2011 - Li & Fung Limited

2011 - Li & Fung Limited

2011 - Li & Fung Limited

- TAGS

- fung

- limited

- www.lifung.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

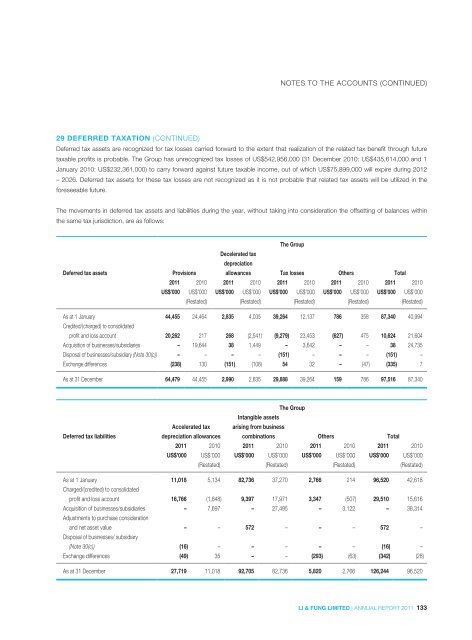

29 DEFERRED TAXATION (CONTINUED)<br />

NOTES TO THE ACCOUNTS (CONTINUED)<br />

Deferred tax assets are recognized for tax losses carried forward to the extent that realization of the related tax benefit through future<br />

taxable profits is probable. The Group has unrecognized tax losses of US$542,956,000 (31 December 2010: US$435,614,000 and 1<br />

January 2010: US$232,361,000) to carry forward against future taxable income, out of which US$75,899,000 will expire during 2012<br />

– 2026. Deferred tax assets for these tax losses are not recognized as it is not probable that related tax assets will be utilized in the<br />

foreseeable future.<br />

The movements in deferred tax assets and liabilities during the year, without taking into consideration the offsetting of balances within<br />

the same tax jurisdiction, are as follows:<br />

Decelerated tax<br />

depreciation<br />

The Group<br />

Deferred tax assets Provisions<br />

allowances Tax losses Others Total<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010 <strong>2011</strong> 2010 <strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000<br />

(Restated) (Restated) (Restated) (Restated) (Restated)<br />

As at 1 January<br />

Credited/(charged) to consolidated<br />

44,455 24,464 2,835 4,035 39,264 12,137 786 358 87,340 40,994<br />

profit and loss account 20,262 217 268 (2,541) (9,279) 23,453 (627) 475 10,624 21,604<br />

Acquisition of businesses/subsidiaries – 19,644 38 1,449 – 3,642 – – 38 24,735<br />

Disposal of businesses/subsidiary (Note 30(c)) – – – – (151) – – – (151) –<br />

Exchange differences (238) 130 (151) (108) 54 32 – (47) (335) 7<br />

As at 31 December 64,479 44,455 2,990 2,835 29,888 39,264 159 786 97,516 87,340<br />

Deferred tax liabilities<br />

Intangible assets<br />

The Group<br />

Accelerated tax arising from business<br />

depreciation allowances combinations Others Total<br />

<strong>2011</strong> 2010 <strong>2011</strong> 2010 <strong>2011</strong> 2010 <strong>2011</strong> 2010<br />

US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000 US$’000<br />

(Restated) (Restated) (Restated) (Restated)<br />

As at 1 January<br />

Charged/(credited) to consolidated<br />

11,018 5,134 82,736 37,270 2,766 214 96,520 42,618<br />

profit and loss account 16,766 (1,848) 9,397 17,971 3,347 (507) 29,510 15,616<br />

Acquisition of businesses/subsidiaries<br />

Adjustments to purchase consideration<br />

– 7,697 – 27,495 – 3,122 – 38,314<br />

and net asset value<br />

Disposal of businesses/ subsidiary<br />

– – 572 – – – 572 –<br />

(Note 30(c)) (16) – – – – – (16) –<br />

Exchange differences (49) 35 – – (293) (63) (342) (28)<br />

As at 31 December 27,719 11,018 92,705 82,736 5,820 2,766 126,244 96,520<br />

LI & FUNG LIMITED | ANNUAL REPORT <strong>2011</strong> 133