Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

• IFRIC 14 IAS 19<br />

The Limit on a Defined Benefit Asset, Minimum<br />

Funding Requirements and their Interaction<br />

(applicable for accounting periods beginning on or<br />

after 1 January 2008).<br />

Adoption of these new standards and interpretations<br />

in subsequent years should not significantly impact<br />

the consolidated financial accounts.<br />

2. Consolidation<br />

Companies controlled by the Group (i.e. in which<br />

the Group has, directly, or indirectly, an interest of<br />

more than one half of the voting rights or is able<br />

to exercise control over the operations) have been<br />

fully consolidated. Separate disclosure is made of<br />

minority interests.<br />

All significant transactions between Group<br />

companies have been eliminated on consolidation.<br />

Companies over which the Group exercises joint<br />

control with a limited number of partners (joint<br />

ventures) are consolidated using the proportionate<br />

consolidation method.<br />

Investments in companies over which the Group<br />

exercises significant influence, but which it does not<br />

control, are accounted for using the equity method.<br />

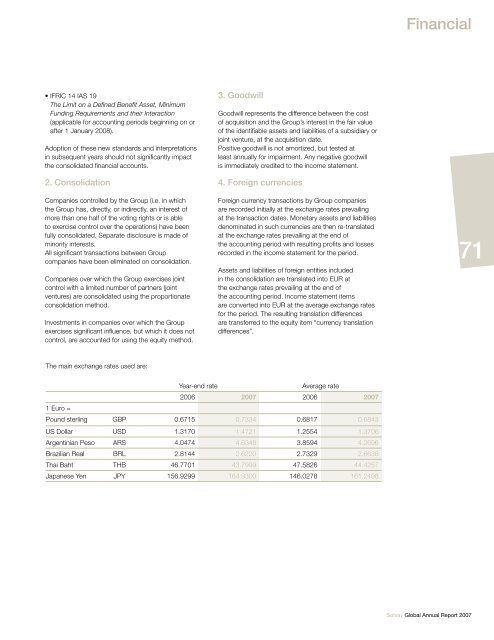

The main exchange rates used are:<br />

3. Goodwill<br />

Goodwill represents the difference between the cost<br />

of acquisition and the Group’s interest in the fair value<br />

of the identifiable assets and liabilities of a subsidiary or<br />

joint venture, at the acquisition date.<br />

Positive goodwill is not amortized, but tested at<br />

least annually for impairment. Any negative goodwill<br />

is immediately credited to the income statement.<br />

4. Foreign currencies<br />

Foreign currency transactions by Group companies<br />

are recorded initially at the exchange rates prevailing<br />

at the transaction dates. Monetary assets and liabilities<br />

denominated in such currencies are then re-translated<br />

at the exchange rates prevailing at the end of<br />

the accounting period with resulting profits and losses<br />

recorded in the income statement for the period.<br />

Assets and liabilities of foreign entities included<br />

in the consolidation are translated into EUR at<br />

the exchange rates prevailing at the end of<br />

the accounting period. Income statement items<br />

are converted into EUR at the average exchange rates<br />

for the period. The resulting translation differences<br />

are transferred to the equity item “currency translation<br />

differences”.<br />

Year-end rate Average rate<br />

2006 2007 2006 2007<br />

1 Euro =<br />

Pound sterling GBP 0.6715 0.7334 0.6817 0.6843<br />

US Dollar USD 1.3170 1.4721 1.2554 1.3706<br />

Argentinian Peso ARS 4.0474 4.6348 3.8594 4.2696<br />

Brazilian Real BRL 2.8144 2.6220 2.7329 2.6638<br />

Thai Baht THB 46.7701 43.7999 47.5826 44.4257<br />

Japanese Yen JPY 156.9299 164.9300 146.0278 161.2498<br />

Financial<br />

<strong>Solvay</strong> Global Annual Report 2007<br />

71

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)