Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The EUR 123 million of asset impairments relates to:<br />

– in the Chemicals Sector, the reorganization of the Fluor activities in the face of competitive pressure<br />

on commodities (EUR 65 million corresponding to the residual value of tangible assets to be decommissioned) and<br />

of SBU Molecular Solutions (EUR 16 million impairment loss on the acquisition goodwill of Girindus given the lower<br />

profitability of this activity compared with expectations at the time of acquisition);<br />

– in the Pharmaceuticals Sector, the pursual of the “INSPIRE” project (EUR 17 million to bring tangible assets into<br />

line with their expected sales value) and the abandoning of the Odiparcil project following the reallocation of R&D<br />

priorities (EUR 19 million of intangible fixed assets attributed to this project at the time of acquisition of Fournier).<br />

The other non-recurring items produce a net income of EUR 154 million.<br />

Income items include here the capital gains on the sale of the Caprolactones activities (EUR 151 million), of<br />

Sofina S.A. shares (EUR 73 million) and of subscription rights to the Fortis S.A. capital increase (EUR 37 million).<br />

The expenses consist essentially of restructuring costs: EUR 42 million in relation to the “INSPIRE” project and<br />

EUR 34 million in the Fluor activities.<br />

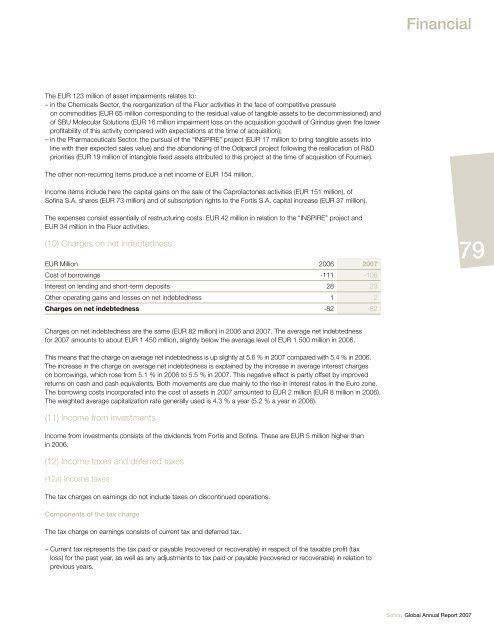

(10) Charges on net indebtedness<br />

EUR Million 2006 2007<br />

Cost of borrowings -111 -106<br />

Interest on lending and short-term deposits 28 23<br />

Other operating gains and losses on net indebtedness 1 2<br />

Charges on net indebtedness -82 -82<br />

Charges on net indebtedness are the same (EUR 82 million) in 2006 and 2007. The average net indebtedness<br />

for 2007 amounts to about EUR 1 450 million, slightly below the average level of EUR 1 500 million in 2006.<br />

This means that the charge on average net indebtedness is up slightly at 5.6 % in 2007 compared with 5.4 % in 2006.<br />

The increase in the charge on average net indebtedness is explained by the increase in average interest charges<br />

on borrowings, which rose from 5.1 % in 2006 to 5.5 % in 2007. This negative effect is partly offset by improved<br />

returns on cash and cash equivalents. Both movements are due mainly to the rise in interest rates in the Euro zone.<br />

The borrowing costs incorporated into the cost of assets in 2007 amounted to EUR 2 million (EUR 8 million in 2006).<br />

The weighted average capitalization rate generally used is 4.3 % a year (5.2 % a year in 2006).<br />

(11) Income from investments<br />

Income from investments consists of the dividends from Fortis and Sofina. These are EUR 5 million higher than<br />

in 2006.<br />

(12) Income taxes and deferred taxes<br />

(12a) Income taxes<br />

The tax charges on earnings do not include taxes on discontinued operations.<br />

Components of the tax charge<br />

The tax charge on earnings consists of current tax and deferred tax.<br />

– Current tax represents the tax paid or payable (recovered or recoverable) in respect of the taxable profit (tax<br />

loss) for the past year, as well as any adjustments to tax paid or payable (recovered or recoverable) in relation to<br />

previous years.<br />

Financial<br />

<strong>Solvay</strong> Global Annual Report 2007<br />

79

![PROC.1 [LETTRE] - Solvay](https://img.yumpu.com/16585746/1/184x260/proc1-lettre-solvay.jpg?quality=85)