2011 - Li & Fung Limited

2011 - Li & Fung Limited

2011 - Li & Fung Limited

- TAGS

- fung

- limited

- www.lifung.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE ACCOUNTS (CONTINUED)<br />

6 TAXATION (CONTINUED)<br />

On 11 June 2010, the Group also applied for a judicial review of the decision of the Commissioner of the HKIR rejecting LFT’s<br />

application for an unconditional holdover of tax for the year of assessment 2008/09 pending the determination of the objection lodged<br />

with the HKIR. The Group purchased tax reserve certificates in respect of LFT for the year of assessment 2008/09 as directed by the<br />

Commissioner of the HKIR pending the decision of the judicial review application. As of the date of this annual report, the hearing date<br />

for the judicial review application is yet to be fixed.<br />

7 PROFIT ATTRIBUTABLE TO SHAREHOLDERS OF THE COMPANY<br />

The profit attributable to shareholders of the Company is dealt with in the accounts of the Company to the extent of US$562,977,000<br />

(2010: US$569,383,000) (Note 26).<br />

8 EARNINGS PER SHARE<br />

The calculation of basic earnings per share is based on the Group’s profit attributable to shareholders of US$681,229,000 (2010:<br />

US$548,491,000) and on the weighted average number of 8,079,799,000 (2010: 7,644,510,000) shares in issue during the year after<br />

taking into account the effect of the Share Subdivision in May <strong>2011</strong>.<br />

Diluted earnings per share is calculated by adjusting the weighted average number of 8,079,799,000 (2010: 7,644,510,000) ordinary<br />

shares in issue by 35,476,000 (2010: 86,438,000), after taking into account the effect of the Share Subdivision in May <strong>2011</strong>, to assume<br />

conversion or all dilutive potential ordinary shares granted under the Company’s Option Scheme and release of all shares held by escrow<br />

agents for settlement of acquisition consideration. For the calculation of dilutive potential ordinary share granted under the Company,<br />

a calculation is done to determine the number of shares that could have been acquired at fair value (determined as the average annual<br />

market share price of the Company’s shares) based on the monetary value of the subscription rights attached to outstanding share<br />

options. The number of shares calculated as above is compared with the number of shares that would have been issued assuming the<br />

exercise of the share options.<br />

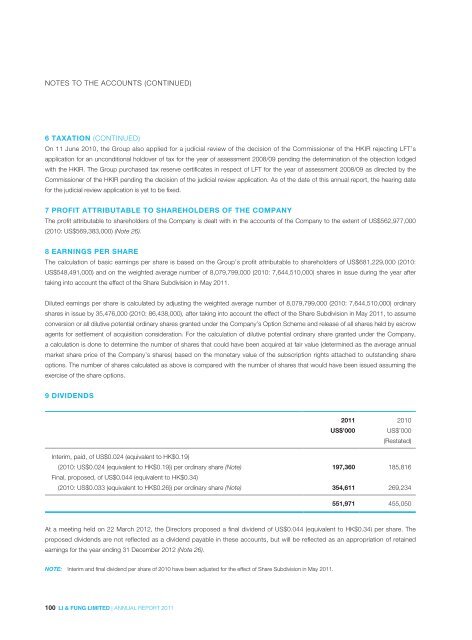

9 DIVIDENDS<br />

100 LI & FUNG LIMITED | ANNUAL REPORT <strong>2011</strong><br />

<strong>2011</strong> 2010<br />

US$’000 US$’000<br />

(Restated)<br />

Interim, paid, of US$0.024 (equivalent to HK$0.19)<br />

(2010: US$0.024 (equivalent to HK$0.19)) per ordinary share (Note)<br />

Final, proposed, of US$0.044 (equivalent to HK$0.34)<br />

197,360 185,816<br />

(2010: US$0.033 (equivalent to HK$0.26)) per ordinary share (Note) 354,611 269,234<br />

551,971 455,050<br />

At a meeting held on 22 March 2012, the Directors proposed a final dividend of US$0.044 (equivalent to HK$0.34) per share. The<br />

proposed dividends are not reflected as a dividend payable in these accounts, but will be reflected as an appropriation of retained<br />

earnings for the year ending 31 December 2012 (Note 26).<br />

NOTE: Interim and final dividend per share of 2010 have been adjusted for the effect of Share Subdivision in May <strong>2011</strong>.