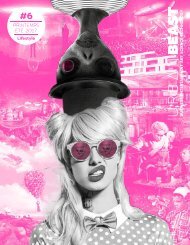

Magazine BEAST #12 2018

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

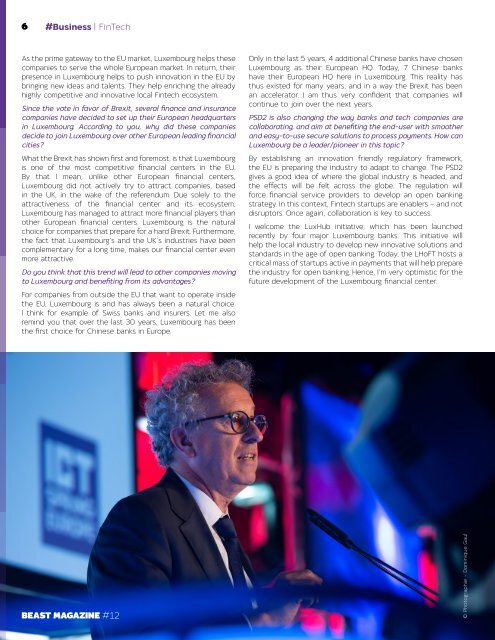

6 #Business | FinTech<br />

As the prime gateway to the EU market, Luxembourg helps these<br />

companies to serve the whole European market. In return, their<br />

presence in Luxembourg helps to push innovation in the EU by<br />

bringing new ideas and talents. They help enriching the already<br />

highly competitive and innovative local Fintech ecosystem.<br />

Since the vote in favor of Brexit, several finance and insurance<br />

companies have decided to set up their European headquarters<br />

in Luxembourg. According to you, why did these companies<br />

decide to join Luxembourg over other European leading financial<br />

cities?<br />

What the Brexit has shown first and foremost, is that Luxembourg<br />

is one of the most competitive financial centers in the EU.<br />

By that I mean, unlike other European financial centers,<br />

Luxembourg did not actively try to attract companies, based<br />

in the UK, in the wake of the referendum. Due solely to the<br />

attractiveness of the financial center and its ecosystem,<br />

Luxembourg has managed to attract more financial players than<br />

other European financial centers. Luxembourg is the natural<br />

choice for companies that prepare for a hard Brexit. Furthermore,<br />

the fact that Luxembourg’s and the UK’s industries have been<br />

complementary for a long time, makes our financial center even<br />

more attractive.<br />

Do you think that this trend will lead to other companies moving<br />

to Luxembourg and benefiting from its advantages?<br />

For companies from outside the EU that want to operate inside<br />

the EU, Luxembourg is and has always been a natural choice.<br />

I think for example of Swiss banks and insurers. Let me also<br />

remind you that over the last 30 years, Luxembourg has been<br />

the first choice for Chinese banks in Europe.<br />

Only in the last 5 years, 4 additional Chinese banks have chosen<br />

Luxembourg as their European HQ. Today, 7 Chinese banks<br />

have their European HQ here in Luxembourg. This reality has<br />

thus existed for many years, and in a way the Brexit has been<br />

an accelerator. I am thus very confident that companies will<br />

continue to join over the next years.<br />

PSD2 is also changing the way banks and tech companies are<br />

collaborating, and aim at benefiting the end-user with smoother<br />

and easy-to-use secure solutions to process payments. How can<br />

Luxembourg be a leader/pioneer in this topic?<br />

By establishing an innovation friendly regulatory framework,<br />

the EU is preparing the industry to adapt to change. The PSD2<br />

gives a good idea of where the global industry is headed, and<br />

the effects will be felt across the globe. The regulation will<br />

force financial service providers to develop an open banking<br />

strategy. In this context, Fintech startups are enablers – and not<br />

disruptors. Once again, collaboration is key to success.<br />

I welcome the LuxHub initiative, which has been launched<br />

recently by four major Luxembourg banks. This initiative will<br />

help the local industry to develop new innovative solutions and<br />

standards in the age of open banking. Today, the LHoFT hosts a<br />

critical mass of startups active in payments that will help prepare<br />

the industry for open banking. Hence, I’m very optimistic for the<br />

future development of the Luxembourg financial center.<br />

<strong>BEAST</strong> MAGAZINE <strong>#12</strong><br />

© Photographie - Dominique Gaul