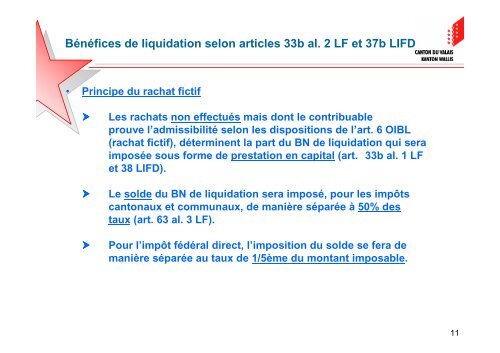

Bénéfices de liquidation selon articles 33b al. 2 LF et 37b LIFD

Bénéfices de liquidation selon articles 33b al. 2 LF et 37b LIFD

Bénéfices de liquidation selon articles 33b al. 2 LF et 37b LIFD

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Bénéfices</strong> <strong>de</strong> <strong>liquidation</strong> <strong>selon</strong> <strong>articles</strong> <strong>33b</strong> <strong>al</strong>. 2 <strong>LF</strong> <strong>et</strong> <strong>37b</strong> <strong>LIFD</strong><br />

• Principe du rachat fictif<br />

Les rachats non effectués mais dont le contribuable<br />

prouve l’admissibilité <strong>selon</strong> les dispositions <strong>de</strong> l’art. 6 OIBL<br />

(rachat fictif), déterminent la part du BN <strong>de</strong> <strong>liquidation</strong> qui sera<br />

imposée sous forme <strong>de</strong> prestation en capit<strong>al</strong> (art. <strong>33b</strong> <strong>al</strong>. 1 <strong>LF</strong><br />

<strong>et</strong> 38 <strong>LIFD</strong>).<br />

Le sol<strong>de</strong> du BN <strong>de</strong> <strong>liquidation</strong> sera imposé, pour les impôts<br />

cantonaux <strong>et</strong> communaux, <strong>de</strong> manière séparée à 50% <strong>de</strong>s<br />

taux (art. 63 <strong>al</strong>. 3 <strong>LF</strong>).<br />

Pour l’impôt fédér<strong>al</strong> direct, l’imposition du sol<strong>de</strong> se fera <strong>de</strong><br />

manière séparée au taux <strong>de</strong> 1/5ème du montant imposable.<br />

11