You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The amount of the provisions reflects the current estimate of the number of plaintiffs treated with our products;<br />

the number of cases continues to evolve, even though it tended to stabilize in 2007. The status of this litigation did<br />

not change significantly in 2007. Proceedings can be expected to continue in 2008 and after.<br />

The ligitation (class actions and individual suits) outstanding against Laboratoires Fournier relates, on the one hand,<br />

to the application of competition rules linked to changes in fenofibrate formulation in the USA and on the other<br />

to intellectual property rights in relation to different fenofibrate formulations in Canada (provisions have been set up<br />

only in respect of the latter item).<br />

Our opponents here are generic product manufacturers, distributors and third party medical care reimbusement<br />

bodies. These risks are the subject of certain contractual guarantees furnished by the former Fournier shareholders<br />

at the time of the acquisition in 2005. Proceedings are expected to continue during 2008 and beyond.<br />

In January 2008 the Group was informed that an application to register a generic equivalent of TRICOR ® had been filed<br />

in the United States. Fournier Laboratories Ireland Ltd and Laboratories Fournier S.A. filed patent infringement actions<br />

against Teva in the USA. Fournier Laobratories asserts intellectual property of TRICOR ® (fenofibrate) 145 mg NFE.<br />

Other provisions<br />

Other provisions stand at EUR 237 million, compared with EUR 287 million at the end of 2006.<br />

These include mainly:<br />

– the provision of EUR 50 million for the payment – deemed probable – of an additional price to the former<br />

Laboratoires Fournier shareholders linked to the absence of generics on the US market in 2008. This provision,<br />

initially set at EUR 100 million, reduced in 2007 to EUR 50 million with the payment of this amount following<br />

the absence of generics in 2007;<br />

– the provision to cover the additional research expenses to speed up the development of the psychiatric<br />

compounds included in the agreement concluded with Wyeth;<br />

– the provisions for any liabilities and charges linked to shut down or disposed-of activities.<br />

Group policy on insurance<br />

<strong>Solvay</strong> group policy is to use insurance to cover all catastrophe hazards, in all cases where insurance is mandatory<br />

and also whenever insurance represents the best economic solution for allocating risk.<br />

The Group closely examines any new insurance coverage solution, so as to limit the financial consequences<br />

of incidents that could have a major impact on its assets, profits and its third party liability.<br />

In 2007, international insurance programs were renewed with a lower level of premiums and ancillary costs. The civil<br />

liability insurance market remains difficult for companies selling pharmaceutical products.<br />

(29) Net indebtedness<br />

The Group’s net indebtedness is the balance between its financial debts and cash and cash equivalents.<br />

It increased by EUR 49 million from EUR 1 258 million at the end of 2005 to EUR 1 307 million at the end of 2007.<br />

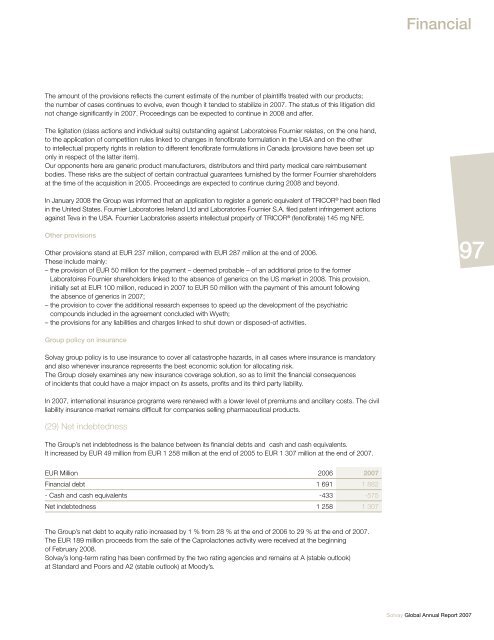

EUR Million 2006 2007<br />

Financial debt 1 691 1 882<br />

- Cash and cash equivalents -433 -575<br />

Net indebtedness 1 258 1 307<br />

The Group’s net debt to equity ratio increased by 1 % from 28 % at the end of 2006 to 29 % at the end of 2007.<br />

The EUR 189 million proceeds from the sale of the Caprolactones activity were received at the beginning<br />

of February 2008.<br />

<strong>Solvay</strong>’s long-term rating has been confirmed by the two rating agencies and remains at A (stable outlook)<br />

at Standard and Poors and A2 (stable outlook) at Moody’s.<br />

Financial<br />

<strong>Solvay</strong> Global Annual Report 2007<br />

97

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)