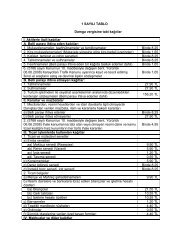

2004 YILI BÃTÃESâ¹Nâ¹N UYGULAMA SONUÃLARI AÃIKLANDI ...

2004 YILI BÃTÃESâ¹Nâ¹N UYGULAMA SONUÃLARI AÃIKLANDI ...

2004 YILI BÃTÃESâ¹Nâ¹N UYGULAMA SONUÃLARI AÃIKLANDI ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

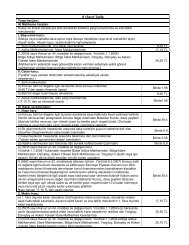

VAT EXCEPTION AS TOSERVICE AND GOODSDELIVERY IN DEFENCEINDUSTRYAccording to the established legalframework, while firms accommodatedabroad, within the conditions indicated in167th article of the Customs Law, wereexempt from VAT on the goods deliveryand service execution on the subject ofnational defense and domestic security,domestic firms providing similar servicesand delivery did not enjoy any flexibilityin VAT liability. This situation gave riseto competition inequality against domesticfirms.Improving competition conditions andceasing the applications against domesticfirms are achieved by means of theparagraph 13/f added to VAT code withthe law numbered 5228.As required by modification to the VATcode by the article 14 of the law numbered5228, dated 16.07.<strong>2004</strong>, the title of thearticle 13 of the VAT Code has become“Exception on vehicles, mine and oilexplorations and domestic securityspendings and investments.” To beenforced as from 01.08.<strong>2004</strong> with the law5228, paragraph “f” has been added to thearticle 13 of the VAT code.Via the paragraph mentioned, delivery andservices to gratify domestic security needshave been granted exemption. Taxpayersgot the right to take back input tax basedon the exception and the article 32 of theVAT Code.By way of the paragraph above, deliveriesand services provided to Ministry ofNational Defense, General GendarmerieCommand, Coast Guard Command,Defense Industry undersecretaries,National Intelligence Undersecretaries,Customs Guard Head Office, GeneralPolice Department and weapons of war,helicopter, aircraft, ship, rocket, missile,armed combat car, tank, armored personnelcarrier, vehicles, equipment, machinery,devices and systems for domestic securityneeds, as well as of spare parts to be usedin the manufacture, maintenance, researchand development, software, modernizationand repair of these for national defenseand domestic security needs have beengranted exemption. Quality and quantityof these services and deliveries are to beapproved by the institutions mentionedabove.It is indicated that Councils of Ministerswould be authorized to determine theamount present in the article 232 of theTax Procedures Code and applied in therelated year as the minimum amount inthe exception application or to raise twicethe determined amount or to decrease tozero and Ministry of Finance shall beauthorized to describe service and goodsdelivery in the scope of exception andshall be authorized to lay down proceduresand principles relevant to the implementationof exception.In the framework of this authorization,Ministry of Finance laid down proceduresand principles relevant to the implementationwith the General Communique ofVAT Code numbered 93.On account of the explanations of thecommunique, the exception is viable inthe deliveries and services provided toMinistry of National Defense, GeneralGendarmerie Command, Coast GuardCommand, Defense Industry undersecretaries,National IntelligenceUndersecretaries, Customs Guard HeadOffice, General Police Department.Services and deliveries within the scopeof exception are also displayed in thecommunique. Delivery of vehicle, weaponand systems of these, and equipment,machinery, spare parts and accessoriesrelated to them and the procurement ofgoods and services in the form of R&D,manufacturing, assembly, maintenance,modification upkeep and modernizationswhich are directly associated with vehicle,weapon and systems mentioned above,and in this framework, training on vehicles,weapons and systems acquired exclusivelythrough exception are granted exemptionfrom VAT. Similarly, other than thoseused for administrative and servicepurposes, the delivery of armed andunarmed, armored and unarmoredmotorized vehicles that are producedspecifically for engagement to meetdefense needs related to tactical operationsand engagement can be evaluated to bewithin the exception.The exception can be applied solely to thedeliveries and services for the institutions,foundation and firms counted in theparagraph mentioned above. Otherexpenses of these institutions are taxablewithin the framework of general provisions.These institutions’ acquisition of food,clothes, office supplies, service buildingand other working places, every officeequipment, furnishing, stationery goods,procurement of vehicles other than theones stated in the paragraph, transportation,manufacturing, construction, upkeep,maintenance and repair expenses ofeconomic values which are not in the scopeof exclusion, and similar procurements ofthese institutions engaged in the nationaldefense, whether directly or indirectlyrelated to national security operations, willnot be assessed in the scope of exclusion.If spare parts, machine, equipments andaccessories relating to fixed assets withinthe scope of exclusion are used at the sametime or for operations outside the scopeof exclusion, VAT is applied to thetransaction.Moreover, detailed argumentation onputting exclusion and refunding proceduresrelated to the direct procurements ofsupplier firms and institution andfoundations engaged in the nationalsecurity and the deliveries and services tothe firms settled abroad in practice aregiven place in the explanations of theannouncement.It is possible to say that a great step hasbeen taken through this arrangement whicheliminates the VAT difference betweenforeign and domestic procurements ofgoods and services that are domestic andexternal security-oriented and are thesubject of international bids, which preventthe competition inequality that negativelyaffects defense industry requiring hightechnology and promising high opportunitieswith its employment, value addedand foreign exchange earning ability.MART 2005 15