: Extensive Landscape -

- Page 273 and 274:

PROGRAM NAME: Extensive Landscape -

- Page 275 and 276:

PROGRAM NAME: Extensive Landscape -

- Page 277 and 278:

PROGRAM NAME: Zone E4-A Daybreak Di

- Page 279 and 280:

PROGRAM NAME: Zone E8 - Promontory

- Page 281 and 282:

PROGRAM NAME: Zone E14 - Mahogany F

- Page 283 and 284:

PROGRAM NAME: Zone M - Median Fund

- Page 285 and 286:

PROGRAM NAME: Zone S - Sunnymead Bl

- Page 287 and 288:

Revenues: RDA ADMIN FUND Taxes: Pro

- Page 289 and 290:

Revenues: RDA ADMIN FUND Taxes: Pro

- Page 291 and 292:

Fund and Business Unit 00891 RDA AD

- Page 293 and 294:

PROGRAM NAME: Alessandro and Day Pr

- Page 295 and 296:

PROGRAM NAME: Rancho Dorado Project

- Page 297 and 298:

PROGRAM NAME: RDA Housing FUND: 894

- Page 299 and 300:

PROGRAM NAME: RDA 2007 TABS, Series

- Page 301 and 302:

Special Revenue Funds

- Page 303 and 304:

Revenues: PUB/EDUC/GOVT ACCESS PROG

- Page 305 and 306:

Revenues: BEVERAGE CONTAINER RECYCL

- Page 307 and 308:

Revenues: TRAFFIC SIGS DEV IMPACT F

- Page 309 and 310:

Revenues: CORPORATE YD DEV IMPACT F

- Page 311 and 312:

Revenues: EMERGENCY SVCS AGENCY FIN

- Page 313 and 314:

Revenues: CDBG FY10/11 FUND Taxes:

- Page 315 and 316:

Revenues: TOTAL SPECIAL REVENUE Tax

- Page 317 and 318:

Revenues: PUB/EDUC/GOVT ACCESS PROG

- Page 319 and 320:

Revenues: BEVERAGE CONTAINER RECYCL

- Page 321 and 322:

Revenues: TRAFFIC SIGS DEV IMPACT F

- Page 323 and 324:

Revenues: CORPORATE YD DEV IMPACT F

- Page 325 and 326:

Revenues: EMERGENCY SVCS AGENCY FIN

- Page 327 and 328:

Revenues: CDBG FY10/11 FUND Taxes:

- Page 329 and 330:

Revenues: TOTAL SPECIAL REVENUE Tax

- Page 331 and 332:

Fund and Business Unit 00134 EMPG-E

- Page 333 and 334:

00186 CFD #4M Fund and Business Uni

- Page 335 and 336:

Fund and Business Unit 80512 Strate

- Page 337 and 338:

Fund and Business Unit 00294 TCA2-0

- Page 339 and 340:

PROGRAM NAME: PW Street Maintenance

- Page 341 and 342:

PROGRAM NAME: PW Signing & Striping

- Page 343 and 344:

PROGRAM NAME: PW Tree Maintenance F

- Page 345 and 346:

PROGRAM NAME: Operating Xfer from F

- Page 347 and 348:

PROGRAM NAME: Measure A Admin FUND:

- Page 349 and 350:

PROGRAM NAME: City-wide Signing/Str

- Page 351 and 352:

PROGRAM NAME: Police - Crime Prev -

- Page 353 and 354:

PROGRAM NAME: Public/Education/Gov'

- Page 355 and 356:

PROGRAM NAME: EMPG Emerg Mgmt Prepa

- Page 357 and 358:

PROGRAM NAME: OTS - Police Fund FUN

- Page 359 and 360:

PROGRAM NAME: CT08272 Click It or T

- Page 361 and 362:

PROGRAM NAME: CT09272 Click It or T

- Page 363 and 364:

PROGRAM NAME: AL1029 DUI Enforcemen

- Page 365 and 366:

PROGRAM NAME: SC10272 Sobriety Chec

- Page 367 and 368:

PROGRAM NAME: AL1104 Avoid the 30 F

- Page 369 and 370:

PROGRAM NAME: Street Sweeping Progr

- Page 371 and 372:

PROGRAM NAME: Public Works - Specia

- Page 373 and 374:

PROGRAM NAME: Public Works - Catch

- Page 375 and 376:

PROGRAM NAME: Inspections FUND: 152

- Page 377 and 378:

PROGRAM NAME: Regulatory Permits/Ag

- Page 379 and 380:

PROGRAM NAME: H.E.A.L. FUND FUND: 1

- Page 381 and 382:

PROGRAM NAME: CACFP Child's Place F

- Page 383 and 384:

PROGRAM NAME: STARS Program Grant -

- Page 385 and 386:

PROGRAM NAME: CACFP At Risk FUND: 1

- Page 387 and 388:

PROGRAM NAME: HOME Administration F

- Page 389 and 390:

PROGRAM NAME: EPA Grant - Box Sprin

- Page 391 and 392:

PROGRAM NAME: Workforce Housing Pro

- Page 393 and 394:

PROGRAM NAME: Neighborhood Stabiliz

- Page 395 and 396:

PROGRAM NAME: CDBG Recovery Act of

- Page 397 and 398:

PROGRAM NAME: Traffic Signal Develo

- Page 399 and 400:

PROGRAM NAME: Police Facility Devel

- Page 401 and 402:

PROGRAM NAME: Corporate Yard Develo

- Page 403 and 404:

PROGRAM NAME: FHWA TRANSIMS Deploym

- Page 405 and 406:

PROGRAM NAME: City Hall Solar Film

- Page 407 and 408:

PROGRAM NAME: City Hall Parking Lot

- Page 409 and 410:

PROGRAM NAME: Fire Station #6 Light

- Page 411 and 412:

PROGRAM NAME: Fire Station #65 Ligh

- Page 413 and 414:

PROGRAM NAME: LED Street Sign Light

- Page 415 and 416:

PROGRAM NAME: Strategy Task Force F

- Page 417 and 418:

PROGRAM NAME: Shadow Mountain Light

- Page 419 and 420:

PROGRAM NAME: 2009-DJ-BX-1178 JAG G

- Page 421 and 422:

PROGRAM NAME: SB 1137 FUND: 232 PRO

- Page 423 and 424:

PROGRAM NAME: 2010-DJ-BX-1238 JAG G

- Page 425 and 426:

PROGRAM NAME: JAG - PD - 08 FUND: 2

- Page 427 and 428:

PROGRAM NAME: JAG 2009 SB-59-2366 G

- Page 429 and 430:

PROGRAM NAME: CDBG Code Compliance

- Page 431 and 432:

PROGRAM NAME: CDBG Social Programs

- Page 433 and 434:

PROGRAM NAME: CDBG Admin - FY10/11

- Page 435 and 436:

PROGRAM NAME: CDBG Code Compliance

- Page 437 and 438:

PROGRAM NAME: UBG14 Used Oil Recycl

- Page 439 and 440:

PROGRAM NAME: Targeted Rubberized A

- Page 441 and 442:

PROGRAM NAME: Oil Payment Program 1

- Page 443 and 444:

PROGRAM NAME: Arts Commission FUND:

- Page 445 and 446:

Fund and Business Unit 00121 GAS TA

- Page 447 and 448:

Fund and Business Unit 00151 STORM

- Page 449 and 450:

Fund and Business Unit 00206 QUIMBY

- Page 451 and 452:

Fund and Business Unit 00263 2010 D

- Page 453 and 454:

PROGRAM NAME: PW - Infrastructure P

- Page 455 and 456:

PROGRAM NAME: PW - Concrete Mainten

- Page 457 and 458:

PROGRAM NAME: PW Graffiti Removal F

- Page 459 and 460:

PROGRAM NAME: P/W Crossing Guards F

- Page 461 and 462:

PROGRAM NAME: Sidewalk Construction

- Page 463 and 464:

PROGRAM NAME: Measure A Admin FUND:

- Page 465 and 466:

PROGRAM NAME: City-wide Signing/Str

- Page 467 and 468:

PROGRAM NAME: ABC Police Grant FUND

- Page 469 and 470:

PROGRAM NAME: Police SLESF-CCAT Gra

- Page 471 and 472:

PROGRAM NAME: Operating Xfer from F

- Page 473 and 474:

PROGRAM NAME: Public Works - Grant

- Page 475 and 476:

PROGRAM NAME: SC08272 Sobriety Chec

- Page 477 and 478:

PROGRAM NAME: AL0842 Avoid the 30 P

- Page 479 and 480:

PROGRAM NAME: SC09272 Sobriety Chec

- Page 481 and 482:

PROGRAM NAME: CT10272 Click It or T

- Page 483 and 484:

PROGRAM NAME: AL 1141 DUI Enfor & A

- Page 485 and 486:

PROGRAM NAME: Public Works Air Qual

- Page 487 and 488:

PROGRAM NAME: CDBG - Family Service

- Page 489 and 490:

PROGRAM NAME: CDBG Administration F

- Page 491 and 492:

PROGRAM NAME: Public Works - Street

- Page 493 and 494:

PROGRAM NAME: NPDES Administration

- Page 495 and 496:

PROGRAM NAME: Plan Checks FUND: 152

- Page 497 and 498:

PROGRAM NAME: Beverage Container Re

- Page 499 and 500:

PROGRAM NAME: Child Care Grant FUND

- Page 501 and 502:

PROGRAM NAME: STARS Program Grant -

- Page 503 and 504:

PROGRAM NAME: STARS Program Grant -

- Page 505 and 506:

PROGRAM NAME: Community Housing Dev

- Page 507 and 508:

PROGRAM NAME: Habitat for Humanity

- Page 509 and 510:

PROGRAM NAME: CFD #4M FUND: 186 PRO

- Page 511 and 512:

PROGRAM NAME: JAG Grant - Code & Ne

- Page 513 and 514:

PROGRAM NAME: ETA Job Training Gran

- Page 515 and 516:

PROGRAM NAME: Homelessness Preventi

- Page 517 and 518:

PROGRAM NAME: Arterial Streets Deve

- Page 519 and 520:

PROGRAM NAME: Fire Facility Develop

- Page 521 and 522:

PROGRAM NAME: Parkland Facility Dev

- Page 523 and 524:

PROGRAM NAME: Recreation Center Dev

- Page 525 and 526:

PROGRAM NAME: City Hall Development

- Page 527 and 528:

PROGRAM NAME: Interchange Improveme

- Page 529 and 530:

PROGRAM NAME: Animal Shelter Develo

- Page 531 and 532:

PROGRAM NAME: City Hall HVAC FUND:

- Page 533 and 534:

PROGRAM NAME: City Hall Interior Li

- Page 535 and 536:

PROGRAM NAME: Senior Center Interio

- Page 537 and 538:

PROGRAM NAME: Fire Station #48 Ligh

- Page 539 and 540:

PROGRAM NAME: Library Interior & Ex

- Page 541 and 542:

PROGRAM NAME: Independence Program

- Page 543 and 544:

PROGRAM NAME: ArcLogistics Software

- Page 545 and 546:

PROGRAM NAME: EECBG Gratn Administr

- Page 547 and 548:

PROGRAM NAME: ICEP Task Force FUND:

- Page 549 and 550:

PROGRAM NAME: Emergency Svcs Agency

- Page 551 and 552:

PROGRAM NAME: Animal Services Spec

- Page 553 and 554:

PROGRAM NAME: JAG - PD - 07 FUND: 2

- Page 555 and 556:

PROGRAM NAME: JAG - COPS Technology

- Page 557 and 558:

PROGRAM NAME: 2010 DD-BX-0445 JAG G

- Page 559 and 560:

PROGRAM NAME: CDBG Social Programs

- Page 561 and 562:

PROGRAM NAME: CDBG Administration F

- Page 563 and 564:

PROGRAM NAME: CDBG Code Compliance

- Page 565 and 566:

PROGRAM NAME: CDBG Social Programs

- Page 567 and 568:

PROGRAM NAME: CDBG Admin - FY10/11

- Page 569 and 570:

PROGRAM NAME: CDBG Code Compliance

- Page 571 and 572:

PROGRAM NAME: UBG12 Use Oil Recycli

- Page 573 and 574:

PROGRAM NAME: UBG14 Used Oil Recycl

- Page 575 and 576:

PROGRAM NAME: Targeted Rubberized A

- Page 577 and 578:

PROGRAM NAME: Oil Payment Program 1

- Page 579 and 580:

PROGRAM NAME: Moreno Valley Foundat

- Page 581 and 582:

PROGRAM NAME: CFD #4I INFRASTRUCTUR

- Page 583 and 584:

Revenues: FACILITY CONST FUND Taxes

- Page 585 and 586:

WARNER RANCH ASDST AUTOMALL CAP-ADM

- Page 587 and 588:

Revenues: DIF TRAFFIC SIGNAL CAP PR

- Page 589 and 590:

Fund and Business Unit 00412 FACILI

- Page 591 and 592:

PROGRAM NAME: Operating Transfers O

- Page 593 and 594:

PROGRAM NAME: 2005 Lease Revenue Bo

- Page 595 and 596:

PROGRAM NAME: 2007 Towngate Special

- Page 597 and 598:

PROGRAM NAME: Auto Mall Capital/Adm

- Page 599 and 600:

Enterprise Fund

- Page 601 and 602:

Revenues: ELECTRIC FUND Taxes: Prop

- Page 603 and 604:

PROGRAM NAME: Electric Utility Fund

- Page 605 and 606:

PROGRAM NAME: 2007 Taxable Lease Re

- Page 607 and 608:

568

- Page 609 and 610:

Revenues: GENERAL LIABILITY INS FUN

- Page 611 and 612:

Revenues: GENERAL LIABILITY INS FUN

- Page 613 and 614:

Business Unit 00741 GENERAL LIABILI

- Page 615 and 616:

PROGRAM NAME: General Liability Adm

- Page 617 and 618:

PROGRAM NAME: Workers' Compensation

- Page 619 and 620:

PROGRAM NAME: Enterprise Applicatio

- Page 621 and 622:

PROGRAM NAME: Communications FUND:

- Page 623 and 624:

PROGRAM NAME: Class Recreation Soft

- Page 625 and 626:

PROGRAM NAME: ERP Replacement Proje

- Page 627 and 628:

PROGRAM NAME: Facilities - City Hal

- Page 629 and 630:

PROGRAM NAME: Facilities - Transp.

- Page 631 and 632:

PROGRAM NAME: Facilities - Library

- Page 633 and 634:

PROGRAM NAME: Facilities - MVTV Stu

- Page 635 and 636:

PROGRAM NAME: Facilities - Senior C

- Page 637 and 638:

PROGRAM NAME: Facilities - March Fi

- Page 639 and 640:

PROGRAM NAME: Facilities - CRC FUND

- Page 641 and 642:

PROGRAM NAME: Facilities - ESA Anne

- Page 643 and 644:

PROGRAM NAME: Facilities - F.S. #2

- Page 645 and 646:

PROGRAM NAME: Facilities - F.S. #48

- Page 647 and 648:

PROGRAM NAME: Facilities - F.S. #65

- Page 649 and 650:

PROGRAM NAME: Security Guards FUND:

- Page 651 and 652:

PROGRAM NAME: Veterans Memorial FUN

- Page 653 and 654:

PROGRAM NAME: In-house Copier Servi

- Page 655 and 656:

PROGRAM NAME: Equipment Maintenance

- Page 657 and 658:

PROGRAM NAME: Fixed Asset Replaceme

- Page 659 and 660:

Debt Service Funds

- Page 661 and 662:

Revenues: CH COP 97 DEBT SVC Taxes:

- Page 663 and 664:

Revenues: 2005 LEASE REV BONDS- DEB

- Page 665 and 666:

OPA SALES TAX #2 FUND CFD #5 STONER

- Page 667 and 668:

PROGRAM NAME: 2005 Lease Revenue Bo

- Page 669 and 670:

PROGRAM NAME: 2007 Towngate Special

- Page 671 and 672:

PROGRAM NAME: City Hall Certificate

- Page 673 and 674:

PROGRAM NAME: Automall Refinancing

- Page 675 and 676:

PROGRAM NAME: OPA Sales Tax #2 FUND

- Page 677 and 678:

636

- Page 679 and 680:

C i t y o f M o r e n o Va l l e y

- Page 681 and 682:

To: Honorable Mayor, Members of the

- Page 683 and 684:

Message from the Financial and Admi

- Page 685 and 686:

The growth in assets funding the li

- Page 687 and 688:

Bond Rating Agency Monitoring of th

- Page 689 and 690:

The 3-Year Deficit Elimination Plan

- Page 691 and 692:

Each department’s deficit reducti

- Page 693 and 694:

evenue enhancements have been recom

- Page 695 and 696:

Fire Department ($1,898,335 in redu

- Page 697 and 698:

The other two Deficit Reduction Opt

- Page 699 and 700:

City of Moreno Valley Deficit Reduc

- Page 701 and 702:

Total Total One- FTC Transfer DROs

- Page 703 and 704:

Total Total One- FTC Transfer DROs

- Page 705 and 706:

STAFFING IMPACT City of Moreno Vall

- Page 707 and 708:

STAFFING IMPACT City of Moreno Vall

- Page 709 and 710:

City of Moreno Valley 2011-12 Defic

- Page 711 and 712:

Total Total One- FTC Transfer DROs

- Page 713 and 714:

STAFFING IMPACT City of Moreno Vall

- Page 715 and 716:

Total Total One- FTC Transfer DROs

- Page 717 and 718:

Total Total One- FTC Transfer DROs

- Page 719 and 720:

City of Moreno Valley 2011-12 DRO D

- Page 725 and 726:

FY 2011/12 Budget Development Guide

- Page 727:

FY 2011/12 OPERATING BUDGET PREPARA

- Page 732 and 733:

APPROPRIATIONS SUBJECT TO THE LIMIT

- Page 736 and 737:

EXHIBIT A BUDGETED BUDGETED PROCEED

- Page 738 and 739:

CITY OF MORENO VALLEY SUMMARY OF AN

- Page 740 and 741:

* The State of California is curren

- Page 742 and 743:

o Rancho Dorado South Housing Proje

- Page 744 and 745:

• Complete the first phase of the

- Page 746 and 747:

Parks & Community Services • Prov

- Page 748 and 749:

Library • Promote books and readi