An Action Plan for Developing Agricultural Input Markets in Tanzania

An Action Plan for Developing Agricultural Input Markets in Tanzania

An Action Plan for Developing Agricultural Input Markets in Tanzania

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

than 5% of the market. This is based on the<br />

abovementioned situation where seed distribution was<br />

not accord<strong>in</strong>g to demand. However, this analysis is not<br />

supported by more recent data obta<strong>in</strong>ed from the Seed<br />

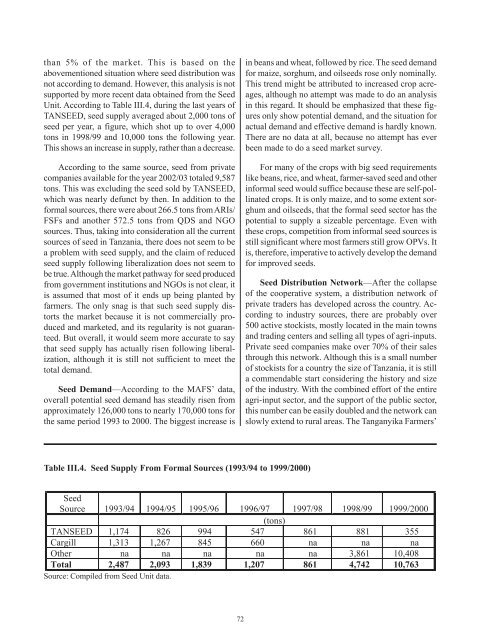

Unit. Accord<strong>in</strong>g to Table III.4, dur<strong>in</strong>g the last years of<br />

TANSEED, seed supply averaged about 2,000 tons of<br />

seed per year, a figure, which shot up to over 4,000<br />

tons <strong>in</strong> 1998/99 and 10,000 tons the follow<strong>in</strong>g year.<br />

This shows an <strong>in</strong>crease <strong>in</strong> supply, rather than a decrease.<br />

Accord<strong>in</strong>g to the same source, seed from private<br />

companies available <strong>for</strong> the year 2002/03 totaled 9,587<br />

tons. This was exclud<strong>in</strong>g the seed sold by TANSEED,<br />

which was nearly defunct by then. In addition to the<br />

<strong>for</strong>mal sources, there were about 266.5 tons from ARIs/<br />

FSFs and another 572.5 tons from QDS and NGO<br />

sources. Thus, tak<strong>in</strong>g <strong>in</strong>to consideration all the current<br />

sources of seed <strong>in</strong> <strong>Tanzania</strong>, there does not seem to be<br />

a problem with seed supply, and the claim of reduced<br />

seed supply follow<strong>in</strong>g liberalization does not seem to<br />

be true. Although the market pathway <strong>for</strong> seed produced<br />

from government <strong>in</strong>stitutions and NGOs is not clear, it<br />

is assumed that most of it ends up be<strong>in</strong>g planted by<br />

farmers. The only snag is that such seed supply distorts<br />

the market because it is not commercially produced<br />

and marketed, and its regularity is not guaranteed.<br />

But overall, it would seem more accurate to say<br />

that seed supply has actually risen follow<strong>in</strong>g liberalization,<br />

although it is still not sufficient to meet the<br />

total demand.<br />

Seed Demand—Accord<strong>in</strong>g to the MAFS’ data,<br />

overall potential seed demand has steadily risen from<br />

approximately 126,000 tons to nearly 170,000 tons <strong>for</strong><br />

the same period 1993 to 2000. The biggest <strong>in</strong>crease is<br />

Table III.4. Seed Supply From Formal Sources (1993/94 to 1999/2000)<br />

Source: Compiled from Seed Unit data.<br />

72<br />

<strong>in</strong> beans and wheat, followed by rice. The seed demand<br />

<strong>for</strong> maize, sorghum, and oilseeds rose only nom<strong>in</strong>ally.<br />

This trend might be attributed to <strong>in</strong>creased crop acreages,<br />

although no attempt was made to do an analysis<br />

<strong>in</strong> this regard. It should be emphasized that these figures<br />

only show potential demand, and the situation <strong>for</strong><br />

actual demand and effective demand is hardly known.<br />

There are no data at all, because no attempt has ever<br />

been made to do a seed market survey.<br />

For many of the crops with big seed requirements<br />

like beans, rice, and wheat, farmer-saved seed and other<br />

<strong>in</strong><strong>for</strong>mal seed would suffice because these are self-poll<strong>in</strong>ated<br />

crops. It is only maize, and to some extent sorghum<br />

and oilseeds, that the <strong>for</strong>mal seed sector has the<br />

potential to supply a sizeable percentage. Even with<br />

these crops, competition from <strong>in</strong><strong>for</strong>mal seed sources is<br />

still significant where most farmers still grow OPVs. It<br />

is, there<strong>for</strong>e, imperative to actively develop the demand<br />

<strong>for</strong> improved seeds.<br />

Seed Distribution Network—After the collapse<br />

of the cooperative system, a distribution network of<br />

private traders has developed across the country. Accord<strong>in</strong>g<br />

to <strong>in</strong>dustry sources, there are probably over<br />

500 active stockists, mostly located <strong>in</strong> the ma<strong>in</strong> towns<br />

and trad<strong>in</strong>g centers and sell<strong>in</strong>g all types of agri-<strong>in</strong>puts.<br />

Private seed companies make over 70% of their sales<br />

through this network. Although this is a small number<br />

of stockists <strong>for</strong> a country the size of <strong>Tanzania</strong>, it is still<br />

a commendable start consider<strong>in</strong>g the history and size<br />

of the <strong>in</strong>dustry. With the comb<strong>in</strong>ed ef<strong>for</strong>t of the entire<br />

agri-<strong>in</strong>put sector, and the support of the public sector,<br />

this number can be easily doubled and the network can<br />

slowly extend to rural areas. The Tanganyika Farmers’