Bénéfices de liquidation selon articles 33b al. 2 LF et 37b LIFD

Bénéfices de liquidation selon articles 33b al. 2 LF et 37b LIFD

Bénéfices de liquidation selon articles 33b al. 2 LF et 37b LIFD

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

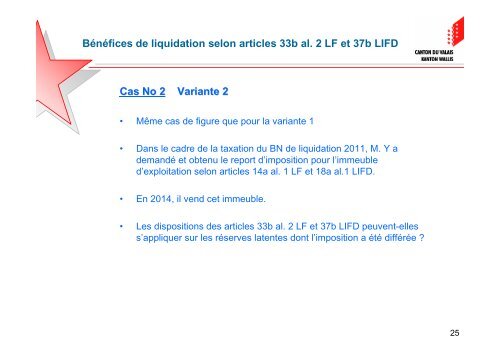

<strong>Bénéfices</strong> <strong>de</strong> <strong>liquidation</strong> <strong>selon</strong> <strong>articles</strong> <strong>33b</strong> <strong>al</strong>. 2 <strong>LF</strong> <strong>et</strong> <strong>37b</strong> <strong>LIFD</strong><br />

Cas No 2 Variante 2<br />

• Même cas <strong>de</strong> figure que pour la variante 1<br />

• Dans le cadre <strong>de</strong> la taxation du BN <strong>de</strong> <strong>liquidation</strong> 2011, M. Y a<br />

<strong>de</strong>mandé <strong>et</strong> obtenu le report d’imposition pour l’immeuble<br />

d’exploitation <strong>selon</strong> <strong>articles</strong> 14a <strong>al</strong>. 1 <strong>LF</strong> <strong>et</strong> 18a <strong>al</strong>.1 <strong>LIFD</strong>.<br />

• En 2014, il vend c<strong>et</strong> immeuble.<br />

• Les dispositions <strong>de</strong>s <strong>articles</strong> <strong>33b</strong> <strong>al</strong>. 2 <strong>LF</strong> <strong>et</strong> <strong>37b</strong> <strong>LIFD</strong> peuvent-elles<br />

s’appliquer sur les réserves latentes dont l’imposition a été différée ?<br />

25