An Action Plan for Developing Agricultural Input Markets in Tanzania

An Action Plan for Developing Agricultural Input Markets in Tanzania

An Action Plan for Developing Agricultural Input Markets in Tanzania

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

experimental purposes only. Attachment IV.2 provides<br />

the current portfolio of registered brands of CPPs available<br />

<strong>in</strong> <strong>Tanzania</strong> <strong>in</strong> 2003. The number of brand names<br />

is higher than the number of active <strong>in</strong>gredients (approximately<br />

200) because many of them are comprised<br />

of the same active <strong>in</strong>gredients, but manufactured and<br />

registered by different companies under different brand<br />

names. For example, over 15 <strong>in</strong>secticides conta<strong>in</strong><br />

cypermethr<strong>in</strong> and over 20 fungicides conta<strong>in</strong> coppers<br />

(oxide or hydroxide). The availability of a large number<br />

of the same product under different brand names<br />

implies that the CPP market <strong>in</strong> <strong>Tanzania</strong> is competitive.<br />

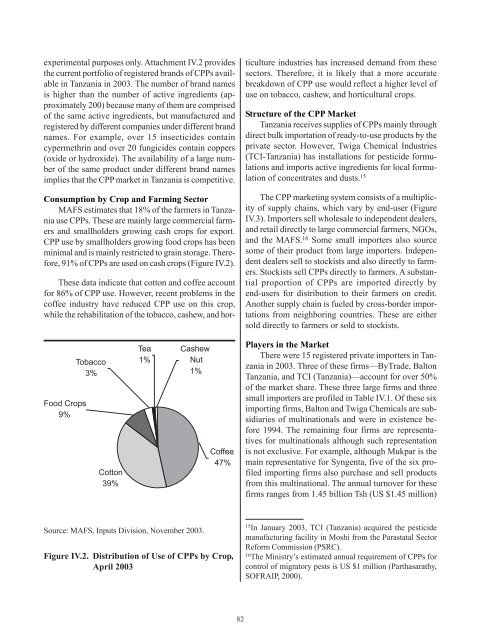

Consumption by Crop and Farm<strong>in</strong>g Sector<br />

MAFS estimates that 18% of the farmers <strong>in</strong> <strong>Tanzania</strong><br />

use CPPs. These are ma<strong>in</strong>ly large commercial farmers<br />

and smallholders grow<strong>in</strong>g cash crops <strong>for</strong> export.<br />

CPP use by smallholders grow<strong>in</strong>g food crops has been<br />

m<strong>in</strong>imal and is ma<strong>in</strong>ly restricted to gra<strong>in</strong> storage. There<strong>for</strong>e,<br />

91% of CPPs are used on cash crops (Figure IV.2).<br />

These data <strong>in</strong>dicate that cotton and coffee account<br />

<strong>for</strong> 86% of CPP use. However, recent problems <strong>in</strong> the<br />

coffee <strong>in</strong>dustry have reduced CPP use on this crop,<br />

while the rehabilitation of the tobacco, cashew, and hor-<br />

Source: MAFS, <strong>Input</strong>s Division, November 2003.<br />

Figure IV.2. Distribution of Use of CPPs by Crop,<br />

April 2003<br />

82<br />

ticulture <strong>in</strong>dustries has <strong>in</strong>creased demand from these<br />

sectors. There<strong>for</strong>e, it is likely that a more accurate<br />

breakdown of CPP use would reflect a higher level of<br />

use on tobacco, cashew, and horticultural crops.<br />

Structure of the CPP Market<br />

<strong>Tanzania</strong> receives supplies of CPPs ma<strong>in</strong>ly through<br />

direct bulk importation of ready-to-use products by the<br />

private sector. However, Twiga Chemical Industries<br />

(TCI-<strong>Tanzania</strong>) has <strong>in</strong>stallations <strong>for</strong> pesticide <strong>for</strong>mulations<br />

and imports active <strong>in</strong>gredients <strong>for</strong> local <strong>for</strong>mulation<br />

of concentrates and dusts. 15<br />

The CPP market<strong>in</strong>g system consists of a multiplicity<br />

of supply cha<strong>in</strong>s, which vary by end-user (Figure<br />

IV.3). Importers sell wholesale to <strong>in</strong>dependent dealers,<br />

and retail directly to large commercial farmers, NGOs,<br />

and the MAFS. 16 Some small importers also source<br />

some of their product from large importers. Independent<br />

dealers sell to stockists and also directly to farmers.<br />

Stockists sell CPPs directly to farmers. A substantial<br />

proportion of CPPs are imported directly by<br />

end-users <strong>for</strong> distribution to their farmers on credit.<br />

<strong>An</strong>other supply cha<strong>in</strong> is fueled by cross-border importations<br />

from neighbor<strong>in</strong>g countries. These are either<br />

sold directly to farmers or sold to stockists.<br />

Players <strong>in</strong> the Market<br />

There were 15 registered private importers <strong>in</strong> <strong>Tanzania</strong><br />

<strong>in</strong> 2003. Three of these firms—ByTrade, Balton<br />

<strong>Tanzania</strong>, and TCI (<strong>Tanzania</strong>)—account <strong>for</strong> over 50%<br />

of the market share. These three large firms and three<br />

small importers are profiled <strong>in</strong> Table IV.1. Of these six<br />

import<strong>in</strong>g firms, Balton and Twiga Chemicals are subsidiaries<br />

of mult<strong>in</strong>ationals and were <strong>in</strong> existence be<strong>for</strong>e<br />

1994. The rema<strong>in</strong><strong>in</strong>g four firms are representatives<br />

<strong>for</strong> mult<strong>in</strong>ationals although such representation<br />

is not exclusive. For example, although Mukpar is the<br />

ma<strong>in</strong> representative <strong>for</strong> Syngenta, five of the six profiled<br />

import<strong>in</strong>g firms also purchase and sell products<br />

from this mult<strong>in</strong>ational. The annual turnover <strong>for</strong> these<br />

firms ranges from 1.45 billion Tsh (US $1.45 million)<br />

15 In January 2003, TCI (<strong>Tanzania</strong>) acquired the pesticide<br />

manufactur<strong>in</strong>g facility <strong>in</strong> Moshi from the Parastatal Sector<br />

Re<strong>for</strong>m Commission (PSRC).<br />

16 The M<strong>in</strong>istry’s estimated annual requirement of CPPs <strong>for</strong><br />

control of migratory pests is US $1 million (Parthasarathy,<br />

SOFRAIP, 2000).