2004 YILI BÃTÃESâ¹Nâ¹N UYGULAMA SONUÃLARI AÃIKLANDI ...

2004 YILI BÃTÃESâ¹Nâ¹N UYGULAMA SONUÃLARI AÃIKLANDI ...

2004 YILI BÃTÃESâ¹Nâ¹N UYGULAMA SONUÃLARI AÃIKLANDI ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

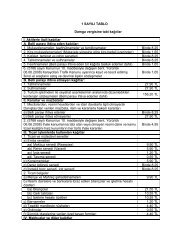

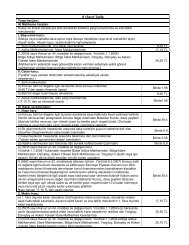

English TranslationTHE ACTUALIZED <strong>2004</strong>BUDGET RESULTSHAVE BEENANNOUNCEDThe most significant authority held by apolitical party that has won the electionsto govern the country in democraticcountries is undoubtedly, to determine andperform public services and collect thenecessary resources from citizens by wayof taxation to perform these services.Therefore, the leading indicator that agovernment is successful or not is the factwhether or not the public services havebeen determined correctly and whether ornot these services are rendered throughefficient and productive use of publicresources. Essentially, this is a responsibilitygranted to governments throughlaw and primarily the constitution. So, thegovernments are faced with the responsibilityto meet the public requirementsthat have increased based on tangible andso-called reasons, using the scarce publicresources in the most efficient way.Besides, this responsibility is a responsibilityof conscience as well as a legalone.When we determine the most significantindicator of success or failure ofgovernments as determining the publicservices required by the public and meetingthem by efficient and productive use ofpublic resources, it is evident that the soleresource to read those indicators aregovernment budgets. Because, governmentbudgets are texts where the public servicesto be used by the government in one yearand the resources to be used to reach thosegoals are shown collectively in the formof a legal document after being ratified bythe parliament. The parliaments ratify thebudgetary acts to approve and authorizethe government’s use of resourcesindicated in the budget for the servicesagain referred to in the budget. When itcomes to use of public resources, thebudgets are supervised closely when theyare being prepared, applied and their resultsare announced and these budgets aresubjected to legal, administrative andjudicial supervision. Since the tax burdenhas not been duly shared by those at thebase of the pyramid and this has preventedgeneration of the sense of ownership overthe public resources, although this is notexperienced in our country, there is alsoa social supervision on the budget indeveloped countries. As a matter of fact,since the number of people trying toinappropriately use the public resources,leaving aside social supervision, this isone of the greatest handicaps thatgovernments are faced with.In developed countries as a consequenceof social supervision on budgets in recentyears, the public financial managementunderstanding is questioned forenhancement of the quality of publicresources, more efficient and productiveuse of public resources and questionabilityof political and administrative practicesand to ensure financial transparency. Asa consequence of this questionability, thebudgetary performances are based onmicro management of resources, ratherthan the traditional budgetary performancesbased on central management in manycountries. As of the end of 1980’s, we seethat first New Zealand and Austria andthen Sweden, USA, Finland, UK, Denmarkand the Netherlands, followed recently byGermany, Switzerland and Austria haveadopted performance-based budgets.Our country has recently taken animportant step on this issue through LawNo. 5018 Concerning Public FinancialAdministration and Supervision that hasbeen ratified by the Turkish Parliament inDecember 2003. In article 9 of this Lawit has been stipulated in relation with theperformance based budgeting that thepublic administrations will prepare theirbudgets on the basis of performance andcompliant with the mission, vision andstrategic objectives and targets that arewritten in their strategic plans. In the Guidedrawn up by the Ministry of Finance, basedon the authority that has been granted toit by the law in question, performancebasedbudget has been defined as a systemthat defines the main functions of publicadministrations, as well as the objectivesand targets to be realized consequent tothe fulfillment of these functions, ensuresallocation and use of resources for theseobjectives and targets evaluates whetheror not the predetermined objectives havebeen reached through performancemeasurement and reports the results.As can be easily deduced from thedefinitions above, the performance-basedbudget system is in a way, a system thatsubmits to the supervision of the publicthe facts whether or not the governmentshave determined the services required bythe public correctly and whether or notthey have rendered the services at thelowest cost possible.The results of the performance budget thathave been announced at the beginning ofFebruary recently reflect the performancein the past year. When we take a look atthe actualized results, the first thing thatcatches the eye is the fact that the budgetdeficit that has been estimated as TL 45quadrillion has been realized as TL 30quadrillion. This has been the result ofexpenditures realized at lower levels thanit has been estimated and income realizedat higher levels than it has been estimated.And as a natural consequence of thissituation, significant decreases have beenexperienced in the ratio of the budgetdeficit to the GDP. This ratio, which hadbeen 16,4% in 2001, 14,6% in 2002 and11,2% in 2003 has been lowered to 7,1%in <strong>2004</strong>. The fact that the deficit, whichhas been correlated with deficits higherthan estimates, has been realized at a levelmuch lower than the estimated level isboth interesting and satisfying. Anothersignificant development in the results isthe share of interest expenses among taxincome. The interest expenses thatconstituted 86,9% in 2002, constituted69,5% in 2003 and 62,6% in <strong>2004</strong> taxincome. If it is considered that this ratehad exceeded 100% in 2001 (103,3%), thesignificance of the developmentsexperienced in recent years would be moreclearly understood. Another consequenceof the decrease in the interest expensescan be observed in its share among theconsolidated budget expenses. The totalinterest expenses that constituted 44,8%of 2002 consolidated budget expenses hasbeen realized as 40,2% of <strong>2004</strong>consolidated budget expenses.The table below shows the comparativerealized results of <strong>2004</strong>, 2003 and 2002budgets.MART 2005 13