2011 - Li & Fung Limited

2011 - Li & Fung Limited

2011 - Li & Fung Limited

- TAGS

- fung

- limited

- www.lifung.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES TO THE ACCOUNTS (CONTINUED)<br />

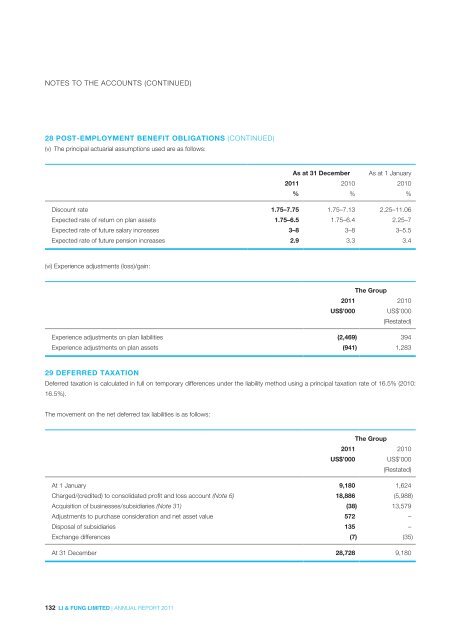

28 POST-EMPLOYMENT BENEFIT OBLIGATIONS (CONTINUED)<br />

(v) The principal actuarial assumptions used are as follows:<br />

132 LI & FUNG LIMITED | ANNUAL REPORT <strong>2011</strong><br />

As at 31 December As at 1 January<br />

<strong>2011</strong> 2010 2010<br />

% % %<br />

Discount rate 1.75–7.75 1.75–7.13 2.25–11.06<br />

Expected rate of return on plan assets 1.75–6.5 1.75–6.4 2.25–7<br />

Expected rate of future salary increases 3–8 3–8 3–5.5<br />

Expected rate of future pension increases 2.9 3.3 3.4<br />

(vi) Experience adjustments (loss)/gain:<br />

The Group<br />

<strong>2011</strong> 2010<br />

US$’000 US$’000<br />

(Restated)<br />

Experience adjustments on plan liabilities (2,469) 394<br />

Experience adjustments on plan assets (941) 1,283<br />

29 DEFERRED TAXATION<br />

Deferred taxation is calculated in full on temporary differences under the liability method using a principal taxation rate of 16.5% (2010:<br />

16.5%).<br />

The movement on the net deferred tax liabilities is as follows:<br />

The Group<br />

<strong>2011</strong> 2010<br />

US$’000 US$’000<br />

(Restated)<br />

At 1 January 9,180 1,624<br />

Charged/(credited) to consolidated profit and loss account (Note 6) 18,886 (5,988)<br />

Acquisition of businesses/subsidiaries (Note 31) (38) 13,579<br />

Adjustments to purchase consideration and net asset value 572 –<br />

Disposal of subsidiaries 135 –<br />

Exchange differences (7) (35)<br />

At 31 December 28,728 9,180