Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

98<br />

<strong>Solvay</strong> Global Annual Report 2007<br />

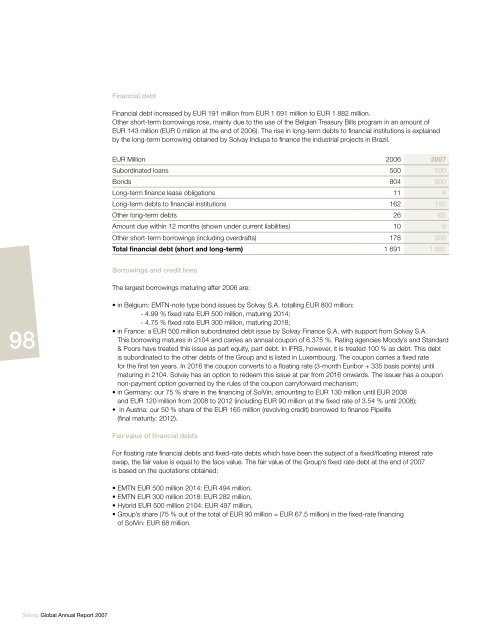

Financial debt<br />

Financial debt increased by EUR 191 million from EUR 1 691 million to EUR 1 882 million.<br />

Other short-term borrowings rose, mainly due to the use of the Belgian Treasury Bills program in an amount of<br />

EUR 143 million (EUR 0 million at the end of 2006). The rise in long-term debts to financial institutions is explained<br />

by the long-term borrowing obtained by <strong>Solvay</strong> Indupa to finance the industrial projects in Brazil.<br />

EUR Million 2006 2007<br />

Subordinated loans 500 500<br />

Bonds 804 800<br />

Long-term finance lease obligations 11 8<br />

Long-term debts to financial institutions 162 192<br />

Other long-term debts 26 65<br />

Amount due within 12 months (shown under current liabilities) 10 9<br />

Other short-term borrowings (including overdrafts) 178 308<br />

Total financial debt (short and long-term) 1 691 1 882<br />

Borrowings and credit lines<br />

The largest borrowings maturing after 2006 are:<br />

• in Belgium: EMTN-note type bond issues by <strong>Solvay</strong> S.A. totalling EUR 800 million:<br />

- 4.99 % fixed rate EUR 500 million, maturing 2014;<br />

- 4.75 % fixed rate EUR 300 million, maturing 2018;<br />

• in France: a EUR 500 million subordinated debt issue by <strong>Solvay</strong> Finance S.A. with support from <strong>Solvay</strong> S.A.<br />

This borrowing matures in 2104 and carries an annual coupon of 6.375 %. Rating agencies Moody’s and Standard<br />

& Poors have treated this issue as part equity, part debt. In IFRS, however, it is treated 100 % as debt. This debt<br />

is subordinated to the other debts of the Group and is listed in Luxembourg. The coupon carries a fixed rate<br />

for the first ten years. In 2016 the coupon converts to a floating rate (3-month Euribor + 335 basis points) until<br />

maturing in 2104. <strong>Solvay</strong> has an option to redeem this issue at par from 2016 onwards. The issuer has a coupon<br />

non-payment option governed by the rules of the coupon carryforward mechanism;<br />

• in Germany: our 75 % share in the financing of SolVin, amounting to EUR 130 million until EUR 2008<br />

and EUR 120 million from 2008 to 2012 (including EUR 90 million at the fixed rate of 3.54 % until 2008);<br />

• in Austria: our 50 % share of the EUR 165 million (revolving credit) borrowed to finance Pipelife<br />

(final maturity: 2012).<br />

Fair value of financial debts<br />

For floating rate financial debts and fixed-rate debts which have been the subject of a fixed/floating interest rate<br />

swap, the fair value is equal to the face value. The fair value of the Group’s fixed rate debt at the end of 2007<br />

is based on the quotations obtained:<br />

• EMTN EUR 500 million 2014: EUR 494 million,<br />

• EMTN EUR 300 million 2018: EUR 282 million,<br />

• Hybrid EUR 500 million 2104: EUR 497 million,<br />

• Group’s share (75 % out of the total of EUR 90 million = EUR 67.5 million) in the fixed-rate financing<br />

of SolVin: EUR 68 million.

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)