2011 - Li & Fung Limited

2011 - Li & Fung Limited

2011 - Li & Fung Limited

- TAGS

- fung

- limited

- www.lifung.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES TO THE ACCOUNTS (CONTINUED)<br />

33 COMMITMENTS (CONTINUED)<br />

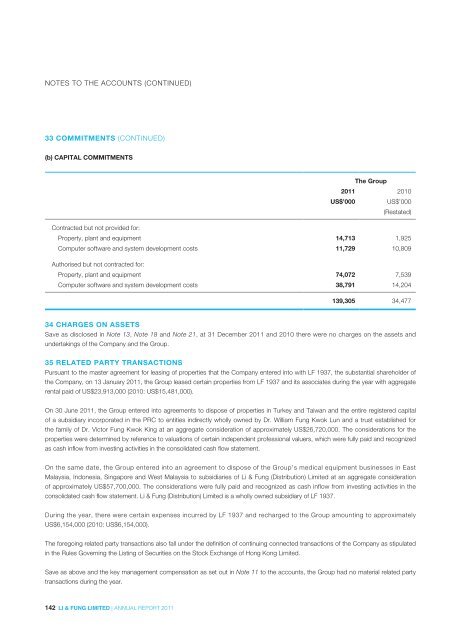

(b) CAPITAL COMMITMENTS<br />

142 LI & FUNG LIMITED | ANNUAL REPORT <strong>2011</strong><br />

The Group<br />

<strong>2011</strong> 2010<br />

US$’000 US$’000<br />

(Restated)<br />

Contracted but not provided for:<br />

Property, plant and equipment 14,713 1,925<br />

Computer software and system development costs 11,729 10,809<br />

Authorised but not contracted for:<br />

Property, plant and equipment 74,072 7,539<br />

Computer software and system development costs 38,791 14,204<br />

34 CHARGES ON ASSETS<br />

139,305 34,477<br />

Save as disclosed in Note 13, Note 18 and Note 21, at 31 December <strong>2011</strong> and 2010 there were no charges on the assets and<br />

undertakings of the Company and the Group.<br />

35 RELATED PARTY TRANSACTIONS<br />

Pursuant to the master agreement for leasing of properties that the Company entered into with LF 1937, the substantial shareholder of<br />

the Company, on 13 January <strong>2011</strong>, the Group leased certain properties from LF 1937 and its associates during the year with aggregate<br />

rental paid of US$23,913,000 (2010: US$15,481,000).<br />

On 30 June <strong>2011</strong>, the Group entered into agreements to dispose of properties in Turkey and Taiwan and the entire registered capital<br />

of a subsidiary incorporated in the PRC to entities indirectly wholly owned by Dr. William <strong>Fung</strong> Kwok Lun and a trust established for<br />

the family of Dr. Victor <strong>Fung</strong> Kwok King at an aggregate consideration of approximately US$26,720,000. The considerations for the<br />

properties were determined by reference to valuations of certain independent professional valuers, which were fully paid and recognized<br />

as cash inflow from investing activities in the consolidated cash flow statement.<br />

On the same date, the Group entered into an agreement to dispose of the Group’s medical equipment businesses in East<br />

Malaysia, Indonesia, Singapore and West Malaysia to subsidiaries of <strong>Li</strong> & <strong>Fung</strong> (Distribution) <strong>Li</strong>mited at an aggregate consideration<br />

of approximately US$57,700,000. The considerations were fully paid and recognized as cash inflow from investing activities in the<br />

consolidated cash flow statement. <strong>Li</strong> & <strong>Fung</strong> (Distribution) <strong>Li</strong>mited is a wholly owned subsidiary of LF 1937.<br />

During the year, there were certain expenses incurred by LF 1937 and recharged to the Group amounting to approximately<br />

US$6,154,000 (2010: US$6,154,000).<br />

The foregoing related party transactions also fall under the definition of continuing connected transactions of the Company as stipulated<br />

in the Rules Governing the <strong>Li</strong>sting of Securities on the Stock Exchange of Hong Kong <strong>Li</strong>mited.<br />

Save as above and the key management compensation as set out in Note 11 to the accounts, the Group had no material related party<br />

transactions during the year.