You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Fair value differences<br />

These record the marking to market of listed securities and financial derivatives used for hedging purposes.<br />

In 2007, the negative variation of EUR 248 million is due principally to the fall in the share price of our shareholding<br />

in Fortis (EUR 182 million) and the taking into income of part of the latent capital gain on Sofina (EUR 66 million)<br />

when selling our shares on the stock market.<br />

The fair value differences include also the marking to market of financial instruments accounted for according to<br />

IAS 39 as cash flow hedges. Only the effective part of the hedge is recognized in equity, with the balance being<br />

taken directly into income. The variation in this effective part, recognized among fair value differences, amounted<br />

to EUR 7 million at the end of 2007 (End 2006: EUR 7 million).<br />

When the financial instrument designated as a hedge matures, its value recognized in equity is transferred to<br />

the income statement. In 2007, EUR 7 million was transferred from equity to the income statement.<br />

Minority interests<br />

“Income and expenses directly allocated to equity” reduced by EUR 39 million, due to the transfer to the income<br />

statement of the latent capital gain on Sofina (EUR 37 million).<br />

The “other” caption contains a EUR 71 million reduction, which represents the repayment of capital of Société<br />

Financière Keyenveld S.A. to the third party shareholder through the contribution of Sofina shares.<br />

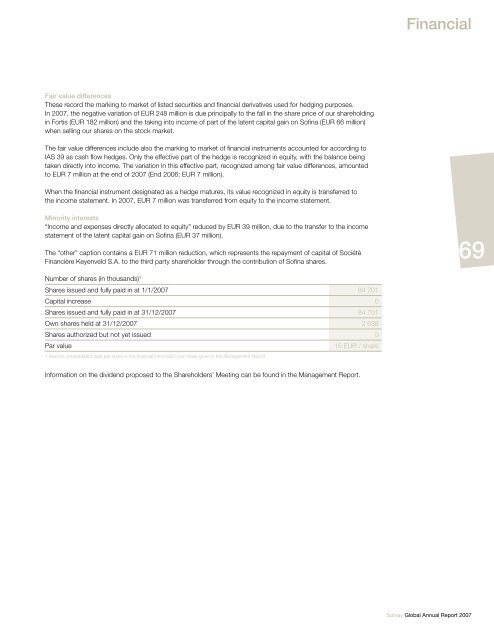

Number of shares (in thousands) 1<br />

Shares issued and fully paid in at 1/1/2007 84 701<br />

Capital increase 0<br />

Shares issued and fully paid in at 31/12/2007 84 701<br />

Own shares held at 31/12/2007 2 638<br />

Shares authorized but not yet issued 0<br />

Par value 15 EUR / share<br />

1 See the consolidated data per share in the financial infromation per share given in the Management Report.<br />

Information on the dividend proposed to the Shareholders’ Meeting can be found in the Management Report.<br />

Financial<br />

<strong>Solvay</strong> Global Annual Report 2007<br />

69

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)