Report and Accounts 2011 | 1 - Efacec

Report and Accounts 2011 | 1 - Efacec

Report and Accounts 2011 | 1 - Efacec

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

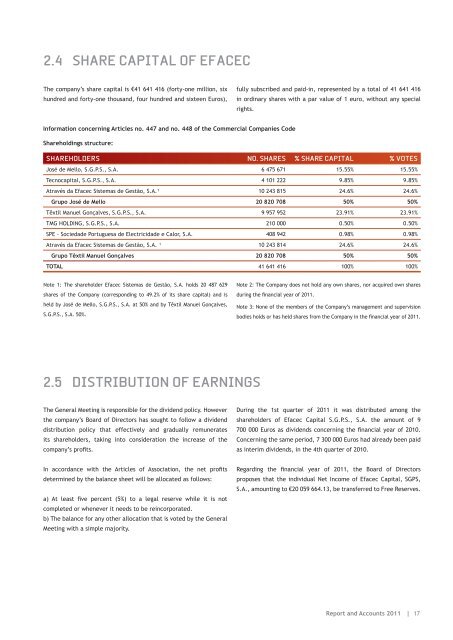

2.4 SHARE CAPITAL OF EFACEC<br />

The company’s share capital is €41 641 416 (forty-one million, six<br />

hundred <strong>and</strong> forty-one thous<strong>and</strong>, four hundred <strong>and</strong> sixteen Euros),<br />

Information concerning Articles no. 447 <strong>and</strong> no. 448 of the Commercial Companies Code<br />

Shareholdings structure:<br />

fully subscribed <strong>and</strong> paid-in, represented by a total of 41 641 416<br />

in ordinary shares with a par value of 1 euro, without any special<br />

rights.<br />

SHAREHOLDERS NO. SHARES % SHARE CAPITAL % VOTES<br />

José de Mello, S.G.P.S., S.A. 6 475 671 15.55% 15.55%<br />

Tecnocapital, S.G.P.S., S.A. 4 101 222 9.85% 9.85%<br />

Através da <strong>Efacec</strong> Sistemas de Gestão, S.A.¹ 10 243 815 24.6% 24.6%<br />

Grupo José de Mello 20 820 708 50% 50%<br />

Têxtil Manuel Gonçalves, S.G.P.S., S.A. 9 957 952 23.91% 23.91%<br />

��������������������������� 210 000 0.50% 0.50%<br />

SPE - Sociedade Portuguesa de Electricidade e Calor, S.A. 408 942 0.98% 0.98%<br />

Através da <strong>Efacec</strong> Sistemas de Gestão, S.A. ¹ 10 243 814 24.6% 24.6%<br />

Grupo Têxtil Manuel Gonçalves 20 820 708 50% 50%<br />

TOTAL 41 641 416 100% 100%<br />

Note 1: The shareholder <strong>Efacec</strong> Sistemas de Gestão, S.A. holds 20 487 629<br />

shares of the Company (corresponding to 49.2% of its share capital) <strong>and</strong> is<br />

held by José de Mello, S.G.P.S., S.A. at 50% <strong>and</strong> by Têxtil Manuel Gonçalves,<br />

S.G.P.S., S.A. 50%.<br />

2.5 DISTRIBUTION OF EARNINGS<br />

The General Meeting is responsible for the dividend policy. However<br />

the company’s Board of Directors has sought to follow a dividend<br />

distribution policy that effectively <strong>and</strong> gradually remunerates<br />

its shareholders, taking into consideration the increase of the<br />

������������������<br />

��� ����������� ����� ���� ��������� ��� ������������� ���� ���� �������<br />

determined by the balance sheet will be allocated as follows:<br />

��� ��� ������ ���� �������� ����� ��� �� ������ �������� ������ ��� ��� ����<br />

completed or whenever it needs to be reincorporated.<br />

b) The balance for any other allocation that is voted by the General<br />

�������������������������������<br />

Note 2: The Company does not hold any own shares, nor acquired own shares<br />

���������������������������������<br />

Note 3: None of the members of the Company’s management <strong>and</strong> supervision<br />

������������������������������������������������������������������������������<br />

During the 1st quarter of <strong>2011</strong> it was distributed among the<br />

shareholders of <strong>Efacec</strong> Capital S.G.P.S., S.A. the amount of 9<br />

�����������������������������������������������������������������<br />

Concerning the same period, 7 300 000 Euros had already been paid<br />

as interim dividends, in the 4th quarter of 2010.<br />

���������� ���� ��������� ����� ��� ������ ���� ������ ��� ����������<br />

proposes that the individual Net Income of <strong>Efacec</strong> Capital, SGPS,<br />

S.A., amounting to €20 059 664.13, be transferred to Free Reserves.<br />

<strong>Report</strong> <strong>and</strong> <strong>Accounts</strong> <strong>2011</strong> | 17